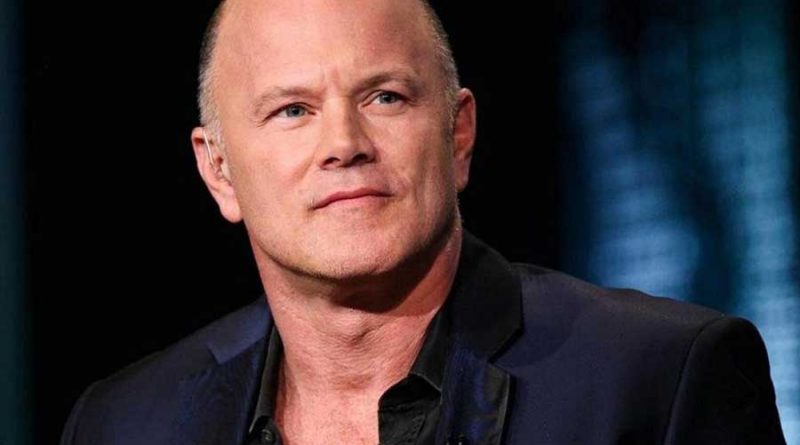

Mike Novogratz: 2023 Will Be a Year of Only Moderate Healing for Crypto

2023 is slated to be – according to various analysts – the year in which bitcoin and the crypto market heal themselves, but per Galaxy Digital CEO Mike Novogratz, things aren’t going to work out that way.

Mike Novogratz: Not Much Will Happen This Year

The bitcoin bull says that while 2023 will open the door to some of the healing these analysts expect to see, we aren’t going to witness any serious bull runs, nor will the digital asset space endure serious levels of repair. Instead, this will be something of a lukewarm year where not many bad things happen, but crypto companies will struggle to maintain what they have and survive.

In a statement, Novogratz said:

We’ve got regulatory headwinds that we didn’t have before. We’ve got time to heal and rebuild narrative, and so people are going to cut costs and survive this transition period.

2022 was arguably the worst period for crypto ever. Prices of assets fell into the doldrums, with currencies like bitcoin losing more than 70 percent of their value. Bitcoin dropped from an all-time high of about $68,000 per unit (achieved in November of 2021) to less than $17K by the time 2022 ended.

From there, several other digital assets followed suit, causing the crypto space to lose more than $2 trillion in overall valuation. The crypto space was also hurt by the many bankruptcies and collapses witnessed during the previous year. Companies like FTX crumbled into heaps, never to be seen again, and there are many people that have lost loads of money due to the fallout.

Novogratz says that an industry like crypto doesn’t just recover from elements like these over the course of a few months or a year. He commented that while 2023 won’t be “horrible,” it also won’t be “great.” This will be a time when the remaining crypto companies in play will do everything that they can to remain steady.

They will seek ways of cutting costs and retaining their financial reserves, so while prices may ultimately experience certain degrees of recuperation, the companies based around these assets will be slower to fix themselves.

So Much Distrust After FTX

Indeed, there is a lot of speculation surrounding where 2023 will head given the amount of distrust that has formed. A lot of this distrust came about after FTX – long considered the golden child of the crypto world – came crashing down into a heap of bankruptcy and fraud.

In December, it was announced that the head executive of the once prominent exchange Sam Bankman-Fried was arrested in the Bahamas after it was alleged that he had used customer funds to pay off loans taken on by his parent company Alameda Research, which he also founded. In addition, he’s believed to have purchased Bahamian real estate with the money.

Source: Read Full Article