XRP

Ripple’s XRP is falling on Friday, January 22nd, and mostly trading at $0.2624.

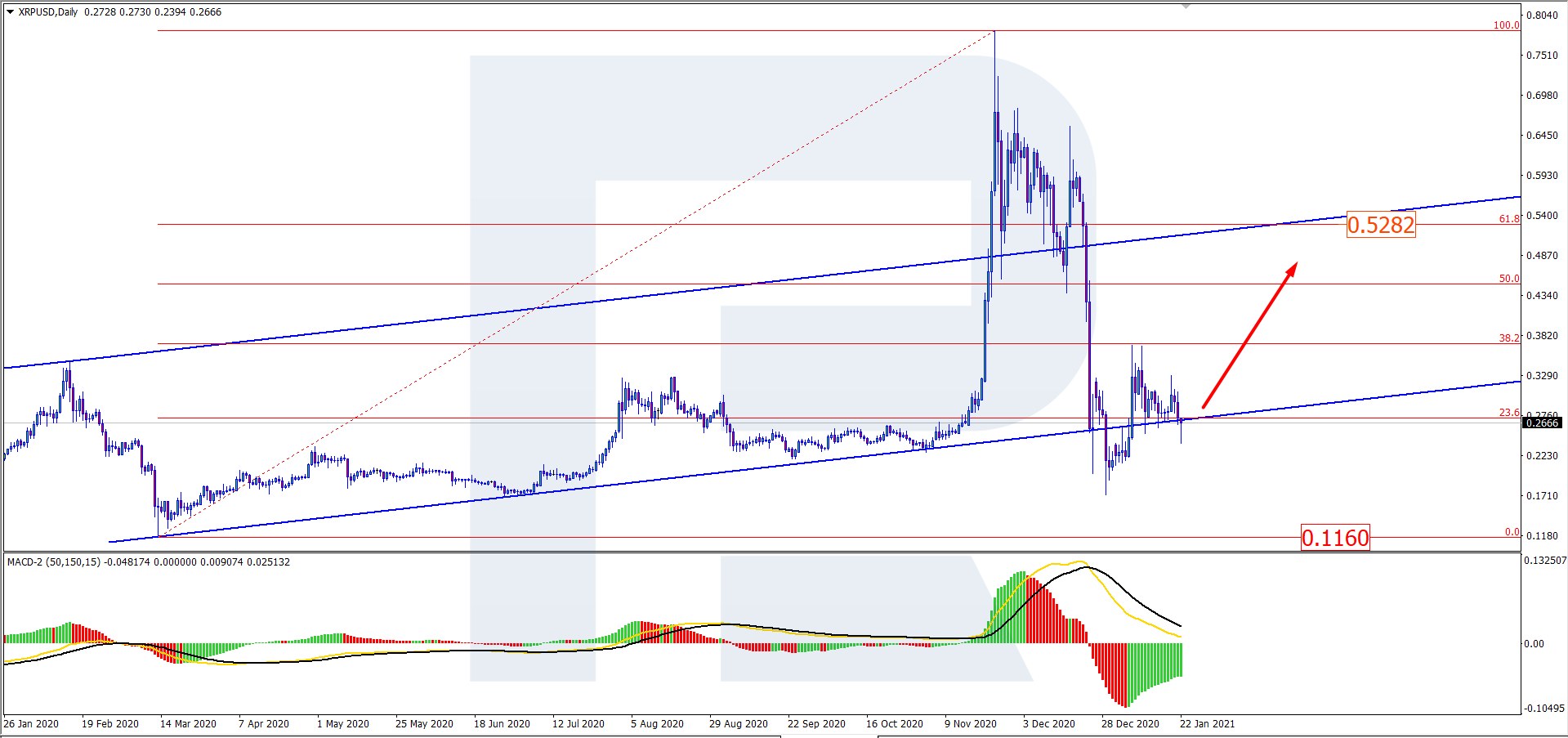

As we can see in the daily chart, XRP/USD continues trading not far from 23.6% fibo. Right now, we may assume that after completing the correction, the asset may resume moving upwards to reach the target at 38.2% fibo. The MACD histogram is also rising, while its signal lines are heading towards 0, which is another signal that the pullback may be over. After it, the pair may resume its ascending tendency to reach the target at 0.5282.

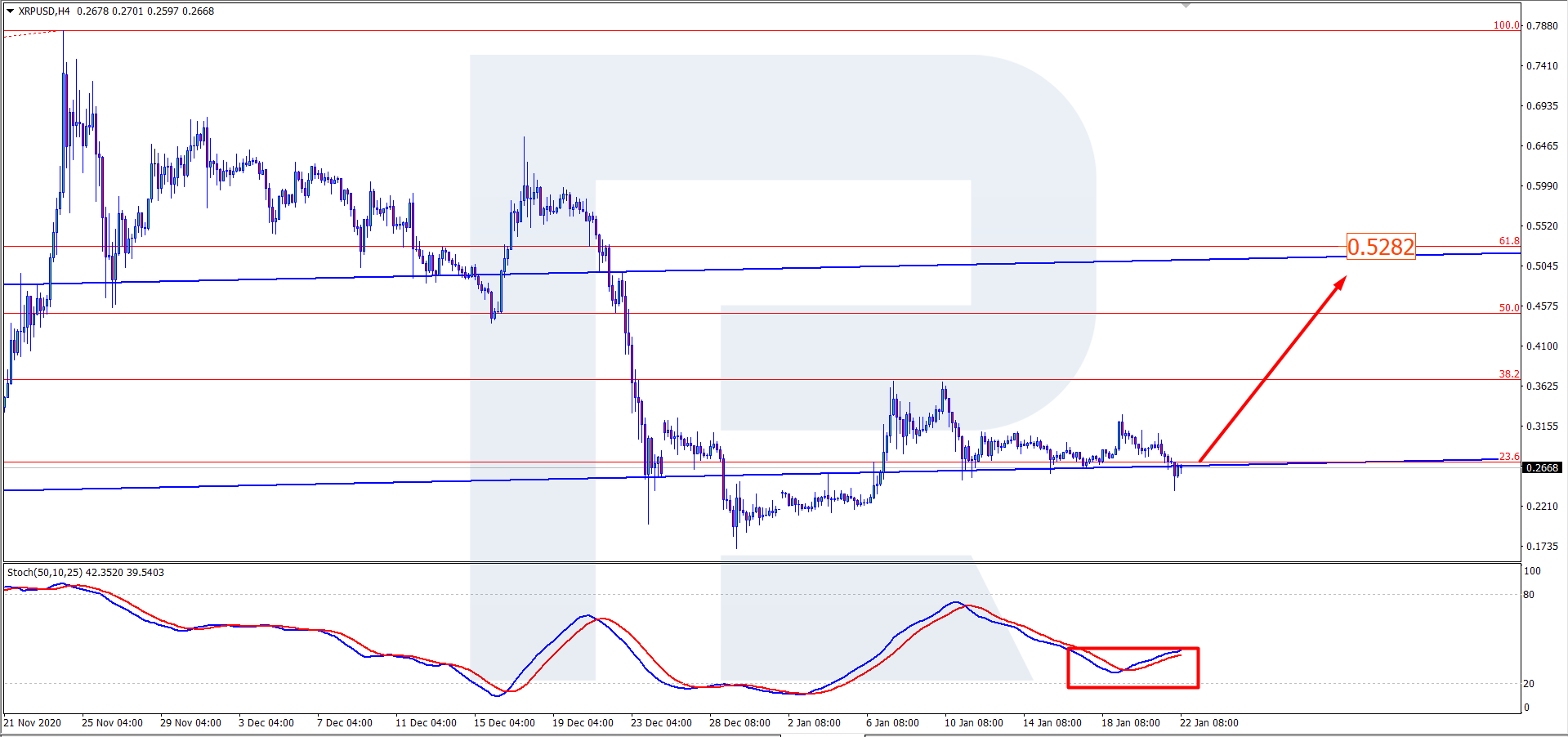

In the H4 chart, the pair continues trading sideways close to the support area at 23.6% fibo. In the nearest future, the price may rebound from this level and then resume growing towards 38.2% and then 61.8% fibo. The Stochastic indicator has formed a “Golden Cross” not far from 20; right now, it is still moving upwards and that’s another signal that the correction may be over. After that, the instrument may continue its growth. The upside target is the same as in the daily chart, 0.5282.

Despite the hard times Ripple is currently experiencing due to disputes with the US Securities and Exchange Commission, the company’s management is very positive about the future of both blockchain and the cryptocurrency market. In their opinion, cryptocurrencies may eliminate the gap with conventional financial assets pretty soon. In the future, fintech companies may seize the initiative and go ahead of small banks and financial organizations. The fact that such big players as PayPal, Robinhood, and others are interested in the opportunities crypto and blockchain have to offer paves the way for digital assets and actually makes them a part of our everyday life.

Fintech companies themselves can benefit immensely from the influx if crypto enthusiasts. PayPal is expected to surpass Cash App and make more than $1 billion on BTC and altcoins.

According to Ripple, 2021 may be a very important and impact-driven year for the cryptocurrency market: finance is getting more accessible and equitable for all people keeping its privacy and safety in use.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Related TAGS:

You can share this post!

Source: Read Full Article