dYdX Airdrops New Governance Token to 64,000 Users

Key Takeaways

- DYDX will be the new governance token of its namesake exchange. The token will be distributed to users who have interacted with the protocol before July 26th 2021.

- While the tokens can be claimed already, users will need to wait until September 8th for it to become transferrable.

- More than 64,000 Ethereum addresses can claim the token granted they make at least one trade in August.

The popular on-chain trading platform has finally released its governance token. The protocol is rewarding past users with an airdrop of the token DYDX.

Rewarding dYdX Users

dYdX is one of the most popular DeFi protocols for margin, spot, and perpetuals trading. On August 3rd, the protocol has announced the much-awaited launch of its governance token. In February of this year, the protocol also announced a partnership with Starkware to bring their trading to layer 2. While the token will be non-transferrable for its first 36 days, DYDX holders will receive trading fee discounts and yield in exchange for securing the protocol.

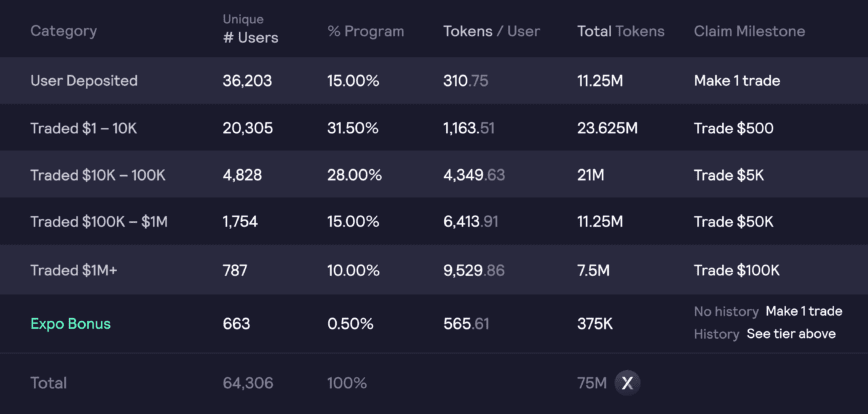

The distribution of 7.5% of the total tokens will take place during the next 28 days. Users with a large trade volume on the decentralized exchange will be entitled to more tokens, but anyone who deposited cryptocurrency before July 26th will receive some amount of DYDX granted they execute at least one trade on the exchange in August.

As we can see, more than 64,000 addresses qualify for the original DYDX distribution, one of the largest airdrops in DeFi history. Users can check if they qualify for the airdrop on this page. Users who don’t qualify for the airdrop can still receive DYDX as trading rewards based on fees paid and open interest on the Layer 2 protocol.

dYdX will also start incentivizing liquidity providers for its Layer 2 protocol over the next five years. In addition, a liquidity staking pool of USDC will be incentivized with the governance token in order to provide the deep liquidity necessary for effective margin trading. Both of these measures will encourage professional market makers to provide liquidity on the exchange.

A safety staking pool will also distribute more of the governance token to users who stake the governance token. This safety pool will be used to create a safety net in case of a security failure. This pool will go live as DYDX becomes transferrable on September 8th.

Disclaimer: The author held ETH at the time of writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article