Fear of unknown grips govt’s privatisation plan

The divestment target of 2021-22 has been set at Rs 1.75 lakh crore as against Rs 32,835 crore garnered in the last fiscal.

With the disruption caused by the second wave of Covid-19 pandemic, the ‘fear of unknown’ is looming over the government’s privatisation drive.

Although there is a lot of uncertainty and unpredictability on how things will unfold, the government is hopeful of completing the transactions listed in the Budget with a delay of one to two months, said a top government official.

However, “there are many unknown factors now, and we do not know whether there could be a third wave. But we are trying to carry on with our work”, the official said.”

Since there is a lot of uncertainty, the estimates will have to be revised as rating agencies are revising their outlook for growth.

However, with over three quarters of the financial year still left, the government is hopeful to complete the transactions we have listed in the budget, the official said.

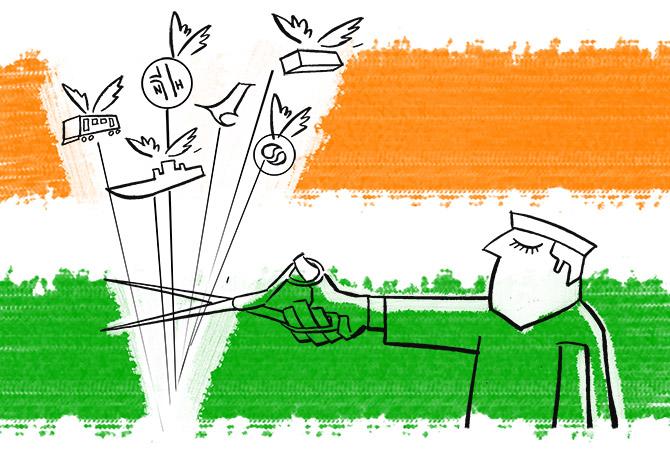

Finance Minister Nirmala Sitharaman, in her Budget speech, had said strategic disinvestment of BPCL, Air India, Shipping Corporation of India (SCI), Container Corporation of India (CONCOR), IDBI Bank, BEML, Pawan Hans, Neelachal Ispat Nigam Ltd (NINL), among others, and IPO of LIC would be completed in 2021-22.

The divestment target of 2021-22 has been set at Rs 1.75 lakh crore as against Rs 32,835 crore garnered in the last fiscal.

The process of privatisation of Air India, BPCL, Pawan Hans, BEML, SCI and NINL has already moved to the second stage after the government received multiple expressions of interest (EoI) for these public sector companies.

“We were targeting to complete some of the transactions before schedule, but there has been a setback for divestment of those companies that are in the pipeline due to the second wave, but all these transactions are well within the government’s target of getting completed in FY22 as of now,” the official said.

Transactions such as BPCL are in the process, and access to virtual data room has been given to bidders.

However, due to restrictions on physical movement, bidders would need more time to complete due diligence.

As of now, the government is expecting a delay of one or two months, the official quoted above said.

The government also expects the privatisation of Air India to take off without any disruptions even as Cairn Energy has sued the airline in the U.S., Business Standard reported Tuesday.

For Air India, as the divestment process is going on for years, many bidders would have done some due diligence, said N.R. Bhanumurthy, vice-chancellor of Bengaluru Dr BR Ambedkar School of Economics (BASE) University.

However, the litigation filed against Air india by Cairn Energy could drag the divestment process a little, Bhanumurthy said.

“Market is conducive for divestment of PSUs, and investors are sitting with cash and may want to invest,” Bhanumurthy said.

He said this year could be better for divestment, and the government would be able to realise better divestment receipts.

The government should move faster to generate more non-tax revenue as it would need money for vaccination, spending to revive the economy, and for giving grants to states, he added.

However, Srivastava from EY India said the government’s “divestment programme can be saved if vaccination in the country goes on smoothly, and the damage caused by the pandemic is contained in the first quarter.”

One positive factor for the government is markets are doing well and investment sentiment has not been impacted excessively, he said.

Agreed Sandeep Shah, managing partner at NA Shah Associates LLP, and said the government’s divestment programme would be dependent on two important factors that are vaccination of the majority of the country’s population, and legal hurdles such as attaching international properties of PSUs.

“If 50-60 per cent of the country’s population is vaccinated on time, it will help in completion of the due diligence process which has been delayed because of restrictions on movement of people,” Shah said.

Legal recourse by companies such as Cairn Energy to attach international properties of PSUs will also impact the government’s divestment program, he added.

“Looking at the vaccination purchase program, it will be difficult to contain yet another wave of the pandemic if it hits India.

“In that case, delay of one or two months is a long shot, and it would be difficult to predict the delay in such transactions,” Shah said.

Source: Read Full Article