Bitcoin Price Corrects After Brief Run Above $1100

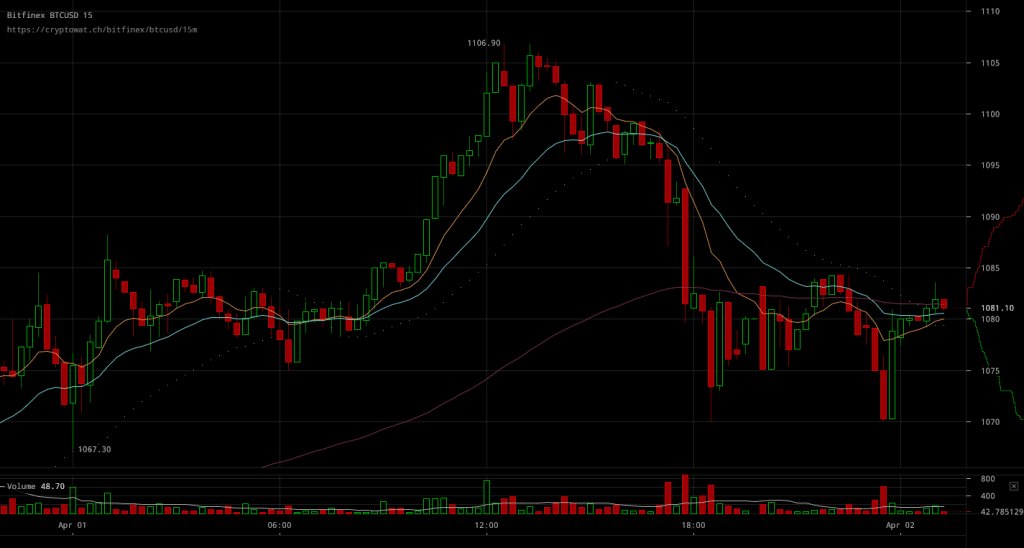

Bitcoin prices did briefly climb above $1100 levels through the last trading session but selling pressure was able to cause a price drop short after that. It seems as though markets weren’t ready to welcome such a sudden price rise as support wasn’t there to help maintain such levels.

Major Signals

- Bitcoin markets are maintaining a pretty neutral market sentiment as no major developments at a certain appear to be hinted at the moment

- Selling pressure only became apparent after BTC/USD rates reached above $1100 levels, causing a price drop down to $1070 levels

- Bitcoin prices have since settled around $1080, with selling pressure ultimately failing to cause a more major price drop

Overall, the market’s sentiment is certainly not too bearish at the moment, yet far from being bullish at the same time as well. Provided that trading volumes have gone down since yesterday, a major development would have a more significant impact on the market. However, the return of selling pressure after the recent rise wasn’t really helpful in establishing a more optimistic market sentiment.

Source: Read Full Article