Exodus: China's Bitcoin Miners Relocate Amid Regulatory Crackdown

Key Takeaways

- Chinese Bitcoin mining firms BIT Mining and Fenghua International are relocating to the U.S. and Kazakhstan.

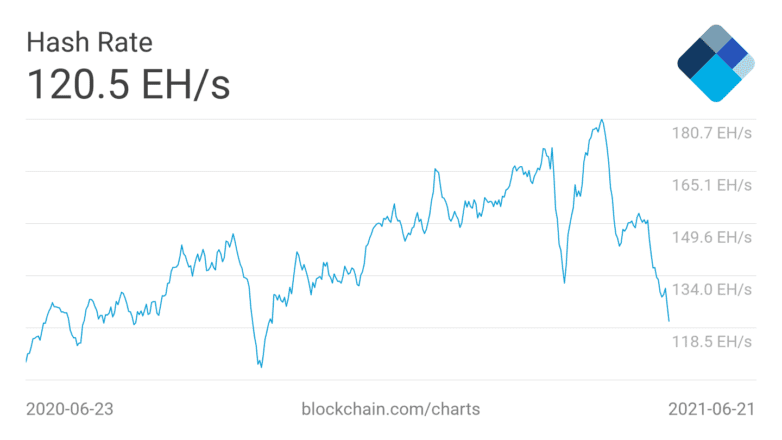

- The Bitcoin network hashrate has significantly dropped as miners go offline following the ban.

- While the short-term effects are negative, the network is witnessing decentralization of the mining industry.

Publicly-listed Bitcoin mining firm BIT Mining is one of many operations moving overseas due to the ban imposed by the Chinese government.

Another Chinese province pulls the plug on Bitcoin

The mining industry is finally moving out of China.

NASDAQ listed firm BIT Mining shipped its first batch of 320 machines to a new facility in Kazakhstan, with an additional 2600 machines expected before the start of July.

Along with moving operations to Kazakhstan, BIT Mining has also invested in new mining facilities in Texas, which the company claims will mostly run on clean and low-carbon energy.

Additionally, a Chinese logistics firm in Guangzhou confirmed it is airlifting 6,600lbs of mining machines to Maryland, USA, for another crypto mining firm Fenghua International.

On Jun. 18, Sichuan, located in the south-west of China, was the latest province to call on miners to stop operating. The shutdown of mining facilities came after the Chinese government in May vowed to curb the mining business in the country citing environmental concerns.

What Does This Mean for Bitcoin?

Since Jun. 19, the total Bitcoin network hashrate has fallen an additional 13%, continuing its downward trajectory since May.

The total hash rate of the network has dropped over 35% from its peak of 180 exo hashes per second EH/s.

However, despite a decrease in the hash rate and price of Bitcoin, there are positive indicators also.

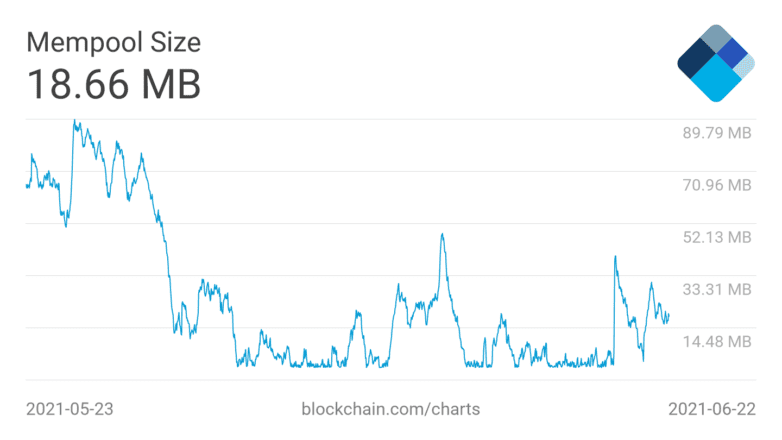

The Bitcoin mempool, a waiting room for transactions yet to be processed, has remained stable. As hash rate decreases, fewer transactions can be processed, putting pressure on existing miners. A stable mempool size indicates that the total mining power comfortably supports all transactions.

The U.S. as a whole is starting to account for more and more of the total network hash rate. During the recent crackdowns in China, American BTC mining pool Foundry USA was the only Bitcoin mining pool to see an increase in hash rate. It is currently the 6th largest pool on the network, according to BTC.com.

Ulrik K.Lykke Executive Director at Crypto/Digital Assets fund ARK36, commented on increased decentralization and clean energy use, stating:

“As miners spread to other locations, they will likely choose places with secure access to cheap energy sources. As a result, hash rate will start recovering, and the network will become even more stable. Additionally, mining will become more decentralized and, likely, more based on clean, renewable energy sources.”

Additionally, Bitcoin mining engineer Brandon Arvanaghi called China’s recent crackdowns “fantastic news” in a Bloomberg interview on Monday.

The former Gemini security engineer explained how moving network hash rate to US states such as Texas or Wyoming provides more safety and security than a “centrally controlling” government like China.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article