Litecoin Price Falls After Halving, Is the Party Over?

Much ado about nothing

In its 12-year history, Litecoin completed its third halving event on 2 August. The event led to a reduction in miners’ block reward from 12.5 LTC to 6.25 LTC.

LITECOIN HAS SUCCESSFULLY HALVED ITS BLOCK REWARD!

⚡ $LTC ⚡ pic.twitter.com/iemCnkPsdu

— Litecoin (@litecoin) August 2, 2023

Before the halving, there was a debate about whether the halving event would result in a positive price rally for LTC. Some analysts believed that the halving was already priced in by most traders in the market. This means that many traders had already factored in the fact that the block reward would be halved and had traded accordingly. This group of people did not think the halving would result in any significant price growth for LTC.

Others, including Litecoin founder Charlie Lee, opined that the halving would increase the price per LTC coin. This is because the halving will reduce LTC’s supply, and should demand stay the same or increase, it would create a supply-demand imbalance, which would drive up the coin’s price.

Lee, on a Twitter spaces session held last week, had said:

“If the supply side gets cut in half and the demand stays the same, then the price should go up.”

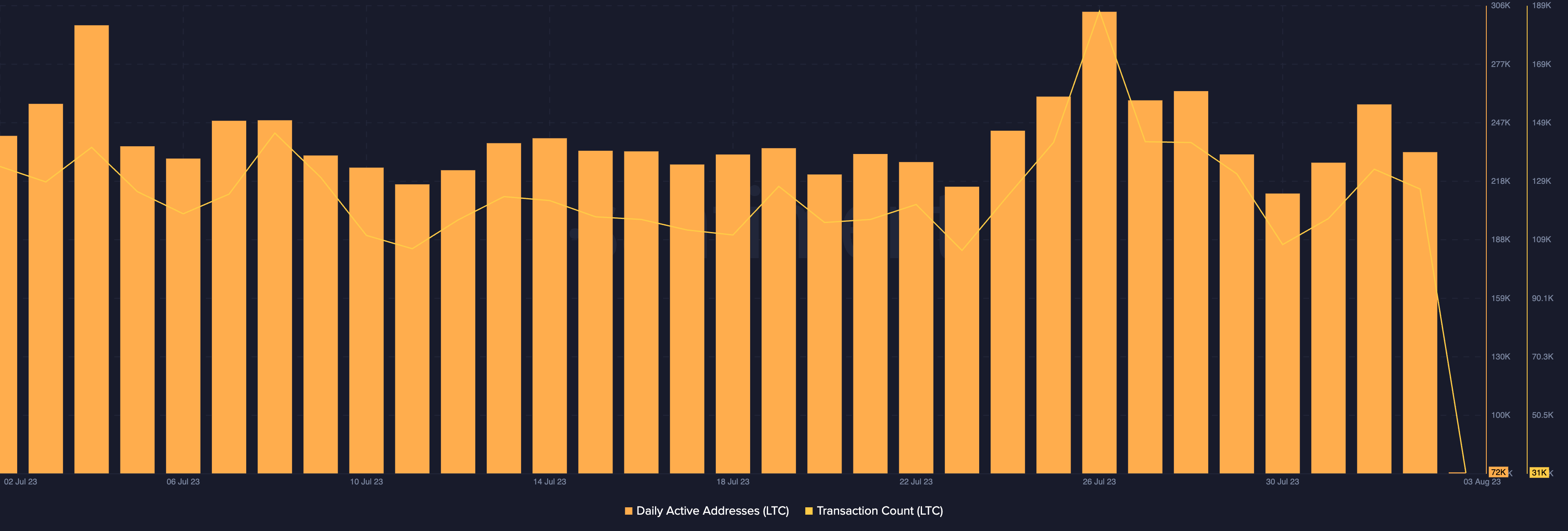

However, an on-chain assessment of LTC’s network activity since the halving event revealed a decline in demand for the alt. Per data from Santiment, yesterday, the count of daily active addresses that traded LTC dropped by 9%. In the early trading hours of today, this had dropped by another 68%.

Likewise, transaction count also dwindled. With 127,110 LTC transactions completed on the day of the halving, a 5% decreased was registered.

On the daily chart, LTC selling momentum rallied. The coin’s Relative Strength Index (RSI) and Money Flow Index (MFI) were 39.44 and 39.39 respectively. Below their neutral lines and trending downwards at press time, it indicated that more traders sold their LTC holdings than bought them.

Source: Read Full Article