Yearn.Finance Adding $100 Million Daily With $2.5B TVL

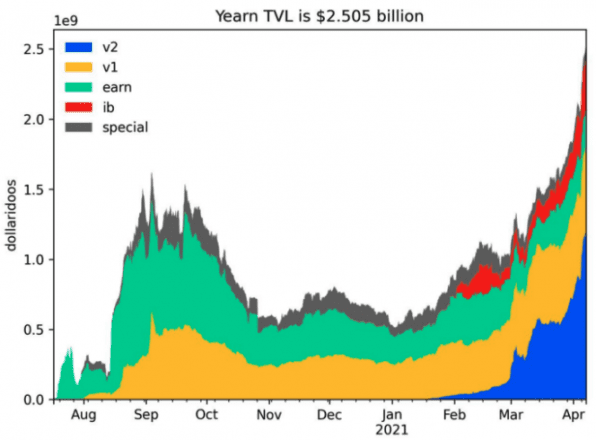

Yearn.Finance has seen astronomical growth in the last few weeks as the protocol’s total value locked reached $2.5 billion.

Yearn’s Active Asset Management Is Underrated

After bursting onto the DeFi scene in August 2020, the project seems to have truly hit its stride in the last few months. In their most recent weekly update State of the Vaults, they announced they passed the milestone of $2.5 billion locked in their vaults.

Behind this rise in price is the increasing value captured by Yearn’s v2 vaults. Announced in January, they originally didn’t capture much value as the strategies didn’t perform as well as other vaults and protocols in DeFi.

The team also drew controversy earlier in the year by minting $200 million worth of YFI to ensure the development of the DeFi protocol could continue to be supported independently in the coming years.

The team behind Yearn is also affirming the crazy APYs will keep on coming, with estimated APRs in the triple digits. This has seen an increasing amount of DeFi users entrust Yearn with their capital.

As moving funds on the Ethereum blockchain becomes increasingly expensive, active portfolio management group strategies become more appealing. Jumping from one farm to the next is a luxury few can afford.

Disclaimer: The author held ETH, BTC and a number of other cryptocurrencies at the time of writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article