Stablecoins Surpass $100 Billion Market Cap

Key Takeaways

- The global stablecoin supply is now worth $100 billion.

- USDT remains the most popular stablecoin with more than 60% of market share.

- Interest in stablecoins has led countries to consider issuing their own versions, central bank digital currencies (CBDC’s).

Stablecoins have hit a $100 billion market cap.

Stablecoin Supply Growth

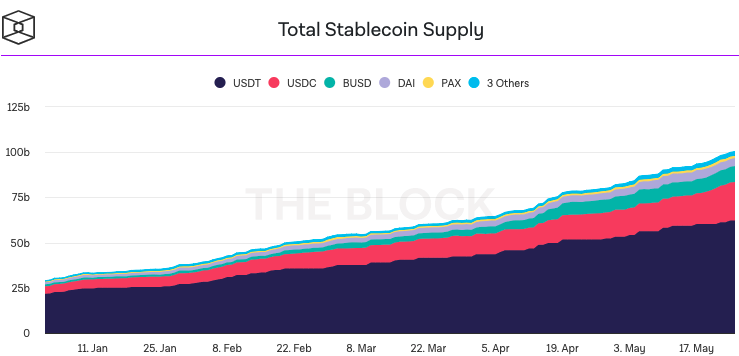

Stablecoin supply has exploded in 2021.

Stablecoins are a type of synthetic asset that track the price of another asset. They’re designed to have the same value as the asset they’re pegged to, and most frequently track the price of fiat currencies like the U.S. dollar.

On Jan. 1, shy of $30 billion in stablecoins were available. That number has tripled since the start of the year to reach $100 billion today, according to data from The Block.

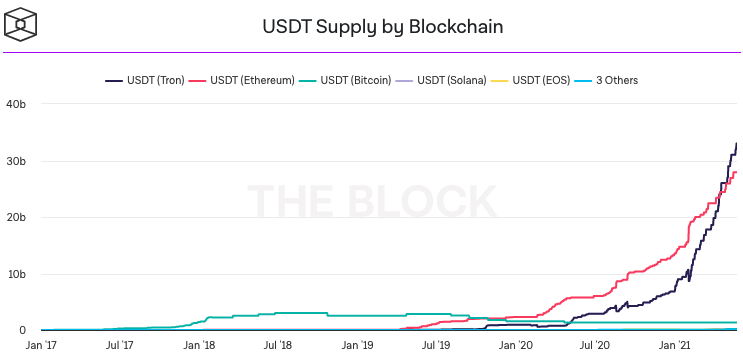

Tether’s USDT is still responsible for over 60% of the total market cap for stablecoins. USDT’s supply on Tron has also progressed exponentially and has now surpassed the supply on Ethereum.

While USDT is currently crypto’s preferred stablecoin, USDC has been starting to catch up. Major partnerships with the likes of Visa have accelerated the growth of USDC, along with fears around Tether’s cash reserves backing its own stablecoin. All crypto-native transactions using Visa cards will now be settled in USDC on the Ethereum blockchain, a major step in global stablecoin adoption.

On Tether’s side, the biggest driving force has been its adoption of the Tron blockchain for faster transaction times and cheaper fees. Since the launch, the supply of USDT on Tron has been exponentially increasing and surpassed supply on Ethereum a few weeks ago.

$20 billion worth of USDC is in the form of an ERC-20 token on Ethereum, which is the vast majority of the overall supply. The USDC supply on Solana follows with around $750 million.

This fast growth can be explained by two factors. Firstly, stablecoins have seen increased usage in DeFi where users can lend or borrow them trustlessly. Complex financial systems have been created that result in significant yield for lenders.

Additionally, they provide an easy medium of exchange for traders to go in and out of their positions without actually withdrawing their funds or return to fiat. Traders don’t have to wait between trades and can mitigate the risks of price fluctuations by keeping their profits in a dollar-pegged asset.

Disclaimer: The author held USDC, USDT, BTC, ETH, and several other cryptocurrencies at the time of writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article