FTSE 100 hits 18-month high as it shrugs off supply chain and inflation worries

The FTSE 100 has hit a new post-pandemic high as rising oil and banking stocks helped it shrug off supply chain and inflation worries.

London’s leading share index ticked up to 7242.7 points in early trading on Friday, taking it above a previous peak in August to hit the highest level since February 2020.

It came as the Brent crude oil benchmark – which has picked up sharply recently to hit prices last seen three years ago – climbed above $85 a barrel, lifting FTSE heavyweights BP and Shell.

The FTSE’s rise follows a bounce for Wall Street stocks on Thursday, which was helped by data pointing to improvements in the US employment and inflation outlook and forecast-beating results for major banks.

In London, lenders HSBC and Barclays were also among those in favour.

British Airways owner International Airlines Group climbed 3% on confirmation that travellers will be able to take cheaper lateral flow tests rather than the pricey PCR tests when arriving in England.

Premier Inn owner Whitbread also made gains on the announcement, which takes effect from later this month when many schools will be on half-term break

The biggest faller was global education group Pearson, which dropped 10% after saying that COVID-19 and a tight labour market had hit enrolments at US community colleges.

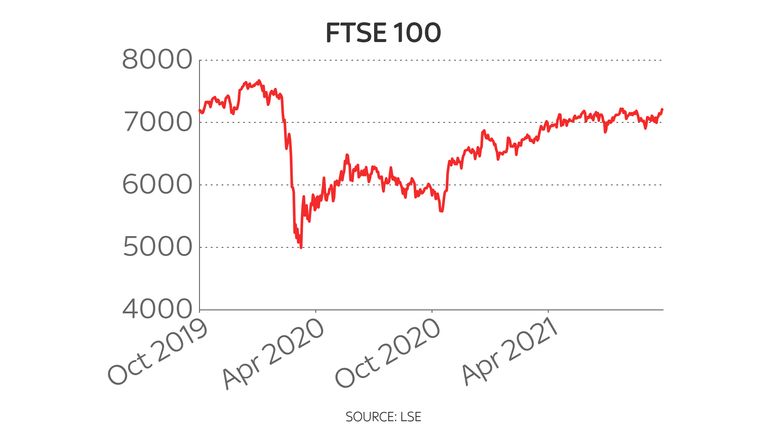

While the FTSE 100 has touched a new 18-month high, it has not quite reached the early 2020 peaks seen before the pandemic began to weigh on stocks, precipitating a catastrophic global sell-off.

Markets have since been recovering from those troughs but it has been taking the FTSE 100 a lot longer than indices across the Atlantic in New York, which took just a few months to bounce back and hit new record levels.

Lately there have also been worries about global supply chain shortages and rising inflation, adding to fears that interest rate rises are nearing.

But markets were taking the positives on Friday, which also saw modest gains for European bourses while elsewhere Bitcoin topped $60,000 on speculation that US regulators would allow the launch of an exchange-trade fund based on the cryptocurrency.

Russ Mould, investment director at AJ Bell, said: “It is interesting to see markets continue to press ahead despite the whirlwind of pressures from supply chain disruption, higher energy prices, rising wages and the threat of rising interest rates.

“Investors seem to be taking the view that central bank monetary stimulus will remain in play and that we aren’t going to be punished by sharp inflation for a long time and interest rates reaching punchy levels.

“Yes, the cost of living has gone up, but rates are coming from such a low base than it would take a very overheated economy to warrant central banks putting the cost of borrowing at such a level that becomes uncomfortable.

“Equally, investors might actually be too complacent. It wouldn’t take much to cause a shock across markets and equity valuations are looking very rich in many places.”

Source: Read Full Article