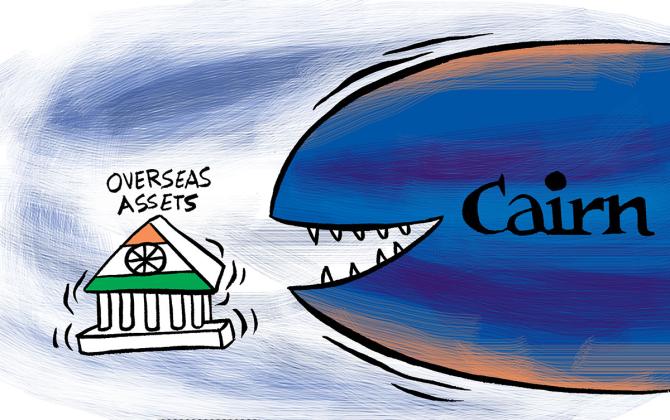

Seizing India’s foreign assets won’t be easy for Cairn Energy

Cairn Energy has threatened the Indian government that it is looking at executing the favourable $1.2 billion international tribunal award in the retrospective taxation case by seizing India’s overseas assets.

Sudipto Dey finds out more.

UK-based Cairn Energy has threatened the Indian government that it is looking at executing the favourable $1.2 billion international tribunal award in the retrospective taxation case by seizing India’s overseas assets. Experts explain the legal intricacies of the process.

What is the nature of foreign assets that could be seized in an international arbitration dispute involving a country or State?

For execution of an arbitration award against a State, a line needs to be drawn between commercial and non-commercial property, says Kshama A Loya, leader, international dispute resolution, Nishith Desai Associates.

“State assets that are used for commercial purposes or activity can be seized. However, assets that are used for sovereign or governmental functions cannot. Consular property and Indian warships would enjoy immunity from seizure. State-run commercial airplanes could be considered for seizure,” Loya adds.

Interestingly, the United Nations Convention on the Jurisdictional Immunities of States and Their Property codifies rules for immunity of a State and its property from the jurisdiction of the courts of another State.

While this Convention was adopted by the General Assembly in 2004, it is yet to come into force, points out Rishab Gupta, partner, Shardul Amarchand Mangaldas & Co.

Experts say ordinarily arbitration awards can be enforced against any assets of the award debtor — whether located in India or abroad.

This can include a variety of assets, such as bank accounts, property, debts, trademarks owned by the government, among others.

Is there a global norm for seizure of assets pertaining to international arbitration awards?

None in this respect, say experts. Arbitral awards, which are final and binding, are generally enforceable in over 150 countries under the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, 1958, popularly referred to as the New York Convention.

The choice of venue for enforcement depends on where India’s assets are located and whether that country is a signatory to the New York Convention, lawyers point out.

Cairn could apply to Indian courts for enforcement of the award to seize any assets in India.

“While Cairn can certainly initiate enforcement proceedings in India, it would be easier to target Indian assets in the UK first,” says Amit Jajoo, partner, IndusLaw.

The procedure and timelines to enforce the award and attach assets will depend on the domestic arbitration law in that jurisdiction.

What are the legal options available to India?

India can challenge the award in the courts of the seat of the arbitration — in this case, the Dutch courts.

India could request the Dutch courts to impose a stay on enforcement of the award during the pendency of the challenge proceedings, say lawyers.

However, such stays are rarely granted, they add. “Simultaneously, India will need to vigilantly monitor developments in jurisdictions where it has State assets,” says Gupta.

One of the defences India might use to protect its overseas assets is to establish non-commercial use of the property, adds Loya.

Is there global precedence of overseas assets of a State getting seized?

One that is currently in the news relates to shareholders of Yukos, a defunct oil company, and the Russian Federation, dating back to 2014.

In another celebrated case, Franz Sedelmayer was involved in a 14-year legal battle with the Russian government.

Source: Read Full Article