BIT Mining Funds Relocation With $50M Stock Offering

Chinese Bitcoin mining company BIT Mining has raised $50 million through a private placement of Class A shares, the company announced Monday.

BIT Mining Looks to Relocate

Chinese mining companies are raising funds to relocate.

NYSE-listed company BIT Mining has announced it has entered into purchase agreements with investors for $50 million worth of Class A shares, with warrants to purchase an additional 100 million shares in the future.

In a press release, the company stated that it would use the placement proceeds to acquire additional mining machines, build new data centers overseas, expand its infrastructure, and improve its working capital position.

Last month, BIT Mining was hit hard by regulatory crackdowns in China when local authorities told Bitcoin miners to cease operations. In response, the company started moving mining machines to Kazakhstan, with the first batch leaving Jun. 21. Along with Kazakhstan, many U.S states are also attracting displaced Chinese miners. Texas has become a popular choice due to its deregulated power grid, and Kentucky is offering tax exemptions for would-be miners.

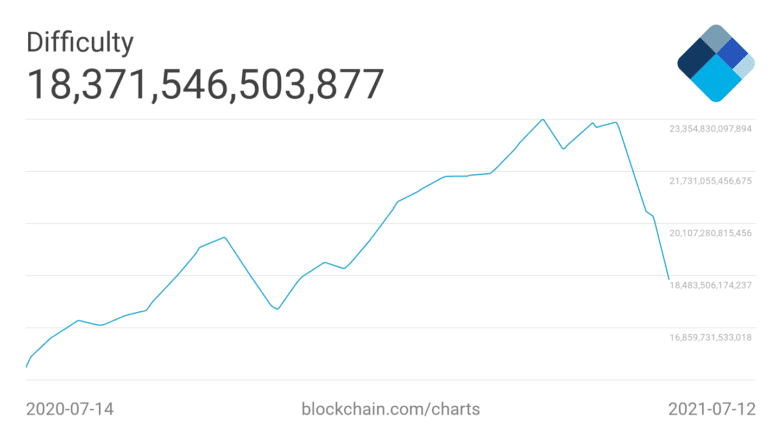

Following China’s mining crackdown, the Bitcoin network hashrate decreased substantially, falling more than 50% over the last two months. When the network hashrate drops, the Bitcoin algorithm is programmed to self-adjust the difficulty of mining new coins. With Bitcoin mining experiencing its biggest difficulty drop in history following China’s shutdown, the race is on for miners to take advantage of the decreased difficulty by relocating their hardware.

BIT Mining is one of the biggest Bitcoin mining companies globally. The company owns Bitcoin mining machines with a theoretical maximum hashrate of over 1,000 petahashes per second (PH/s). With a fresh $50 million cash injection, the company is positioned to build back bigger outside China.

Disclaimer: At the time of writing this feature, the author held BTC and ETH.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article