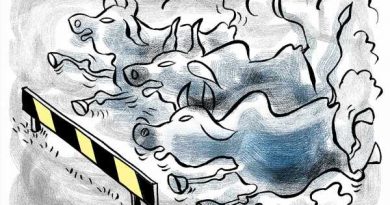

U.S. Stocks Seeing Further Downside Following Yesterday’s Sell-Off

Stocks have moved mostly lower in morning trading on Friday, extending the sell-off seen over the course of the previous session. With the continued decrease on the day, the tech-heavy Nasdaq hit its lowest intraday level since November 2020.

The major averages have climbed off their worst levels of the day but currently remain in negative territory. The Dow is down 185.08 points or 0.6 percent at 32,812.89, the Nasdaq is down 95.89 points or 0.8 percent at 12,221.80 and the S&P 500 is down 25.76 points or 0.6 percent at 4,121.11.

The continued weakness on Wall Street comes following the release of a closely watched Labor Department report showing stronger than expected job growth in the month of April.

The report showed non-farm payroll employment surged by 428,000 jobs in April, matching the revised jump seen in March.

Economists had expected employment to climb by 391,000 jobs compared to the addition of 431,000 jobs originally reported for the previous month.

Meanwhile, the Labor Department said the unemployment rate came in unchanged at 3.6 percent versus expectations the rate would edge down to 3.5 percent.

With the report showing continued strength in the labor market, economists predicted the Federal Reserve will continue with its plans to raise interest rates relatively sharply over the coming months.

“Overall, with labor market conditions still this strong – including very rapid wage growth – we doubt that the Fed is going to abandon its hawkish plans because of the current bout of weakness in equities,” Ashworth said.

Worries about the outlook for interest rates may be weighing on Wall Street along with a continued increase in treasury yields.

Airline stocks have moved sharply lower in morning trading, dragging the NYSE Arca Airline Index down by 2.8 percent to its lowest intraday level in almost two months.

Substantial weakness has also emerged among housing stocks, as reflected by the 2.8 percent plunge by the Philadelphia Housing Sector Index.

Financial stocks are also seeing considerable weakness on the day, with the NYSE Arca Broker/Dealer Index and the KBW Bank Index tumbled by 2.4 percent and 1.9 percent, respectively.

Biotechnology, chemical and steel stocks have also shown notable moves to the downside amid another day of broad based weakness.

In overseas trading, stock markets across the Asia-Pacific region moved mostly lower during trading on Friday. China’s Shanghai Composite Index slumped by 2.2 percent and Hong Kong’s Hang Seng Index plunged by 3.8 percent, although Japan’s Nikkei 225 Index bucked the uptrend and rose by 0.7 percent.

The major European markets have also moved to the downside on the day. While the French CAC 40 Index has tumbled by 2 percent, the German DAX Index and the U.K.’s FTSE 100 Index are down by 1.6 percent and 1.5 percent, respectively.

In the bond market, treasuries are extending the sell-off seen in the previous session. Subsequently, the yield on the benchmark ten-year note, which moves opposite of its price, is up by 3.5 basis points at 3.101 percent.

Source: Read Full Article