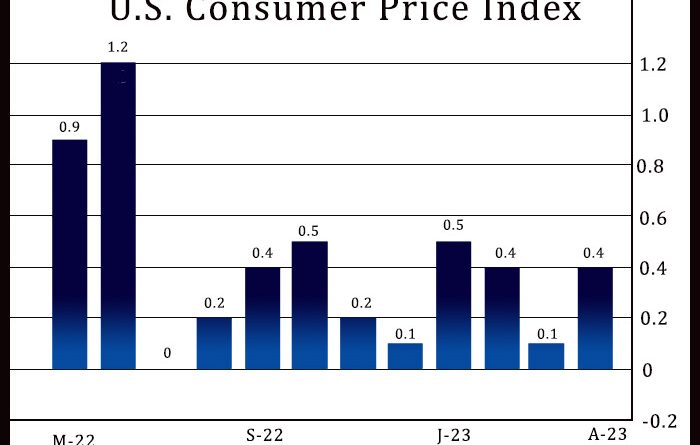

U.S. Consumer Prices Increase 0.4% In April, Annual Growth Slows To 4.9%

Consumer prices in the U.S. increased in line with economist estimates in the month of April, the Labor Department revealed in a highly anticipated report released on Wednesday.

The Labor Department said its consumer price index climbed by 0.4 percent in April after inching up by 0.1 percent in March. Economists had expected consumer prices to rise by 0.4 percent.

The monthly increase in consumer prices was led by a continued advance by prices for shelter, which rose by 0.4 percent in April after climbing by 0.6 percent in March.

Energy prices also increased by 0.6 percent in April after plunging by 3.5 percent in March, with a surge in gasoline prices more than offsetting declines in prices for other energy components.

Meanwhile, the report said food prices were unchanged for the second straight month, as an increase in prices for food away from home was offset by a dip in prices for food at home.

Excluding food and energy prices, core consumer prices also rose by 0.4 percent in April, matching the increase seen in March as well as economist estimates.

The core price growth reflect the increase in prices for shelter as well as higher prices for used cars and trucks, motor vehicle insurance, recreation, household furnishings and operations, and personal care.

The Labor Department noted prices for airline fares and new vehicles were among those that decreased over the month.

The report also showed the annual rate of consumer price growth edged down to 4.9 percent in April from 5.0 percent in March. Economists had expected the year-over-year growth to be unchanged.

The year-over-year growth in April marked the smallest 12-month increase since April 2021 but is still well above the Federal Reserve’s 2 percent target.

The annual rate of core consumer price growth also slipped to 5.5 percent in April from 5.6 percent in March. The modest slowdown matched economist estimates.

“We expect to receive more encouraging news on the inflation front as the economy cools though we won’t reach the Fed’s 2% inflation target for quite some time,” said Oren Klachkin, Lead U.S. Economist at Oxford Economics.

He added, “A positive consequence of the oncoming mild recession that we expect in H2 2023 is it should help ease price pressures.”

On Thursday, the Labor Department is scheduled to release a separate report on producer price inflation in the month of April.

Producer prices are expected to rise by 0.3 percent in April after falling by 0.5 percent in March, while the annual rate of growth is expected to slow to 2.4 percent from 2.7 percent.

Source: Read Full Article