Circle Limits USDC Minting for Retail Users, Moves Toward Tether's Model

Circle Internet Financial, the issuer of the USDC stablecoin (USDC), announced yesterday that it is discontinuing the ability for individual accounts to create stablecoins. A spokesperson from Circle told CoinDesk that the company is “phasing out support for legacy consumer accounts” and has informed the affected users about this change. However, this restriction will not apply to business or institutional accounts under the Circle Mint umbrella.

The spokesperson further clarified that Circle is currently catering only to qualified institutional clients and does not offer services directly to retail consumers. For retail users interested in accessing USDC, the company suggests using brokerages, cryptocurrency exchanges, and digital wallet services.

According to a report by CoinDesk, screenshots of an email from Circle to an individual account holder, shared on social media platform X (formerly known as Twitter), revealed that the company plans to cease wire transfers and stablecoin minting capabilities for these accounts by 30 November 2023. This has led to widespread speculation that Circle may be tightening its policies on account management.

This latest move by Circle appears to bring the company’s policies more in line with those of its primary competitor, Tether (USDT). Tether has long had a policy of setting a minimum threshold of $100,000 for minting and redeeming its USDT stablecoin.

USDC is currently the second-largest stablecoin in the market, boasting a supply of $25 billion. However, it has seen a significant decline in market share over the course of this year. As of the latest data, USDC has lost 43% of its market capitalization year-to-date, while Tether’s USDT has reached a new all-time high with a market capitalization exceeding $84 billion.

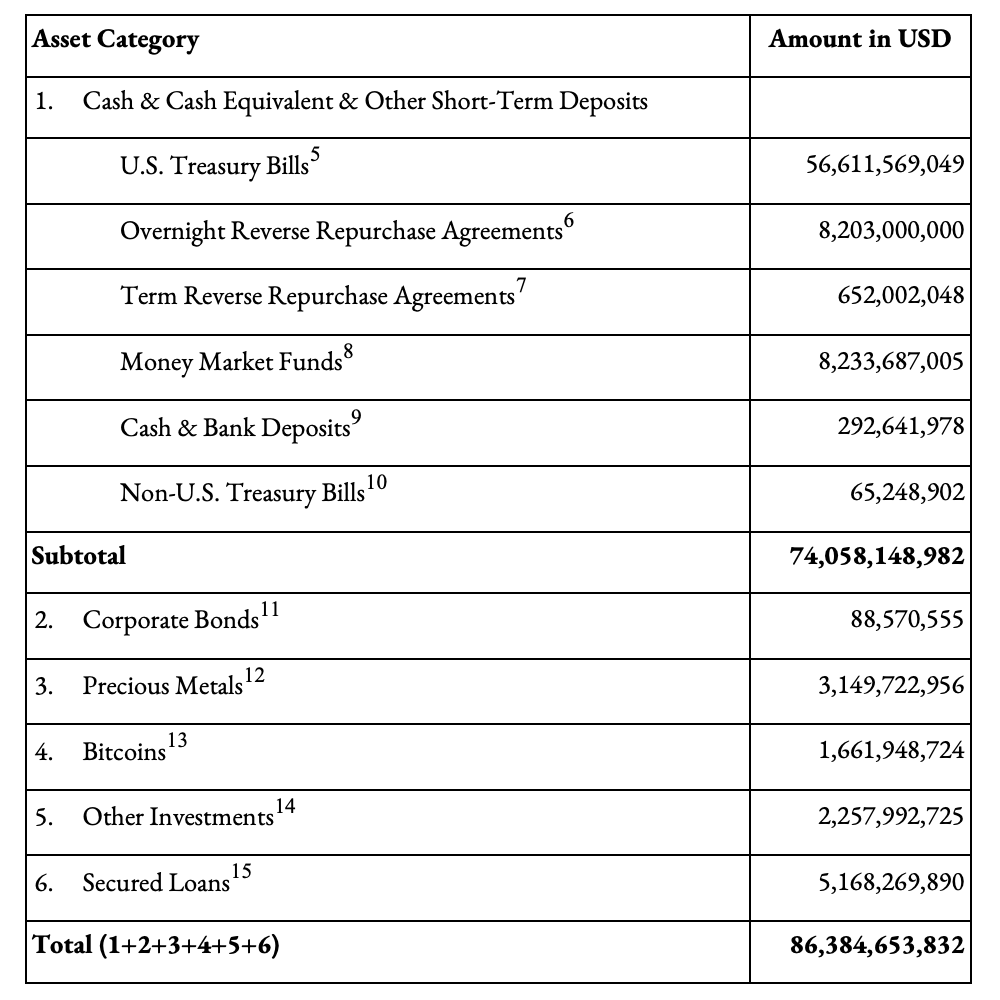

In a related development, Tether disclosed in its Q3 2023 attestation, released on 31 October 2023, that it has $3.2 billion in excess reserves backing its stablecoins, including USDT. The attestation, verified by accounting firm BDO Italy, revealed that Tether has $86.4 billion in assets against $83.2 billion in liabilities as of 30 September 2023. These assets — which mostly consisted of exposure to U.S. Treasuries — amounted to about $72.6 billion.

The attestation also highlighted that Tether has $5.2 billion in secured loans, marking a reduction of $330 million from the previous quarter. The company has pledged to reduce these loans to zero by the end of 2023, indicating ongoing efforts to meet this commitment.

Featured Image via Pixabay

Source: Read Full Article