Budget 2021: Acid test for Sunak’s budget will follow in the coming months as inflation and cost of living worsens

It was Rishi Sunak’s third budget, but in some ways it was his first.

This the moment that the chancellor finally stepped out of his role as crisis chancellor and got on with the task of rebooting Britain’s post-COVID economy.

And he did so against a more optimistic backdrop than he thought he’d have but a few months ago.

There was better-than-expected economic news in a bigger-than-expected budget.

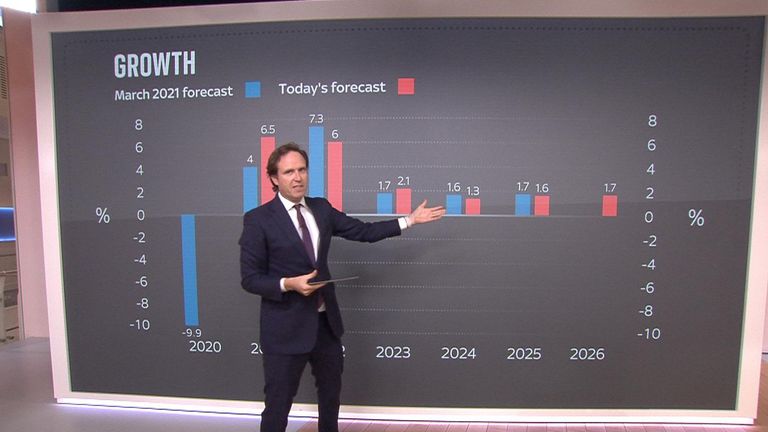

The economy is growing faster than anticipated and the long-term scarring on the economy from COVID less deep, with the economy now forecast to be 2% smaller in the 2025 than the 3% predicted earlier in the year.

It matters hugely because it gave the chancellor far more room for manoeuvre – and he responded with big spending increases – a £150bn increase in departmental spending over the parliament, with more money for courts, schools, local government and of course the NHS.

As Paul Johnson of the Institute of Fiscal Studies put it: “Those are big spending increases. Much more in common than Brown and Blair than Osborne and Cameron.”

And it’s true.

After a decade of austerity (and at Conservative party conference Mr Sunak paid homage to his predecessors for “their 10 years of sound Conservative management of the economy”), this Conservative chancellor has raised taxes by a record amount, with the tax burden now at a level not seen since 1949, and increased spending to an extent that the state is bigger than ever before.

And while the chancellor used the end of his speech to talk of his “moral mission” to reduce taxes and halt the growth of the state – “the government has its limits” – the message that rang loud and clear from this budget was that of a higher tax version of Conservatism to a Thatcherite or Osbornite one. Mr Johnson has won out.

“The chancellor has today delivered a ‘Boris budget’ by spending half of the large £141bn borrowing windfall that was handed down by the Office for Budget Responsibility,” observes Torsten Bell of the Resolution Foundation think-thank.

“He’s used that windfall to spend significantly more, especially in the next few years. The lasting effect of that extra spending is to allow him to partially reverse some of his own decisions by reinstating cuts to aid spending, and increasing Universal Credit generosity for working claimants.”

Forecasts then which worked for the chancellor, but the acid test for this budget isn’t how it lands in the next few days but how this lands in the coming months against a backdrop of inflation, predicted to hit 4% next year, and continued cost of living pressures in the form of energy bills and rising prices, which the chancellor himself warned would take months to unwind.

Council tax bills are going up, as is national insurance, while people will feel the freeze on income tax bands as the cost of living goes up.

And while the £3bn boost to Universal Credit announced on Wednesday will help ameliorate the pain from the withdrawal of the £20-a-week uplift – worth £6bn, there will be winners and losers with some of the poorest families in the UK worse off.

“Inflation is going to head up to 4%, even 5%. We have big tax rises coming next April,” says Paul Johnson.

“The economy’s not really growing very fast, so it’s likely on average people’s incomes will only be crawling over the next three, four even five years and certainly some people, particularly those whose wages don’t go up as fast, will be feeling worse off. So this is not a period of people feeling better I’m afraid.”

Mr Sunak, perhaps alive to that risk, did use this budget to inject the prospect of a more feel good taxation policies ahead of a general election by setting himself up for tax cuts just before the country goes back to the polls.

But there is huge uncertainty baked into this.

If the economic forecasts – so different today than there were back in March – change again and the forecasted growth doesn’t come through, this would leave no room for tax cuts.

And in the meantime, there is a real risk that the gap between the optimism and the lived experience of people is going to grate and this budget and government could soon look very out of touch with the people they lead.

Source: Read Full Article