Analyst Warns of Bear Market Manipulation as CFTC and DOJ Investigate Binance

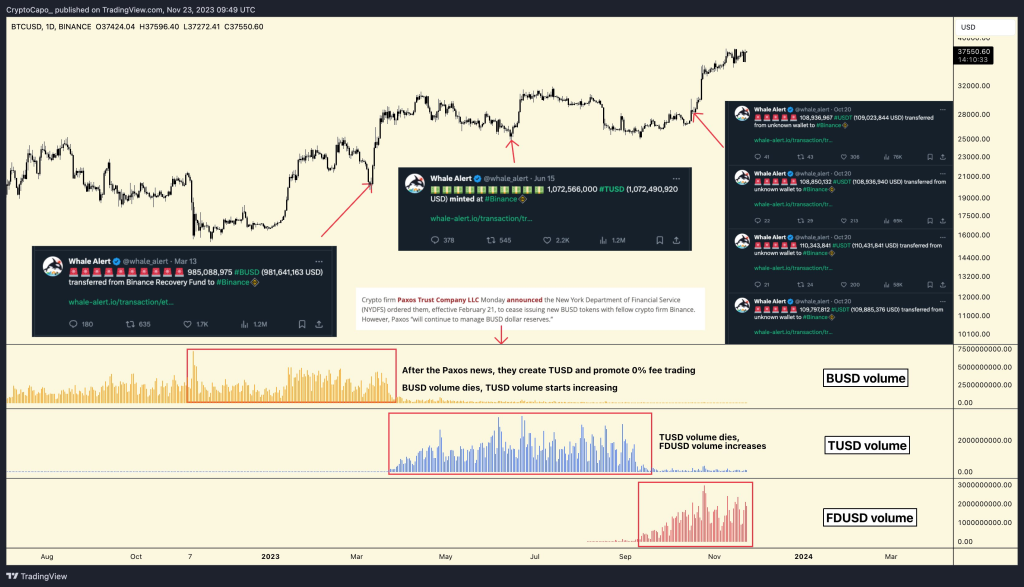

In a recent tweet, prominent crypto analyst Capo of Crypto has raised eyebrows with a bold assertion. He stated that the recent surge in cryptocurrency prices may be nothing more than a manipulated bear market rally.

According to Capo, this alleged manipulation, orchestrated by familiar players, aims to create a façade of a robust bull market. This manipulation is to deceive investors into believing that a sustained upward trend is underway.

Capo’s claims gain additional weight as the Commodity Futures Trading Commission (CFTC) reportedly raised similar concerns back in March 2023. The CFTC alleged market manipulation, pointing fingers at entities exerting control over the crypto markets.

DOJ is poised to gain access to the books of Binance

Now, the Department of Justice is poised to investigate further by gaining access to Binance’s books through a monitoring process.

The notion of a manipulated bear market rally challenges the prevailing narrative of a resurgent bull market, and Capo remains resolute in his analysis despite the adversities.

In a market known for its volatility, the ability to discern genuine market movements from orchestrated ones becomes crucial. Capo emphasizes the challenge of maintaining objectivity in the face of extreme situations where emotions threaten to cloud judgment.

The CFTC’s earlier involvement in March has already hinted at the complexity of the issue, and the DOJ’s recent move to scrutinize Binance adds another layer of intrigue to the unfolding story.

Investors, both seasoned and novice, now find themselves navigating uncertain waters, grappling with the possibility that market dynamics may not be as organic as they appear.

Source: Read Full Article