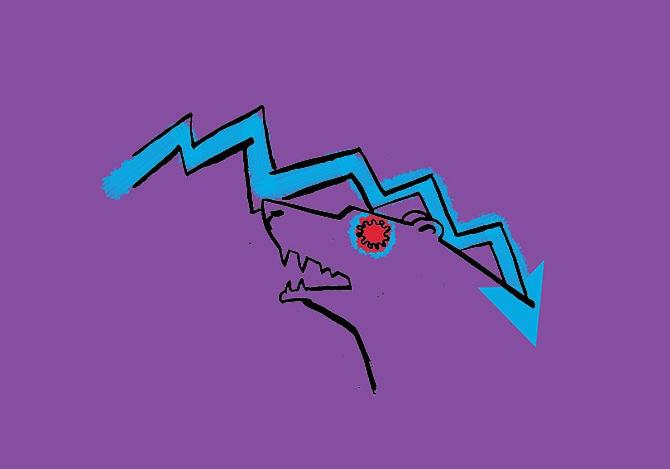

India on the cusp of a bear market: Experts

The faster-than-expected rise in interest rates by the US Federal Reserve (US Fed) shook global financial markets in early 2022.

And now the ongoing war between Russia and Ukraine has lifted commodity prices, with Brent crude oil hitting a 14-year high of $139 a barrel in intraday trade.

All these developments have sent the equity markets across the world into a tailspin.

While the Dow Jones is in a correction mode (-10.5 per cent from its peak since 2020), the Nasdaq has entered bear territory (-21 per cent).

The German DAX, too, has entered the bear zone (down 21 per cent from the high since 2020), while the Nikkei is at the threshold (-19.5 per cent).

In India, the Nifty50 has tumbled around 14 per cent from its 52-week high level of 18,604.45.

An index or a stock is said to be in a ‘bear phase/territory’ when it falls 20 per cent or more from its peak level.

A ‘correction’ is when it is down 10 per cent-20 per cent from its recent peak.

The recent turn of events, analysts said, are a cause for concern and if the situation worsens and takes oil prices higher, it will have a negative impact on India which imports nearly 85 per cent of its annual oil requirement.

This, in turn, will put pressure on the economy and can take the markets into a bear phase.

“The Indian markets have declined less because domestic institutions and retail investors lent support when foreign investors were selling.

“The bulk of flows into India are from emerging market (EM) funds. The constraint for India is oil and a rise in oil prices will weigh on sentiment.

“The Indian markets are on the cusp of a bear market. If the war does not end, the markets can enter a bear phase.

“A 5 per cent fall for the Nifty50 here on is not a big deal,” said Jyotivardhan Jaipuria, founder & managing director, Valentis Advisors.

On its part, the government has kept petrol and diesel prices unchanged despite skyrocketing crude oil prices against the backdrop of the Assembly polls in five states.

Experts believe with the polls now over, a spike in fuel prices to the tune of Rs 13-26 per liter in petrol and diesel is possible.

“The situation is quite fluid. It is difficult to take a call but a further downside in the markets from the current levels is not ruled out.

“I suggest traders wait out this period, while investors should look for buying from a medium-to-long-term perspective,” said Vaibhav Sanghavi, co-CEO, Avendus Capital Public Markets Alternate Strategies.

Empirical analysis of past 17 market corrections in excess of 10 per cent, according to a note by Antique Stock Broking, suggests that market recoveries are swift with entire losses getting recouped in a three-six-month period and the recovery is usually led by capital goods, metals, and banks.

“The past four market corrections due to war also indicate that market recoveries during such events are even sharper with the average market performance from the trough in a 1-month/ 3-month/ 6-month period at 18 per cent/ 31 per cent/ 33 per cent.

“Overall, we believe that given the sharp correction from the October 2021 peak, there may be a limited downside at the current levels, unless the Russia-Ukraine crisis worsens,” said Pankaj Chhaochharia, India equity strategist at Antique Stock Broking.

Source: Read Full Article