CCData Report: XRP's Court Win & Its Implications for Crypto Market

In what CCData reports as a groundbreaking verdict, Judge Torres favored XRP in its closely watched lawsuit against the U.S. Securities and Exchange Commission (SEC). This decision, as CCData indicates, could usher in a new era for the digital assets industry, specifically regarding the categorization of such assets as securities in the United States.

In a blog post published on 14 July 2023, CCData, a leading provider of institutional-grade real-time market data for digital assets, suggests that the ruling brings a renewed sense of optimism to an industry that has been grappling with regulatory actions, creating a potential precedent that may influence ongoing legal cases, restoring confidence in industry participation. Moreover, CCData predicts it could potentially draw in more liquidity into the ecosystem as market makers encounter less risk in dealing with these assets.

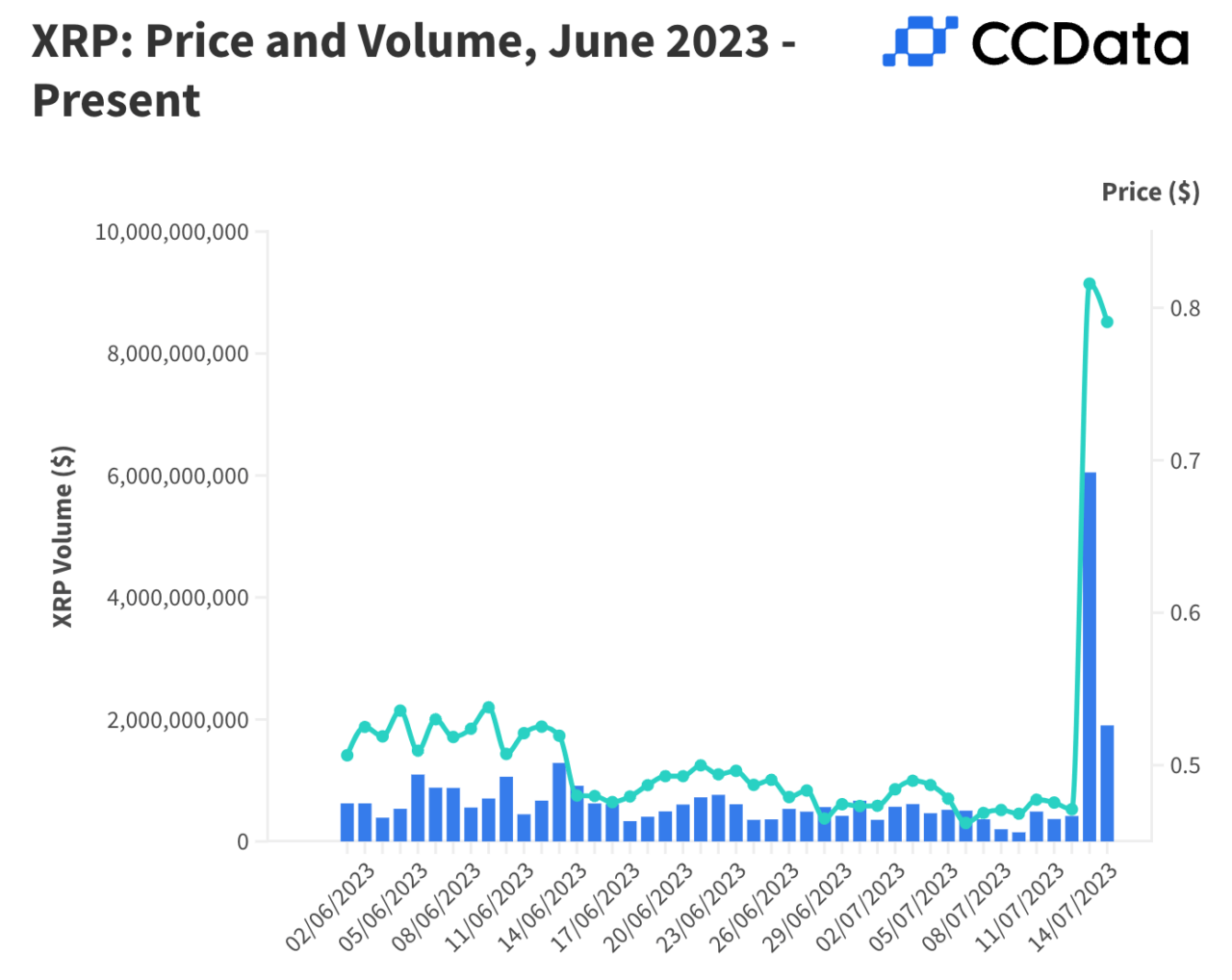

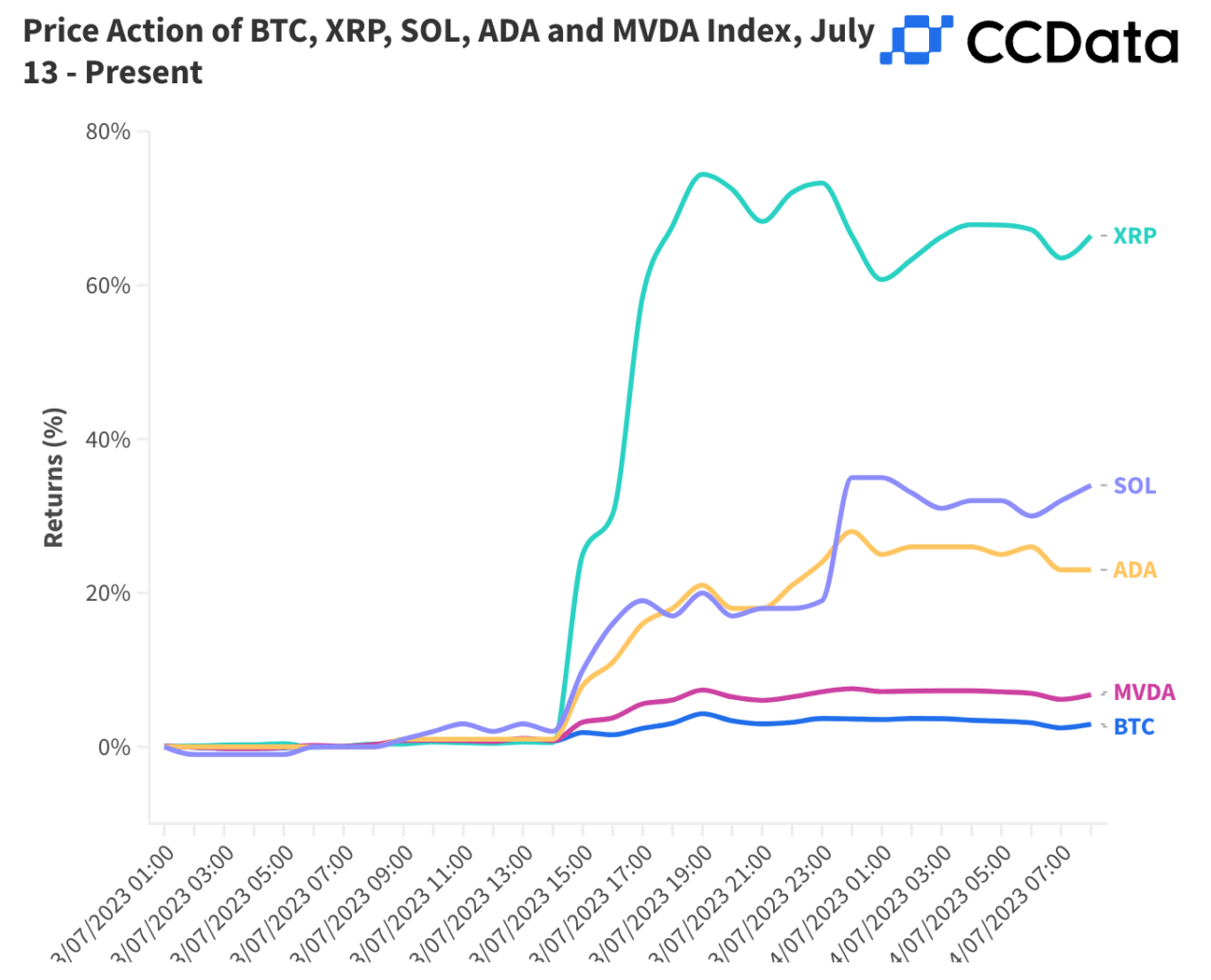

In the aftermath of the court ruling, XRP’s price performance escalated to record levels, CCData observes. The cryptocurrency peaked at $0.93—the highest since May 2021—and closed at $0.82.

This news triggered a dramatic increase in trading activity, with XRP trading pairs on centralized exchanges hitting a total volume of $6.05 billion on the day—an impressive 1351% increase from the previous day.

Moreover, tokens such as Solana and Cardano, which have been recently classified as securities, also witnessed significant gains.

As CCData indicates, the decision to relist XRP on centralized exchanges such as Coinbase, Kraken, and Gemini contributed to the jump in trading volumes. Despite the legal complications faced by XRP due to the lawsuit, its market-depth liquidity demonstrated resilience throughout the year. This could be an indicator of the perceived risk of market-making on the XRP pair, which becomes riskier if XRP were deemed a security.

CCData’s Orderbook data suggests that the ruling caught most speculators off guard, with a vast number of orders within a very tight range around $0.45 before the announcement. This led to a surge in buy orders, causing the price to rise to $0.95 from $0.60.

From a derivatives perspective, XRP maintained a positive funding rate, which CCData attributes to the broader positive market sentiment. The event stimulated a significant rise in Open Interest across exchanges, reaching three times higher than its baseline level prior to the announcement. CCData highlights this increase as a demonstration of the positive speculation surrounding XRP.

In conclusion, CCData believes this landmark verdict introduces new clarity to the digital asset market. and that this development could reshape industry trends, potentially boost coins deemed securities, and challenge BTC’s market cap dominance. Furthermore, it says that this could prompt a reevaluation of the SEC’s regulation by enforcement approach and catalyze industry growth by attracting fresh liquidity and fostering confidence in continued innovation in the digital asset sector.

Featured Image Credit: Photo / illustration by vjkombajn via Pixabay

Source: Read Full Article