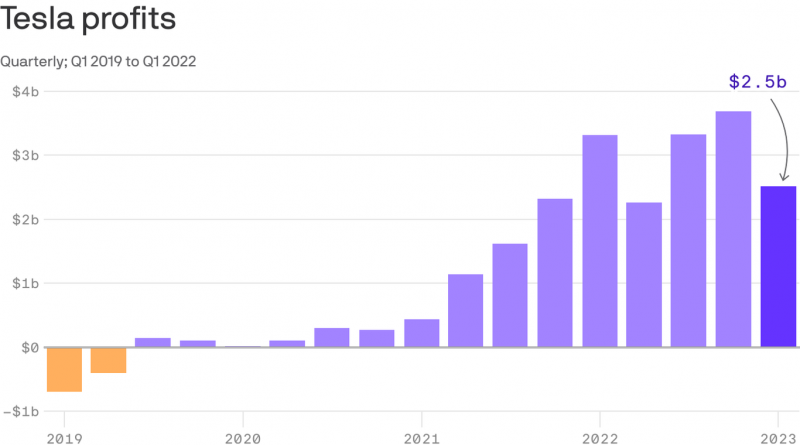

Tesla's profits and margins fell in Q1 after several rounds of price cuts

Scenes from a price war: Tesla's profits and margins fell in Q1 as several rounds of price cuts hit the EV maker's financials.

Driving the news: Tesla reported a $2.5 billion Q1 profit and $23.3 billion in revenues (the lion's share from its car business), during a quarter that saw record deliveries.

The big picture: "We've taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin," CEO Elon Musk told analysts on a call.

- "We expect our vehicles, over time, will be able to generate significant profit through autonomy," he said Wednesday.

- Its Q1 investor deck says operating margins "reduced at a manageable rate."

Quick take: A dicey economy, growing competition, and Musk's unfiltered online persona are emerging as threats to the U.S. EV sales leader.

- But the climate law lifted the cap on the number of vehicles per manufacturer eligible for federal consumer subsidies — a big win for Tesla, which had long ago hit the ceiling.

What they're saying: Price cuts and tax credits make the Model 3 and Model Y "far more attainable" for U.S. customers, Edmunds analyst Jessica Caldwell said.

- "Given the limited number of affordable EVs on the market, these actions certainly help in the short term to increase sales volume and fend off the growing number of competitors."

- But she notes problems facing Tesla, such as an aging product lineup.

The bottom line: Tesla is gambling.

- Axios auto expert Joann Muller says Tesla's strategy of going for the jugular with price cuts assumes it will be more efficient at making EVs than legacy automakers.

- But that remains to be seen, she adds. Once the giants get cranking at scale, they can be very efficient.

Source: Read Full Article