Morgan Stanley Q3 Profit Down 9%, But Tops Estimates

Financial services firm Morgan Stanley (MS) reported Wednesday a profit for the third quarter that decreased 9 percent from last year, pulled down by surging provisions for credit losses and higher expenses, despite 2 percent revenue growth. Both adjusted earnings per share and quarterly topped analysts’ estimates.

In Tuesday pre-market trading, MS is currently trading on the NYSE at $77.88, down $2.45 or 3.05 percent.

“While the market environment remained mixed this quarter, the Firm delivered solid results with an ROTCE of 13.5%. Our Equity and Fixed Income businesses navigated markets well, and both Wealth and Investment Management produced higher revenues and profits year-over-year,” said James Gorman, Chairman and CEO.

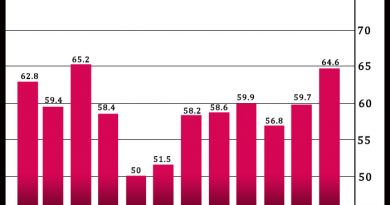

For the third quarter, the company reported net income applicable to the company’s common shareholders of $2.41 billion or $1.38 per share, up from $2.63 billion or $1.47 per share in the year-ago quarter.

On average, 16 analysts polled by Thomson Reuters expected the company to report earnings of $1.22 per share for the quarter. Analysts’ estimates typically exclude special items.

Net revenues for the quarter increased 2 percent to $13.27 billion from $12.99 billion in the same quarter last year. Analysts expected revenues of $12.58 billion for the quarter.

Institutional Securities net revenues declined 27 percent to $5.67 billion from $5.82 billion, reflecting solid results in Equity and Fixed Income and muted completed activity in Investment Banking.

Wealth Management net revenues increased 5 percent to $6.40 billion from last year’s $6.12 billion, reflecting increased asset management revenues on higher average asset levels.

Investment Management net revenues were $1.34 billion, up 14 percent from $1.17 billion a year ago, driven by increased asset management revenues and higher Assets Under management (AUM).

The company’s provision for credit losses soared to $134 million from $35 million in the year-ago quarter.

The company’s board of directors declared a $0.85 quarterly dividend per share, payable on November 15, 2023 to common shareholders of record on October 31, 2023.

The company said it completed the integration of E*TRADE in the quarter, further executing on its strategy of building revenue synergies across channels and attracting clients to its best-in-class advice offering.

For more earnings news, earnings calendar, and earnings for stocks, visit rttnews.com

Source: Read Full Article