Helen Of Troy Q2 Adj. Profit Declines, Core Business Sales Revenue Up 11.1%; Lowers FY23 Outlook

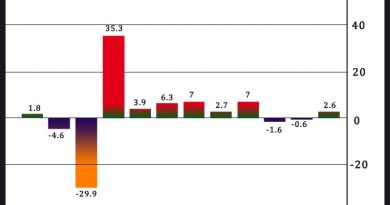

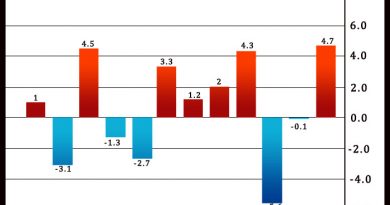

Helen of Troy Limited (HELE) reported that its second-quarter non-GAAP core adjusted EPS was $2.27, a decrease of 14.3% from last year. Non-GAAP adjusted EPS was $2.27, a decrease of 14.3%. The company noted that the decrease in adjusted EPS was primarily due to lower adjusted operating income in the Beauty segment and higher interest expense. On average, five analysts polled by Thomson Reuters expected the company to report profit per share of $2.21, for the quarter. Analysts’ estimates typically exclude special items.

Net income declined to $30.67 million from $51.32 million, prior year. GAAP EPS was $1.28, compared to $2.11.

Consolidated net sales revenue was $521.4 million, an increase of 9.7% from a year ago. Core business net sales revenue was up 11.1%, for the quarter. Analysts on average had estimated $518.43 million in revenue.

Julien Mininberg, CEO, said: “Although we reported results in-line with our expectations for the quarter, we see consumers increasingly adjusting their spending patterns in response to rising inflation and the impact of higher interest rates, particularly in our premium segments in some categories. Additionally, retailers continue to adjust their inventories to better align with their updated sales forecasts. We expect the current external operating environment to remain highly challenging, causing us to lower our fiscal year 2023 outlook.”

For fiscal 2023, the company now expects GAAP EPS of $4.26 to $4.93 and consolidated non-GAAP adjusted EPS in the range of $9.00 to $9.40, which implies a decrease in consolidated adjusted EPS in the range of 27.2% to 23.9%, and a decrease in core adjusted EPS in the range of 26.1% to 22.8%.

The company now expects fiscal 2023 consolidated net sales revenue in the range of $2.00 billion to $2.05 billion, which implies a decline of 10.0% to 7.8%, and a core business decline of 8.6% to 6.4%. The company now expects a mid-teen percent sales decline in the third quarter, and a high-teen sales decline in the fourth quarter.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com.

Source: Read Full Article