Bitcoin Legal Tender, A Financial Earthquake For Dollarization?

Dollarization is dead, long live bitcoinization? That’s what some might be wondering as a new financial order upgrades with a dollarized country declaring bitcoin legal tender.

The declaration is wholistic and total, stating bitcoin (and only bitcoin where cryptos are concerned) must be accepted for any and all payments in shops, or for debts, or for taxes.

The state of El Salvador is also to direct its civil service towards the promotion of bitcoin acceptance in a novel official government policy.

There have been no studies whatever as far as we are aware, nor any economic theories, on what bitcoinization might mean, except Krugman, who hates bitcoin, once stated that “microeconomic efficiency would be maximized with a global currency” back in 1993.

That seemingly different era was the height of dollarization. Brazil had their money pegged to USD, as did Argentina, while the dollar strengthened and strengthened to all time high, which it never reached again.

Succinctly put, in a 2003 paper for the International Journal of Political Economy, Louis-Philippe Rochon and Sergio Rossi say of dollarization:

“It is assumed that eliminating the local currency and adopting the U.S. dollar leads to the adoption of the prevailing monetary policy in the United States and, hence, to credibility in international markets.

In this sense, dollarization would lead to the implementation of credible monetary policies in dollarized countries and would guarantee market discipline, which, in turn, would lower the overall ‘country risk.’

As a result, international investors would find domestic securities more attractive, which would lead to increasing capital inflows (largely in the form of foreign direct investment) or would at least prevent abrupt capital outflows.

In particular, elimination of devaluation risks could have some positive effects on the overall country risk, thus leading to further falls in domestic interest rates, with a number of positive effects on the domestic economy in terms of stimulating investment, employment, and output growth.”

It is to grab these benefits that El Salvador decided in 2000 to ditch their own money and use the dollar.

Looking at their stats, inflation is rising now but low at under 3%, as are interest rates at about 4%. There is some growth at about 3% prior to the pandemic with it nearing 5% at times during the past decade.

Dollarization here has worked generally, although we don’t know what it would have been otherwise, but it’s a risky business.

As El Salvador was going on the dollar, Argentina was changing presidents almost daily while announcing a default in December 2001 on $98 billion sovereign debt.

About a decade earlier in 1989, a hyperinflating Argentina went USD. This was great. Argentina was growing at the fastest rate in Latin America. Wall Street fell in love with them. But then Brazil went off the peg with the dollar, devaluing Rial and bankrupting Argentina which now had become uncompetitive.

Zimbabwe provides a different story. Hyperinflation, went on the dollar, then got off again. Almost as soon as it did, inflation jumped, reaching 800% last year.

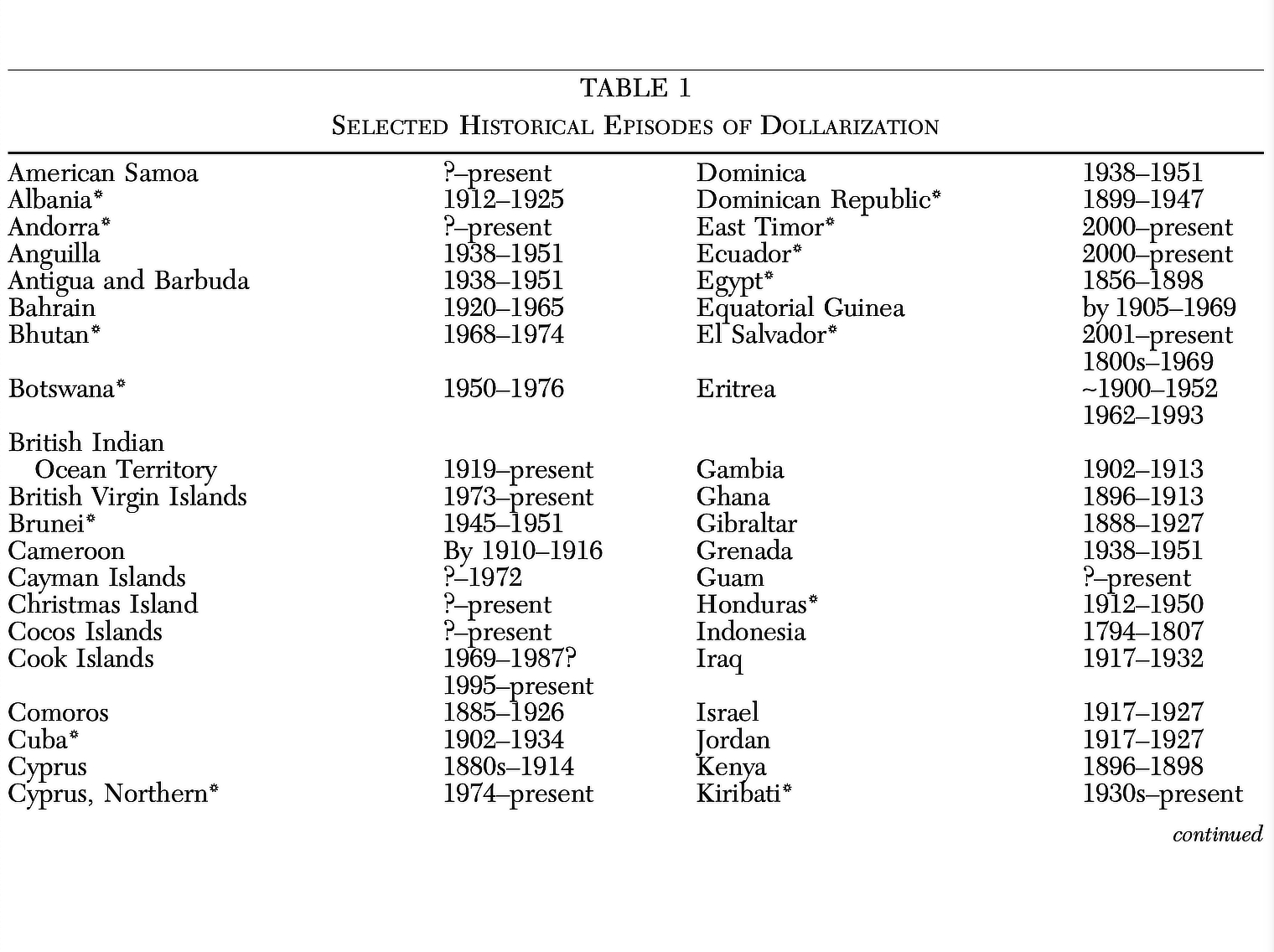

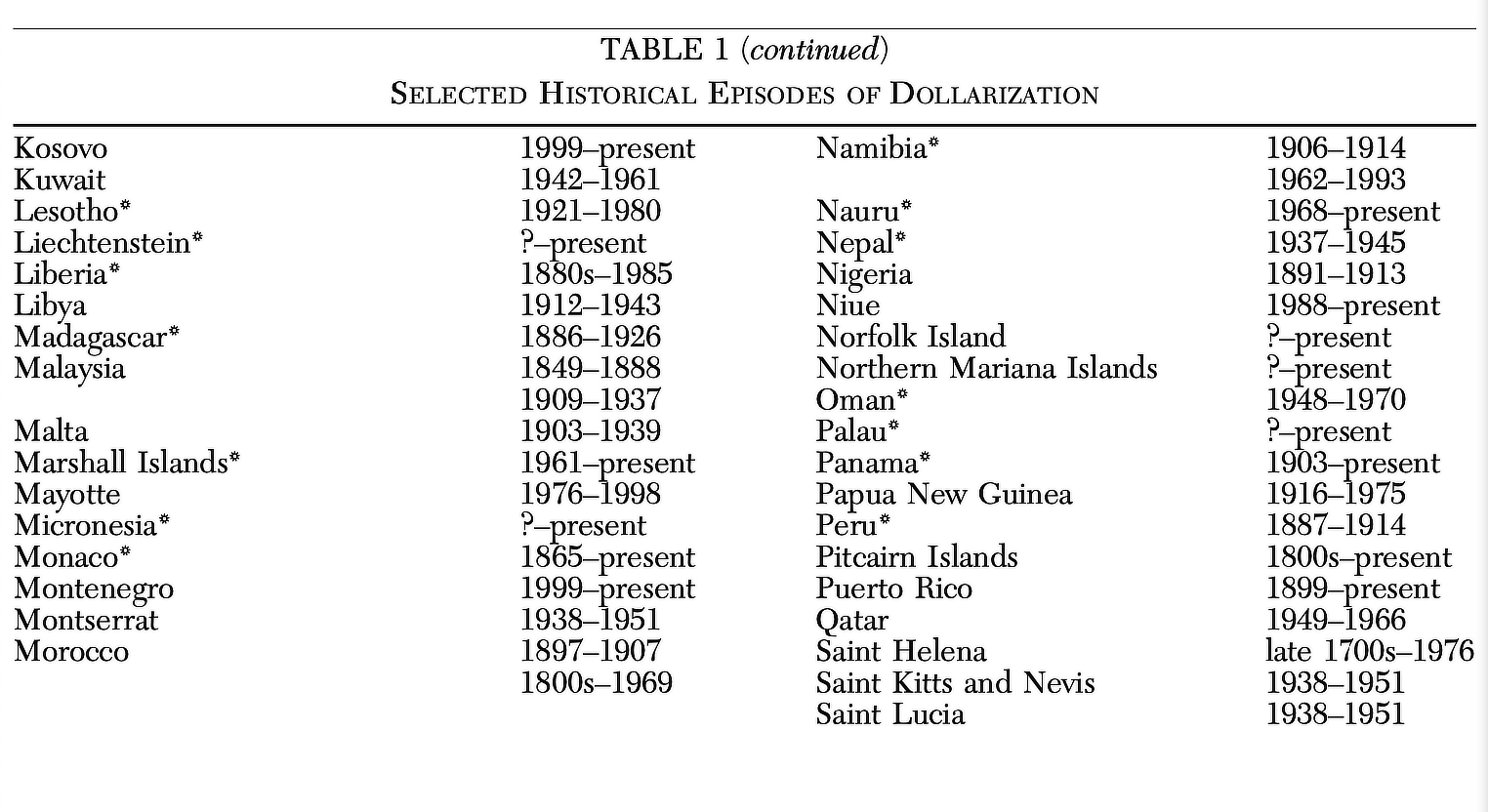

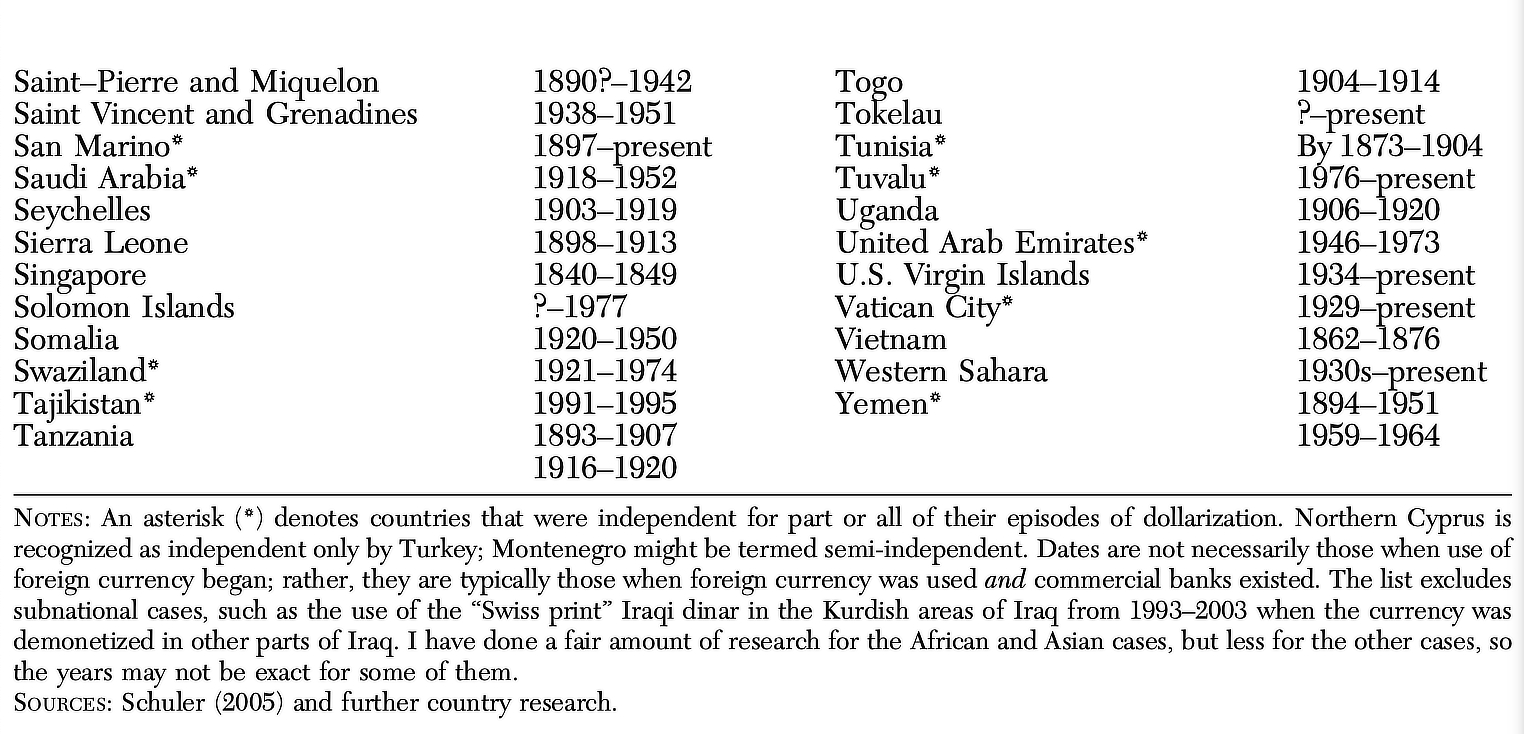

In fact this story is that of much of the world, with dollarization – here broadly defined as using the money of any other nation including for a short period – having a long list of countries:

Saudi Arabia is pegged to the dollar. Just to illustrate how loose the definition is however, the 1912 period for Albania – a country arguably at the crossroads of empires next to Greece and Italy – is described as follows:

“Even after the declaration of Albania’s independence, in 1912, the country continued to use the Ottoman monetary system, adopted in 1844. The main currency in circulation was the Gold Ottoman lira, which was worth 100 silver grosh.

This was a natural consequence of monetary funds still in circulation after the declaration of independence and public deposits. Political and economic developments during WWI and foreign occupation were determinant factors for the circulation of other currencies.

The landscape of currencies in circulation during 1912-26 would perfectly fit the metaphor of the Tower of Babel. In addition to the silver and gold Ottoman currency, whose legal tender was envisaged to continue until the issue of the Albanian national currency, other gold currencies circulated in that time in Albania such as American, French, Italian, and Greek ones.

Silver coins, which, prior to WWI equalled 5, 2, 1 and ½ gold franc of various countries, circulated as well. In everyday life, they were called “Korona Sermi” (silver kroner).

Although the monetary value had depreciated, the people had great confidence in them. In the absence of a formal exchange rate, this myriad of currencies was officially recorded in the state revenue and expenditure books.

In 1920, with the internal organisation of the Albanian State and introduction of the fundamental elements of the constitution envisaging free and independent institutions from foreign interventions, the first measures were taken to set the monetary situation in order.

According to the Decision of the Council of Ministers No 273, of 6 May 1920, for the first time, state revenues would be declared on the basis of the gold franc.”

Albania sits at the other corner of the world from El Salvador, bordering the now vast block of the eurozone with Albania itself softly euronizing.

Euronization is in fact very much on the ascendance, not least because the euro is strengthening and for bordering countries they want to be past of the EU.

The latter have a full monetary control and sovereignty, albeit continent wide. So someone like Greece can find itself in a situation like Argentina, but the troubles of someone like Greece are or were to some extent continental, while America didn’t care about Argentina because confidence in the dollar wasn’t affected.

Or was it? Was America too high up its horse to see the troubles of Argentina were in part because of shared monetary policy controlled by USA to its great benefit, and saving Argentina to keep dollarization may have benefited it far more than the mere cost of $100 billion?

We Empire

“In a nutshell, dollarization leads to better policies (Powell 2000).” Yes, our Powell arguing that the loss of the ability to set interest rates or for the central bank to act as the lender of last resort was or is a good thing because it will impose discipline.

The budget will have to be kept in surplus, no print baby print. “Dollarization would not only impose better monetary policies but also better fiscal policies that would force deficit-holding and indebted countries to restructure their debt and curtail ‘irresponsible spending’.”

America did not liberalize however and arguably missed its opportunity to empire despite de facto being one.

An overlooked section of this history has the lesson for Europe. As Gnos and Rochon argued in 2005 “it is time to ‘reform the reform.’”

That is a dollarised or euronized country should be given to some extent some say or access to the benefits of fiat money, like the ability of the commercial bank to print them which translates to the bank/s of euronized countries having access to ECB and its oversight.

That can have dangers for Europe because if these commercial banks go on printing spree, the euro itself is affected, so sending us back to the 60s theory of the Optimum currency area (OCA) by Mundell.

That tries to find the balance between control over monetary policy and the benefits of being part of a currency block with studies finding same currency countries have increased bilateral trade in addition to many other benefits.

Yet the costs can be dangerous as Lebanon is finding currently with their dollar peg gone off the hook because they did spend too much and no one stopped such ‘irresponsible spending’ in time.

America has come across as nothing to do with any of this at all where Lebanon is concerned, despite the fact that America enjoys great benefits from the dominance of the dollar.

The United States therefore may in history be said to have wanted the benefits of empire without any of the costs. Such historians maybe will conclude it was more due to naivety or aloofness, that the benefits of Lebanon pegging to USD could clearly be seen for Lebanon, but not USA which also benefits by being able to export its inflation and by enlarging the economy that effectively backs the dollar.

A falling Lebanon to some extent arguably also weakens the dollar, but a trillions printing United States appears unwilling to even consider giving some little billions for its dollarization.

The arrangement therefore can not quite maintain, and sooner or later these countries that need such clinging to stability will either adopt a more self-aware monetary empire, like the euro, or will experiment with something new and yet in many ways the same, or indeed both.

The Dawn of Bitcoinization?

The history of money is the history of class war and the history of class war is all history. This is apparently what Karl Marx said.

Bitcoin has no class however, but it can easily be argued it is the ordinary people’s money as anyone is free to use it or not use it. Just as one can argue it is the elite’s money for those with most capital, most bitcoin, gain the most returns.

Both communists and capitalists however will probably agree that the one quality bitcoin has is that it is independent.

There is no empire here, except the dynasties that might be born out of this movement but they too powerless over bitcoin the code.

As such, bitcoinization or dollarization have the same drawbacks. No lender of last resort. No interest rates tools to manipulate the economy for booms and busts or to try and weather shocks.

For both the solution can be the same. “The Treasury could set up either a ‘stabilization fund’ or emergency credit lines with banks direct.”

This is the socialized losses that crypto exchanges came up with after some very fast price movements led to liquidations that couldn’t be closed but at a very big loss which had to be paid by the gainers with the solution being a tax of sorts.

Deribit for example after every liquidation takes a percentage that goes to a fund that is used to cover any losses during fast price movements or in any other events.

Another example is what far more covertly some exchanges do or should use, which is set aside a percentage of their monthly profits to cover any potential hacks. Losses from any such hack are then covered from these savings without having to tell (scare) the people or worse, without having to get users to cover the loss.

Likewise a country or the banking system itself can by law be required to keep a percentage to be used in instances like last year. Living off savings, in short.

Something like America is on print baby print, so this won’t happen anytime soon, but something like El Salvador already has to live on their savings or they go the way of Lebanon with neither America or anyone else carrying at all to be the lender of last resort.

If the drawbacks are the same, what is the benefit. For the dollar, we highlighted them above. Basically higher confidence in monetary policy which can draw more foreign investment and thus economic growth.

El Salvador has not seen that much of a growth in foreign investment mainly because of a high rate of violence which the new president is apparently bringing down, so that might change.

The benefit of bitcoinization may also involve an increase in foreign direct investment because a friendly jurisdiction may attract more business.

For a financially underdeveloped country like El Salvador, it might also amount to a leap of sorts to a new digital and global crypto economy, tapping into far greater access to monetary tools especially where remittances are concerned.

The greatest benefit however is the choice to not operate on Fed’s terms. To not have your savings devalued if the dollar is devalued. To not have your deposits frozen if your government spent too much as happened in Argentina.

It’s effectively gaining monetary independence where the people are concerned, and that creates a more competitive economy because to some extent the dollar in El Salvador is operating or will be operating on a bitcoin standard.

Not officially, but organically. If bitcoin is rising, then you want to be paid in bitcoin, which increases bitcoin’s utility, now more want bitcoin, and so it continues rising.

If bitcoin busts, you want to operate on the dollar, or you hold if it is savings and you don’t need them to spend, so putting a floor of sorts on its bust.

This competitive force can exert disciplinary pressures on the Fed and other central banks who are now faced with a significant challenge in considering the effects of bitcoin usage in the empire’s periphery, like El Salvador, and thus how their action might affect the decision of people in El Salvador to use dollars or bitcoin.

For El Salvador this is awesome. It gains some power and say on the monetary policy of the main money while continuing to use that main money and so gaining the theoretical or practical benefits from doing so.

While for someone like America, it can be one of those cases of not knowing what you take for granted until it’s gone, or as Trump put it:

“Bitcoin, it just seems like a scam. I don’t like it because it’s another currency competing against the dollar.”

So a competing scam? Even under those terms, something like Lebanon would have faired a lot better, or at least its people, if bitcoin had been a state sanctioned choice.

Plenty argue that the monetary policy of America too would be a lot better if bitcoin was or is to freely compete.

That includes stronghold think tanks of the Republican Party which argue that America should take the step to declare bitcoin legal tender so that it can compete on uninhibited free market basis.

The Republican Party now however has been hijacked to become more a nationalist Trump party despite this man attempting to usurp democracy and thus the foundations of the American Republic.

Yet good sense must prevail in the United States if it is to gracefully manage its decline into a multipolar world of three empires, Europe, USA and China.

Monetarily speaking China is cheating by undervaluangly pegging its currency to the dollar, with PBoC fighting markets to prevent the yuan from strengthening.

A Chinese monetary empire therefore appears to not quite be in vision any time soon as monetarily they operating like a little poor developing country, rather than a confident visionary leader.

Europe is in the ascendancy at least narratively with a significant opportunity to learn from the mistakes of dollarization with a policy of eurozation that comes with benefits which include assistance in very exceptional circumstances under rigid oversight.

The United States failed to responsibly exercise its power and privileges, both in directly razing Mesopotamia and Babylon as well as in indirectly letting Argentina fall when it did not have to.

Those are very costly mistakes that have clearly courted correction, with Latin America so leading the way to effectively bootstrap to a state level a new global reserve currency which is a unique social experiment that only time will tell whether it is a trickling wave or a fizzling thought.

Whichever way, we should be enriched at least in knowledge by now tackling these very big country level matters of political economic theory and practice.

Source: Read Full Article