Traditional Finance Leverages Stellar Network for Real-World Asset Tokenization

Traditional Finance Enters the Blockchain Arena

On 16 October 2023, Jamie Coutts, a crypto market analyst at Bloomberg Intelligence, highlighted the increasing role of traditional finance (TradFi) in the expansion of real-world assets on public blockchains. According to Coutts, more traditional financial firms are expected to join this trend soon. The growth, although starting from a modest base, is showing a consistent upward trajectory. Coutts also noted that demand is particularly strong in emerging markets, which aligns with the growing adoption of stablecoins in these regions.

Tokenization of US Money Market Funds

Coutts revealed that the tokenization of US money market funds has surged to $600 million, a significant increase from $100 million year-to-date. This indicates a growing interest in the tokenization of traditional financial assets, offering a more flexible and decentralized way to manage these resources.

Key Players in TradFi’s Blockchain Involvement

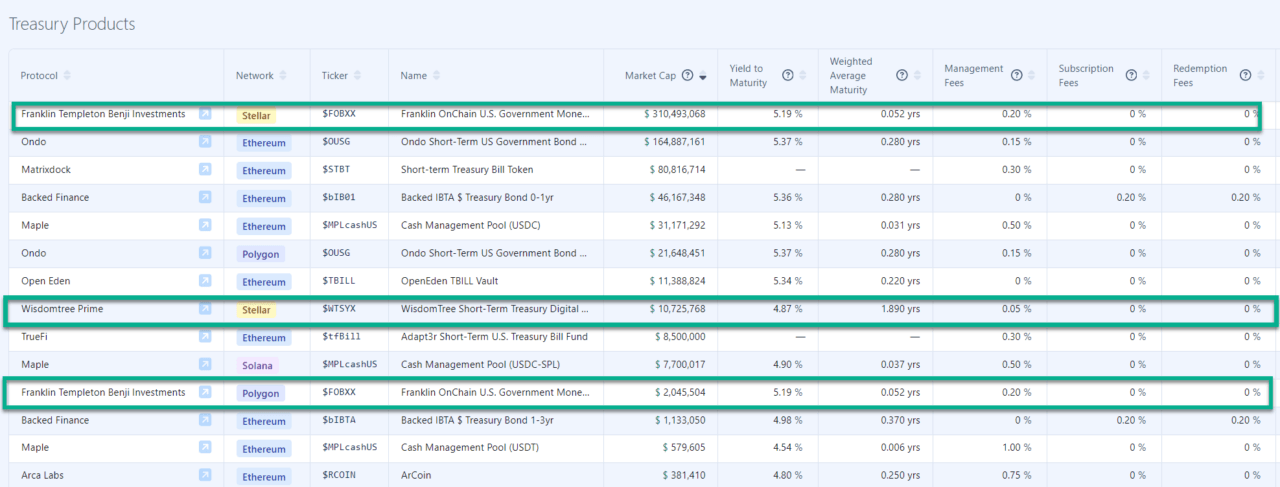

The analyst pointed out that some well-known names in traditional finance have been responsible for issuing 50% of these blockchain-based assets. Specifically, Franklin Templeton Benji Investments has issued assets on the Stellar network, while Wisdotree Prime has also chosen Stellar for its issuance. Additionally, Franklin Templeton Benji Investments has issued assets on the Polygon network.

Network Choices for Asset Issuance

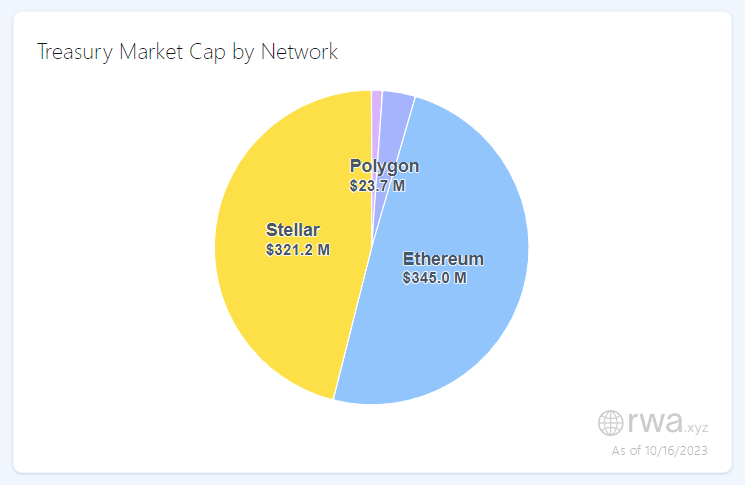

Coutts found it noteworthy to discuss the networks chosen for these issuances. According to the data, Stellar has seen asset issuance worth $321.2 million, Polygon has garnered $23.7 million, and Ethereum leads with $345 million. The choice of network could be indicative of various factors such as transaction speed, cost, and the ecosystem’s maturity.

The Future of Blockchain Adoption

In his final remarks, Coutts opined that while stablecoins remain the most significant catalyst for blockchain adoption, other sectors like NFTs (Non-Fungible Tokens), GameFi, and the tokenization of Real-World Assets (RWA) hold immense potential despite being in their infancy.

Ripple CTO on Tokenization of Real-World Assets and the XRP Ledger

David Schwartz, Ripple’s CTO, recently expressed a bullish view on the XRP Ledger (XRPL) becoming a leading platform for tokenizing real-world assets. Speaking in an interview after his talk at the Apex 2023 developer summit, Schwartz outlined several factors that make XRPL an attractive option for asset tokenization. He emphasized the platform’s low transaction fees and its seamless integration with decentralized exchanges as key benefits.

Schwartz also discussed the need for a platform that offers ease of access and adaptability for tokenized assets. He believes users want a platform that allows them to buy, sell, hold, and move assets without being tied to a specific currency. For example, he mentioned that tokenizing debt shouldn’t be limited to just U.S. dollars, as that would restrict its reach.

Schwartz is optimistic that within the next 18 months, XRPL will emerge as the go-to platform for launching tokenized assets. This timeline has sparked enthusiasm among XRPL supporters. In the same conversation, Schwartz also talked about the transformative impact of tokenization on the financial sector, stating that it will make a wide range of financial products more accessible, particularly in regions with limited access to traditional financial services.

https://youtube.com/watch?v=esRMojalcpA%3Ffeature%3Doembed

Featured Image via Midjourney

Source: Read Full Article