Why fewer people HODL

I have not heard or seen the word “HODL” in quite a long time. Blockchain enthusiasts use to tell the world to HODL every time the price of digital assets dropped or plummeted, but now, it seems like the HODL strategy has been retired.

But why? To answer this question, we need to take a look at why a majority of digital asset owners hold digital assets: speculation. There is a population of users that are genuinely interested in the technology and the innovation it can introduce into the world, but, unfortunately, that population is much smaller than the group of people who are buying coins and tokens because they believe they will appreciate in price.

The majority group is incentivized by the potential they have to make money, and since money is their motive, it doesn’t make sense for them to HODL for long periods of time.

The best time to trade ‘crypto’

There are very few trading days in a year that actually matter.

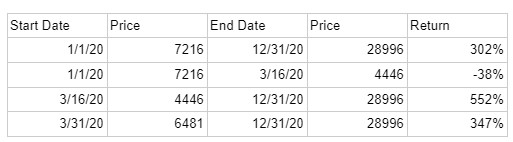

The chart above shows us four different trading timeframes for BTC; row 1 represents an individual that held BTC from January 1, 2020, and sold on the last day of 2020. Although this individual experienced a return on investment of over 300%, they had the second-worst return on their investment amongst the four data points in the chart.

The individual that had the highest return bought BTC when it bottomed on March 16, 2020, sold it on the last day of 2020, and made an astronomical return on investment that exceeded 550%.

Although the chart above is just a single data point in a sea of information, it shows that HODL’ing coins and tokens isn’t the best strategy for a group of individuals whose primary goal is to earn as much money as possible.

If the majority group is really looking to capitalize on their digital asset portfolio, they will buy digital assets at the lowest price(s) they possibly can and sell them when new all-time highs are reached; it does not make sense to continually buy digital assets–especially when the market is falling—unless you are truly a long-term investor or have a goal outside of maximizing returns.

Get ready to trade

In the United States, there are economic and political events that are expected to have a negative effect on the U.S. equity markets and risk assets. The Federal Reserve has already begun to raise interest rates, quantitative tightening (the Federal Reserve selling the assets on its balance sheet) will begin in the near future, and the conflict in Russia/Ukraine, as well as the Coronavirus lockdowns in China, have the potential to unexpectedly drag money markets down.

Many economists are expecting interest rates to rise until something in the economy “breaks,” it is hard to predict which part(s) of the economy will break, but there is consensus around the idea that the United States economy is on the road to recession.

Before we enter a recession, we are likely to see risk assets drop by double-digit percentages. In other words, we are approaching a day like March 16, 2020, in the chart above, a day that will arguably be the best trading day of the year to buy digital assets.

The best way to take advantage of this opportunity and maximize your returns is to have some fiat firepower, to make purchases on the day that the markets tank, by trading your assets as they approach or reach new highs, and by remembering not to HODL.

Watch: Fabriik presentation at CoinGeek New York, The Future of Digital Assets and a Tokenized World

Source: Read Full Article