How Billionaire Mark Cuban Got Rugged In Iron Finance Crash

Mark Cuban has been publicly bullish on Ethereum and DeFi. The billionaire has gone all-in on this sector. He believes dApps have great potential to build a new financial system. However, some protocols carry higher risk, sometimes that leads to a higher reward or a bigger loss, as Cuban himself just discovered.

The billionaire got into a protocol called Iron Finance (TITAN), an algorithmic stablecoin project. After a couple of days live, the protocol’s native token TITAN crashed to 0, as the team reported via their Twitter handle.

Since the price of titan has fallen to 0, the contract does not allow for redemptions.

We will need to wait for 12 hours for the timelock to pass before USDC redemptions are possible again.

— IRON Finance (@IronFinance) June 17, 2021

Cuban wrote about TITAN in a blog post titled “The Brilliance of Yield Farming, Liquidity Providing, and Valuing Crypto Projects”, published on June 13, 2021. There in he claims to be the only liquidity provider for the trading pair DAI/TITAN on QuickSwap with an initial $75,000 investment.

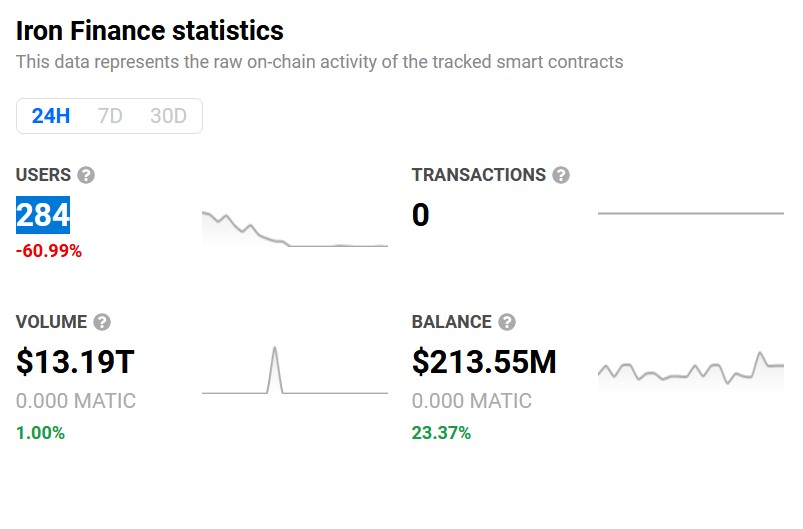

Data from DappRadar indicates that Iron Finance has lost more than 60% of its users in the past week alone and, at the time of writing, the protocol records 0 transactions.

Mark Cuban decided to participate by becoming a TITAN liquidity provider, but as he admitted in an interview with Bloomberg, he failed to see the shortcomings of the project:

In any new industry, there are risk I take on with goal of not just trying to make money but also to learn. Even thought I got rugged on this, it’s really on me for being lazy. The thing about defi plays like this is that it’s all about revenue and math and I was too lazy to do the math to determine what the key metrics were.

Mark Cuban didn’t reveal the exact amount of his loss. However, since the incident, he has called for more regulations. The billionaire believes regulators should define what is a stablecoin and what level of collateralization it’s acceptable for these types of digital assets. He added:

(…) should the math of the risk have to be clearly defined for all users and approved before release? Probably given stable coins most likely need to get to hundreds of millions or more in value in order to be useful, they should have to register.

What Exactly Happen With Mark Cuban And TITAN?

The team behind Iron Finance has published a postmortem report on TITAN’s crashed. As the report claims, the chain of events that led to the crash begun at 10 am UTC on June 16th, 2021. At this moment, the team recorded activity from whales that started removing liquidity from the IRON/USDC trading pair.

The Whales later sold their TITAN holding for IRON and eventually sold them for USDC. This process caused IRON’s price, the stablecoin, to off-peg. As a consequence, TITAN’s price lost 50% of its value in less than 2 hours.

This process took place during the entire day. Eventually, users panicked, and the protocol began to operate with a negative feedback loop.

A classic definition of an irrational and panicked event also known as a bank run. At the time of writing this, the TITAN supply is 27,805 billion. The team claimed the following:

At some points, the price of TITAN became so low, close to 0 actually, which caused the redeem contract to revert the redeem transactions. We already queued the fix for this, so people can redeem again at 5pm UTC.

Despite the event, the team will work on new products (IronBank for lending and IronSwap for a pegged assets-focused swap solution). In addition, they disagree with Mark Cuban and don’t consider TITAN’s crash as a rug pull. A team member said:

There was no rug pull or exploits. What happened is just the worst thing that could possibly happen considering their tokenomics.

At the time of writing, ETH trades at $2,389 with minor losses in the daily chart.

Source: Read Full Article