ACY Securities Doubles Instruments, Reduces Spreads & Commissions in Australia

ACY Securities, one of the world’s fastest growing premium multi-category CFD brokers has announced a drastic reduction in its spreads and commission across the major FX pairs, Gold and Oil, as well as a doubling of instruments available to clients from 800 to just over 1600.

The Sydney based multi-regulated broker released a statement this morning saying that all 3 developments were part of its overall mission to empower clients through low costs of trading and increased product choice.

Justin Pooni, Head of Branding & Communications at ACY said the company is always working hard to secure competitive costs of trading for clients at all levels and provide as much choice as possible when it comes to the number of instruments available for clients to trade.

Mr Pooni made three separate statements today in relation to each of the major announcements.

Reduction of spreads for Australian clients

Mr Pooni stated that although substantial reductions in spreads were automatically applied to Australian clients some time ago, he wanted to bring increased awareness to what he described was a significant development for the benefit of traders.

“When it comes to cost of trading, we are always working hard to achieve the most competitive spreads for our clients. We’re delighted to have already implemented big reductions in spreads to clients under our Australian entity across all major FX pairs including AUDUSD, EURUSD, GBPUSD, USDCAD, USDCHF and USDJPY, as well as on Gold and (WTI) Oil” said Mr Pooni in an interview today.

Reduction of commission for Australian clients

“On top of that, we have reduced commissions on the ProZero account for our Australian clients from A$8.50 round-turn to just A$3 round turn. That’s just $1.50 per lot per side and represents one of the lowest commissions in Australia when looking at raw commission-only accounts. But it doesn’t stop there. If you apply our Levelling discounts that could drop even further to a ridiculously low A$2.5 round-turn, truly representing one of the most competitive commission cost structures available anywhere in Australia”.

Doubled the number of instruments to over 1600

The other big news ACY shared through a written statement today was of course the doubling of instruments.

Mr Pooni complimented the statement by stating:

“The other significant development we would like to formally acknowledge is that we have more than doubled our offering across our share CFDs on the ASX, NYSE, Nasdaq and NYSE Arca Equities from 800 to over 1600.

What that means is that you can now trade CFDs on over 1600 shares and ETFs including Apple, Facebook, Tesla, Amazon, SPDR S&P500 ETF Trust, VanEck Vectors Gold Miners, and the Proshares UltraPro Dow 30 to name a few”.

Mr Pooni went on to say:

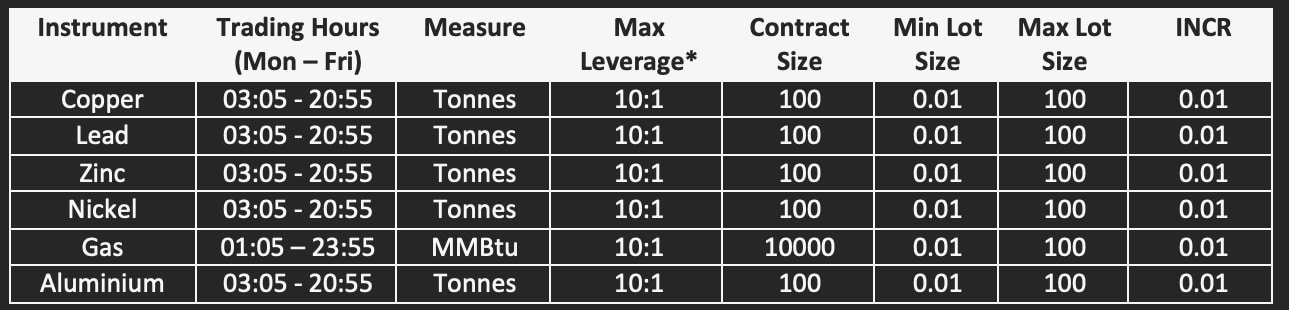

“For the commodities traders amongst us, in addition to the massive increase in exchange-related products, we have also added a fresh lineup of new hard commodities to include Copper, Lead, Zinc, Nickel, Gas and Aluminium. These are all in addition to our already extensive commodities offering”.

New Commercial (Hard) Commodities of offer:

Earlier this year ACY Securities announced the appointment of Clifford Bennett as their new Chief Economist, and a multi-million-dollar multi-year partnership extension with Socceroos legend and former Everton star Tim Cahill.

See highlights of the partnership announcement in 2019.

See the 2020 TVC – over 500,000 views.

See the 2021 TVC – almost 1 million views.

About ACY Securities

ACY Securities Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC AFSL:403863). Registered address: ACY Tower, Level 18, 799 Pacific Hwy, Chatswood NSW 2067. AFSL is authorised us to provide our services to Australian Residents or Businesses. Only Australian residents and businesses can be onboarded with ACY.

© 2018 – 2021 ACY Securities is a brand name of ACY AU and ACY LTD, ACY Securities Pty Ltd. All right Reserved.

Terms of use ACY Securities Website

Source: Read Full Article