An arduous second half awaits oil marketing firms

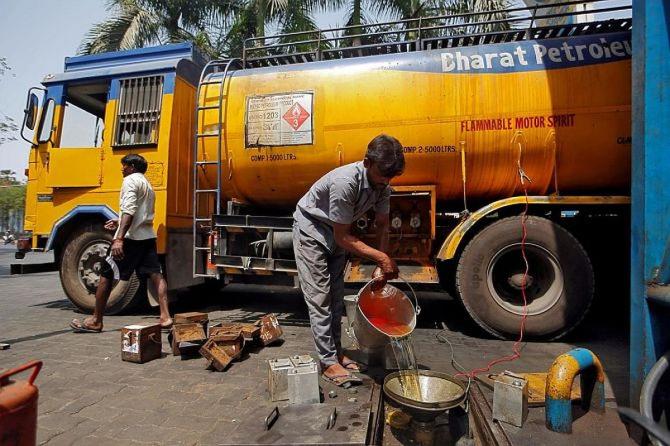

The medium-term scenario for oil marketing companies (OMCs) is high risk due to the surging crude and gas prices.

Apart from OPEC-plus cutting production, the Hamas-Israel conflict has caused fears of supply disruption.

The July-September quarter of 2023-24 (Q2FY24) saw positive surprises for OMCs. Strong gross refining margins (GRMs) more than offset weak marketing margins.

Most commodity traders are betting energy prices will remain high.

While OMCs have availed Russian crude at discounts the price differential between benchmark Brent and Russian has narrowed.

Elections makes it unlikely the OMCs will be able to fully pass on hikes in raw material costs.

Hence marketing margins could be poor.

Hopefully, GRMs will remain strong, but there are signs of weakening.

For HPCL, the Q2FY24 operating profit and net profit were stronger and positive year-on-year (Y-o-Y), but down 15 per cent, and down 17.5 per cent Q-o-Q on a fall in integrated margins due to the decline in marketing margins.

The reported GRM was $13.33/barrel or bbl ($7.44 the previous quarter, $8.4 a year ago).

There would be a refinery inventory gain, which may work out to $2.8/bbl versus a loss of $0.2 the prior quarter, and a loss of $1.6/bbl a year ago.

The refinery throughout was 5.75mmt at 112 per cent utilisation (106 per cent in Q1FY24, 100 per cent Y-o-Y.

The integrated core operating profit margin was around $4.5/bbl ($9.4 Q-o-Q, and negative $0.8 Y-o-Y).

The marketing profit is calculated at Rs 1.2/ litre (Rs 5.8 Q-o-Q, negative Rs 1.5 Y-o-Y). There was a Rs 230 crore forex loss which hit profits.

The capex was at Rs 3,350 crore with Rs 6670 crore in H1FY24 and an FY24 target of Rs 10,000 crore.

The debt was at Rs 51,760 crore, up Rs 60 crore Q-o-Q and down Rs 16,790 crore Y-o-Y.

IOC reported an operating profit of Rs 21,300 crore (up 4.3 times Y-o-Y), led by better-than-expected GRM at $17.9/bbl and higher marketing margins at Rs 5.8/litre.

Refining throughput was at 17.8 million metric tonnes (mmt), up 10 per cent Y-o-Y.

Petchem sales volumes rose 53 per cent Y-o-Y to 0.82mmt vs. 0.54mmt in Q2FY23.

The petchem segment profit was Rs 160 crore. Petchem margins declined in Q2FY24 and saw further decline in October.

The company hopes to divest its hydrogen plant, which would mean a cash infusion and it will commission various projects over the next two years.

The Panipat refinery s capacity will expand from 15mmt per annum (mmtpa) to 25mmtpa by September 2024, and the Gujarat and Barauni refineries will also expand capacity by December 2024.

BPCL s Q2FY24 net profit of Rs 8,500 crore (vs loss Y-o-Y) was also a positive surprise.

Strong GRMs were key to the turnaround at $18.5/bbl.

Marketing volumes were up 7 per cent Y-o-Y but margins moderated Q-o-Q.

There was an inventory gain of Rs 1500 crore.

The timelines on the proposed rights issue are unclear but it is seeking approvals from the ministry of petroleum and natural gas and Securities and Exchange Board of India (Sebi) for the issue.

In the consolidated P&L account, BPCL booked Rs 300 crore in a non-recurring provision towards a stranded Mozambique LNG project where it has 10 per cent stake.

The management reiterated capex plans of more than Rs 1.5 trillion, which includes Bina refinery expansion and a petchem project, as well as renewables investments, marketing, and thrust into city gas distribution.

The results have led to share price gains across all three stocks.

Valuations are moderate but H2FY24 could see bottom lines under pressure.

Disclaimer: This article is meant for information purposes only. This article and information do not constitute a distribution, an endorsement, an investment advice, an offer to buy or sell or the solicitation of an offer to buy or sell any securities/schemes or any other financial products/investment products mentioned in this article to influence the opinion or behaviour of the investors/recipients.

Any use of the information/any investment and investment related decisions of the investors/recipients are at their sole discretion and risk. Any advice herein is made on a general basis and does not take into account the specific investment objectives of the specific person or group of persons. Opinions expressed herein are subject to change without notice.

Source: Read Full Article