Polygon Project SafeDollar Crashes to Zero After Attack

Key Takeaways

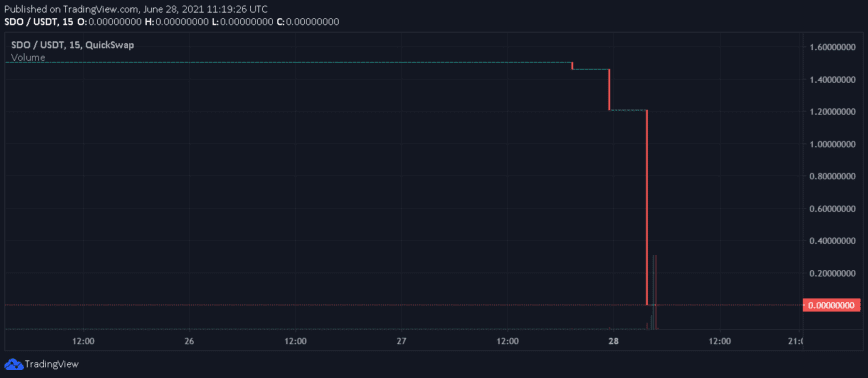

- Algorithmic stablecoin SafeDollar (SDO) has crashed to zero following an exploit.

- Attackers exploited a vulnerability and drained almost $250,000 from SafeDollar’s liquidity pools.

- The team has said it is not responsible for the attack. It’s also promised to publish a post-mortem report.

Polygon-based stablecoin SafeDollar collapsed to zero after its liquidity pools were exploited in a security incident.

SafeDollar Plunges To Zero

Within a couple of weeks of launch, algorithmic stablecoin SafeDollar (SDO) has succumbed to an economic attack and its price has crashed to zero dollars.

SafeDollar launched its Decentralized Exchange Offering on its partner exchange PolyDEX on Jun. 14. The project hoped to maintain a peg with the U.S. Dollar via techniques like seigniorage, deflation, and the use of synthetic assets.

Announcing the attack in the project’s official Telegram group, the team said:

“SafeDollar has been under attack. We have paused activities on SafeDollar and investigating the matter.”

In the incident, attackers exploited a vulnerability to mint 831 Quadrillion stablecoin units. They then sold off the inflated supply in the liquidity pools, leading to a complete price collapse.

According to smart contract security project, RugDoc, which highlighted the incident on Twitter, attackers siphoned roughly $248,000 in USDC and USDT. The transaction can be viewed on PolygonScan.

The project’s team has said that it was not responsible for the attack, and has confirmed its plans to return with a post-mortem report.

Meanwhile, the team said it had paused all pools to investigate the incident. It also claimed it would compensate liquidity providers who lost their funds.

It’s the second incident SafeDollar has suffered in as many weeks. On Jun. 20, its IDO vault was compromised for $95,000.

The latest incident follows the well-documented attack on another algorithmic stablecoin project, Iron Finance. Its governance token TITAN collapsed due to an alleged bank run that caused the supply to become hyperinflated, leading to losses for Mark Cuban and other investors in the project.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article