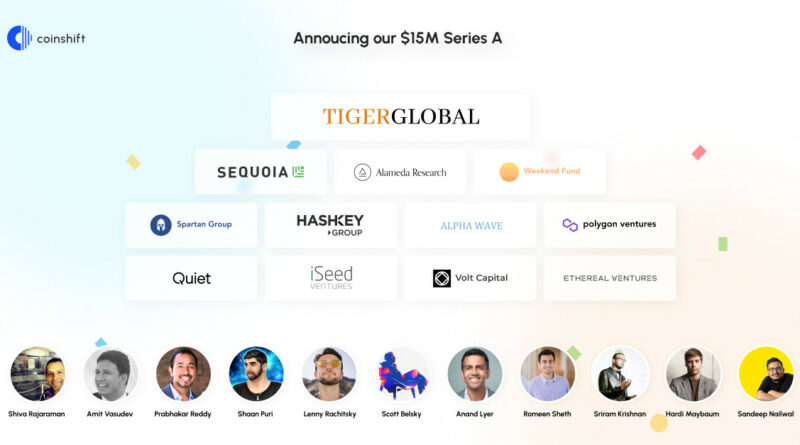

Coinshift Closes $15 Million Series A Led by Tiger Global, Sequoia Capital India, Alameda Ventures

Cash management company announces roadmap to build cutting-edge multichain treasury infrastructure for Web3

Coinshift, leading treasury management and infrastructure platform that enables DAOs and crypto businesses to manage cash reserves, announced its $15 million series A funding round and its roadmap for building a novel full-service treasury management solution in the industry.

The series A funding round is led by Tiger Global and joined by Sequoia Capital India, Ryan Hoover (Founder of Product Hunt and the Weekend Fund), Alameda Ventures, Spartan Group, Ethereal Ventures, Alpha Wave Capital, Hash key Capital, Quiet Capital, Polygon Studios, Volt Capital and 300 and more angels and operators in crypto and fintech.

Coinshift has undergone rapid growth since its launch in June 2021, managing more than 1000 safes, $1.3 billion in assets, and $80 million in payouts for organizations like Consensys, Messari, Biconomy, Uniswap, Perpetual Protocol, Balancer and many others.

Coinshift Founder and Chief Executive Officer Tarun Gupta, commented, “Today, a new chapter of the Coinshift journey begins. We are unveiling a glimpse into our platform’s second version, through which we share our vision to build the most sophisticated multichain treasury infrastructure for Web3. The fact that our investors have returned to participate in a series A funding round is a testimony to the quality of our platform and the timely solution we offer to fill the current needs in the market.”

Coinshift’s version 2 was built and designed in close collaboration with the industry’s leading Decentralized Autonomous Organizations (DAOs). Coinshift’s version 2 will allow users to manage multiple Gnosis Safes for multiple chains under one organization to enable significant time saving and transparency in treasury operations. The major architectural change between Coinshift version 1 and Coinshift version 2 is that users can add multiple safes to a single organization across multiple chains, whereas in version 1, one safe address was tied to one organization, in Coinshift’s feature-rich version 2 architecture, treasury managers and sub-DAO committees will be able to efficiently consolidate all their safes across networks and seamlessly visualize overall treasury balances. In addition, users will have global access to payees, labels, budgets, reporting, and advanced access level control between safes.

“With Coinshift’s version 1, our team has done an incredible job of building a sophisticated mass payouts platform. With our version 2, we are taking a massive leap forward to enable DAOs of any size, to manage their treasury. But we’re just getting started, and we are excited for the opportunity that lies ahead as we work toward building the most sophisticated next-generation cryptocurrency treasury management platform.”

Source: Read Full Article