Behind The Quiet: Low Bitcoin Volatility Masks Market Dynamics

In the world of Bitcoin, silence is not always golden. The recent weeks have seen Bitcoin’s price volatility drop to historical lows, with the BTC price trading mostly between $29,000 and $30,000. However, beneath this placid surface, a number of intriguing market dynamics are at play.

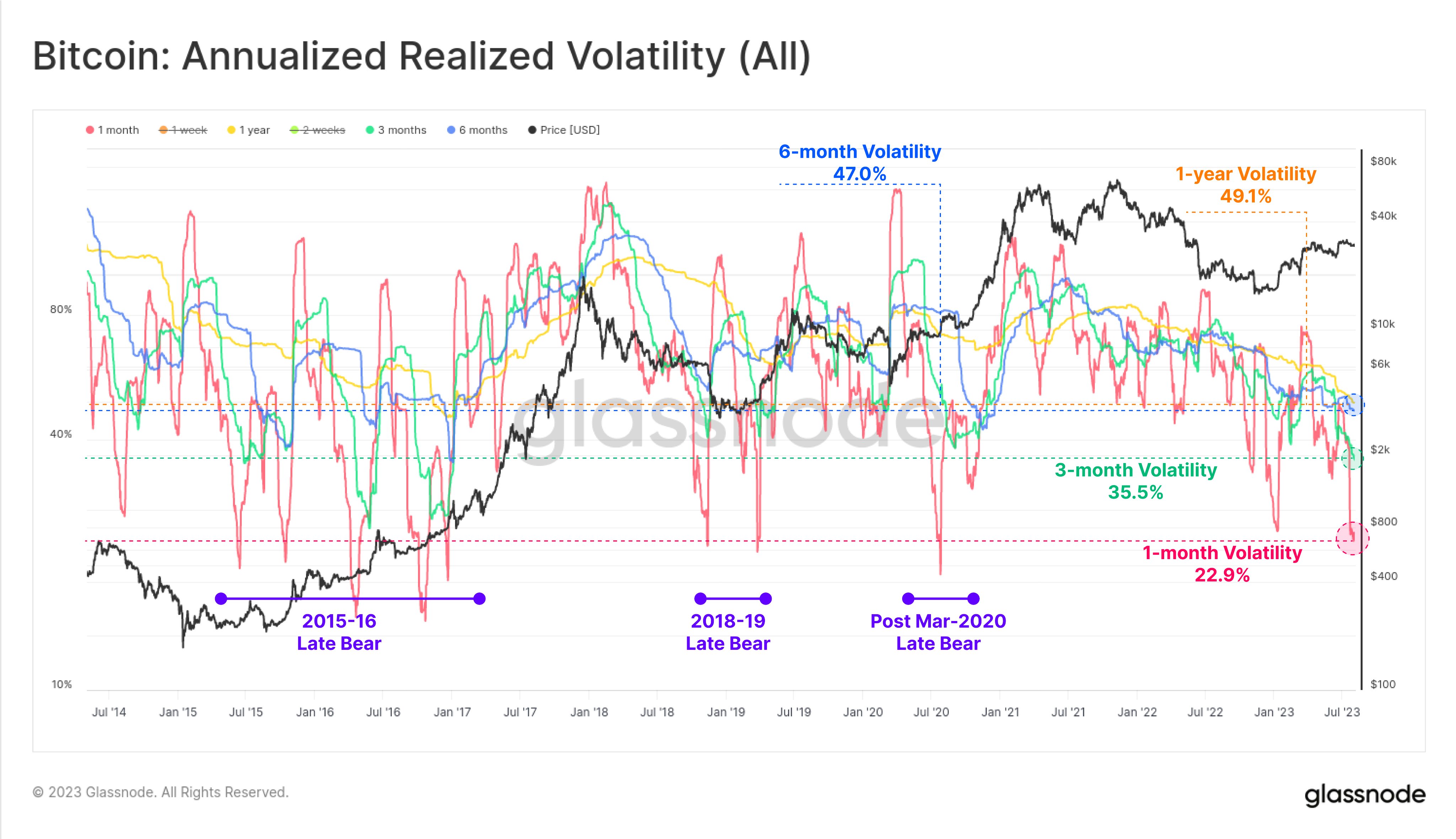

“Realized volatility for Bitcoin has collapsed to historical lows. Across 1-month to 1yr timeframes, this is the quietest we have seen the corn since after March 2020. Historically, such low volatility aligns with the post-bear-market hangover periods (re-accumulation phase),” stated Checkmate, lead on-chain analyst at Glassnode.

The chart shared by Checkmate shows that annualized realized volatility resembles the post-bear era for Bitcoin from March 2020 when volatility was at 47%. Currently, 1-year volatility sits at 49.1%, 3-month volatility at 35.5%, and 1-month volatility at 22.9%.

Quit Before The Storm For Bitcoin

However, the low volatility is not the only story. Checkmate also highlighted a new all-time high for Bitcoin’s long-term holder supply, now at 14.59M BTC, which accounts for 75% of the circulating supply. This shows that an increasingly high number of Bitcoin investors are convinced of a future rally, leading to a supply shortage, while high risk traders are washed out of the market due to lacking volatility.

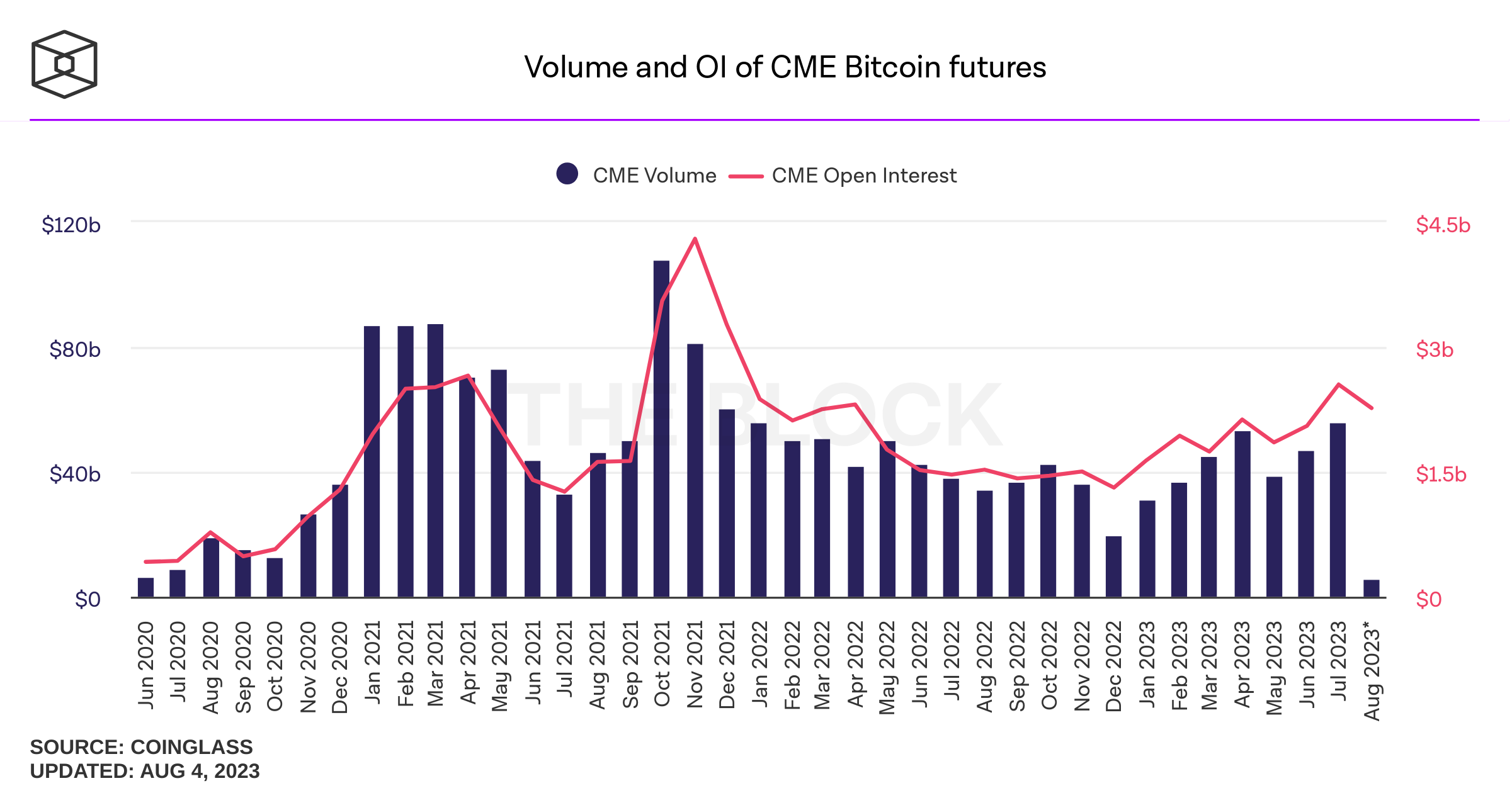

Simultaneously, there’s a surge in institutional positioning; volume and open interest of the CME Bitcoin futures have reached a 20-month high in July. Despite the Bitcoin spot markets recording low volumes, the CME futures saw the highest volume since January 2022, with $55.8 billion in July.

The CTFC data reveals a fascinating slugfest between two investor groups. Asset managers are $1.2 billion net long, while hedge funds are net short by -$980 million. This standoff suggests an imminent breakout in Bitcoin’s price, potentially leaving one of these groups with burnt fingers.

On-chain analyst Ali Martinez provided further insight: “Even as Bitcoin dropped from $32,000 to $29,000, the number of new BTC addresses steadily rose! This bullish divergence between price and network growth hints at a stable long-term BTC uptrend. Buy the dip!”

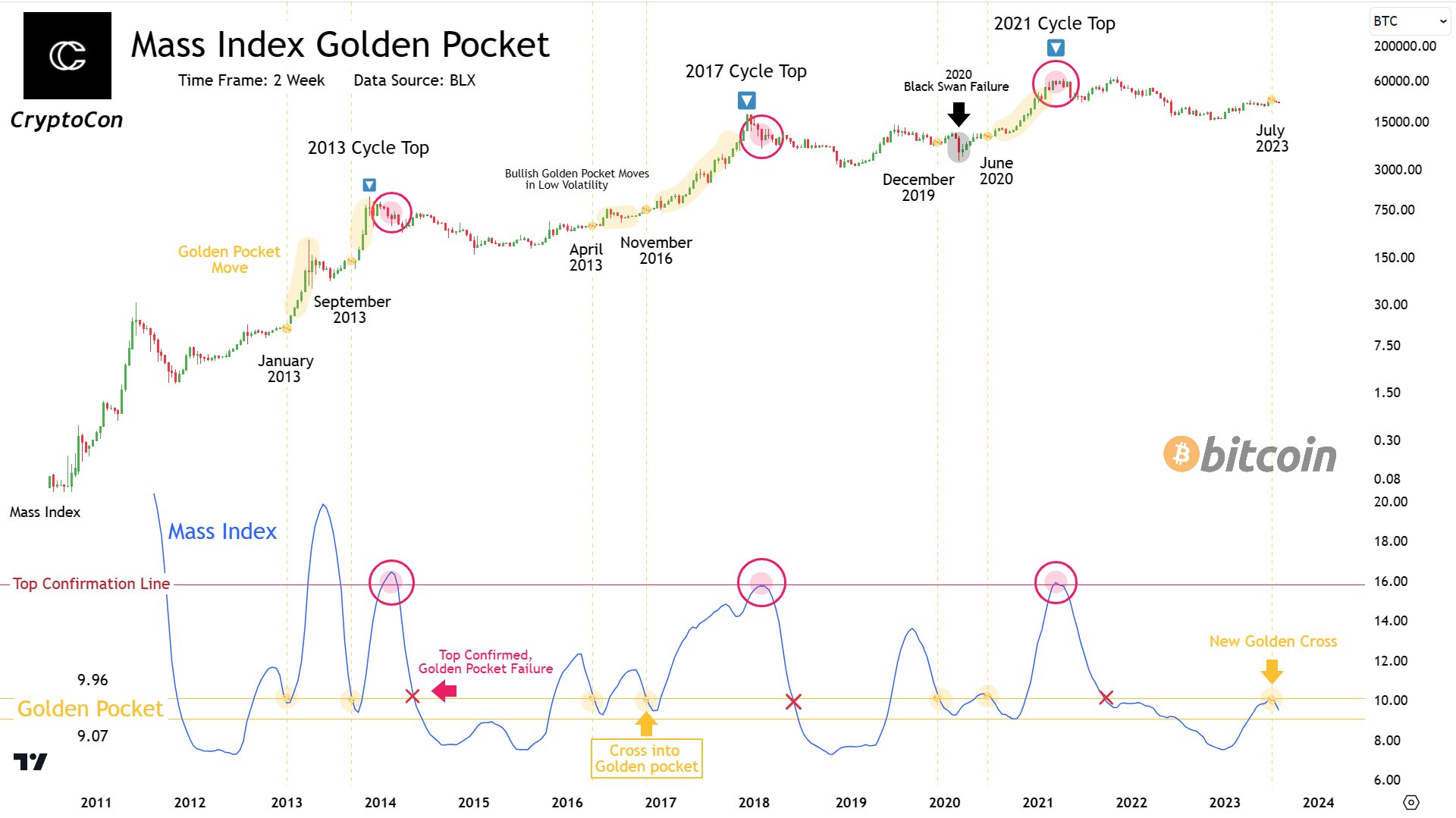

Indeed, the current low volatility phase is not without precedent or predictive power. Renowned analyst @CryptoCon provides a compelling perspective on this, stating that such periods of sideways price action are not only normal but potentially bullish.

“Bitcoin sideways price action at this point in the cycle is completely normal! The 2 Week Mass Index crosses into the golden pocket at the most stagnant cycle points, just before massive bullish moves. Data everywhere points to the same conclusion: Low volatility is bullish,” CryptoCon tweeted.

Chris Burniske, partner at Placeholder VC, also shared his perspective on the current market dynamics. “Currently, tourists are inactive while residents are accumulating swiftly, owning 74.8% of all supply. That’s consistent with an early-stage bull market. Thirty percent of BTC has left for cold storage since 2020, leaving exchanges with 2.26 million. Bitcoin seems fairly valued relative to the number of active entities on the network.”

Burniske’s simplified price/cycle model projects Bitcoin to reach near $39,000 by the fourth quarter of 2023 and $92,000 (base scenario) by Q4 2025 with entities above 600,000.

In conclusion, the current low volatility phase of Bitcoin may seem uneventful on the surface, but the underlying market dynamics suggest a different story. The tug-of-war between asset managers and hedge funds, the steady rise in new BTC addresses, and the swift accumulation by long-term holders all hint at a brewing storm.

At press time, the Bitcoin price was at $29,076.

Source: Read Full Article