DeFi’s TVL Added $35B in Q1 2021. What’s Next for Decentralized Finance?

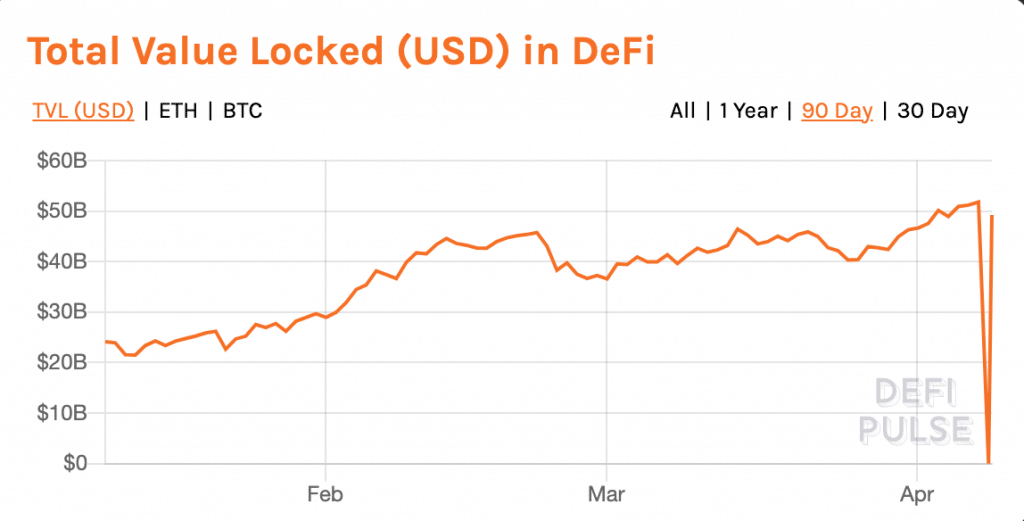

The first quarter of 2021 was an eventful period for the DeFI world. From January 1st to the end of March, the ‘Total Value Locked’ (TVL), the amount of capital that is being stored in DeFi protocols, rose from roughly $16 billion to more than $49 billion.

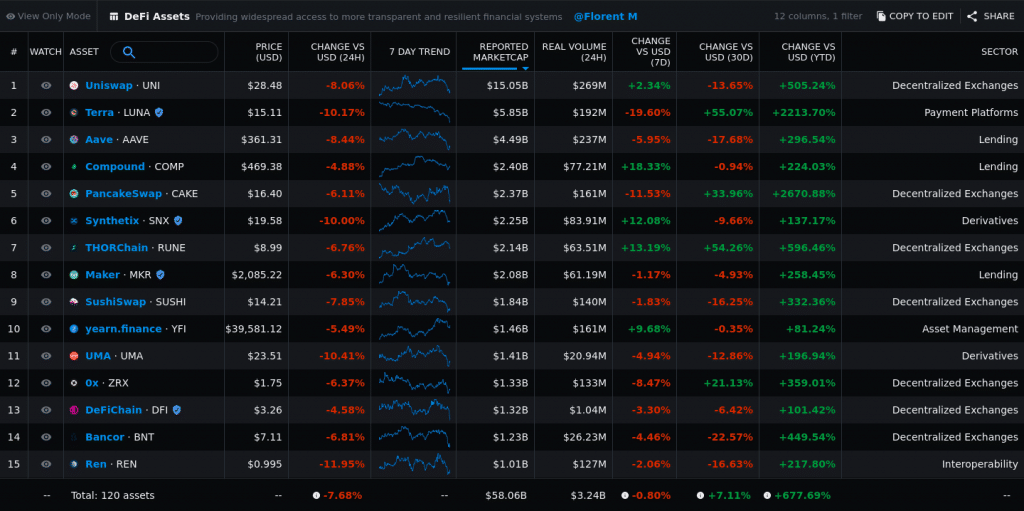

Simultaneously, a number of DeFi assets have continued to perform incredibly well. According to Data from Messari, at least 74 DeFi assets have increased their value by more than 100% since the beginning of the year. Seven of these assets have increased their value by more than 1000%.

Looking Forward to Meeting You at iFX EXPO Dubai May 2021 – Making It Happen!

The high performance of the DeFi space as a whole seems to have created a sort of ‘snowball effect’: the more money that comes into DeFi, the more new investors and users it seems to attract. And so, the cycle continues, or at least, that is what has been happening.

As we enter into Q2 of 2021, what’s next for DeFi?

“Some Want to Ensure They Don’t Miss Out on an Opportunity to Make Money, While Others Believe in the Defi Mission and See It as the Future of Finance.”

Nishank Khanna, Chief Financial Officer of Clarify Capital, told Finance Magnates that one of the most important trends that will develop this year is the continual entrance of corporate investors into crypto assets, including DeFi assets.

“Enterprises will continue to purchase cryptocurrency,” Khanna told Finance Magnates. “Just like regular people, enterprises have a fear of missing out, too. We can expect corporations to continue to invest in cryptocurrencies for a few reasons. Some want to ensure they don’t miss out on an opportunity to make money, while others believe in the DeFi mission and see it as the future of finance.”

“There is more and more buy-in from stakeholders who are impactful decision-makers and industry leaders, including those at enterprise corporations,” Khanna explained to Finance Magnates.

Is DeFi Showing Signs of Market Maturity?

As more of these large investors enter into DeFi, the ecosystem could also begin to show signs of market maturity.

Konstantin Richter, CEO and Founder of Blockdaemon, explained to Finance Magnates that: “there are growing signs that it is already beginning to enter a phase of maturation with central banks and large businesses studying its potential economic impact.”

“Although there are still kinks to be ironed out, particularly in regards its complex UX and attracting a wider demographic of retail users, DeFi is a tangible and ready for market use-case which has genuine potential to revolutionize our financial system.”

How exactly can DeFi revolutionize the financial system as we know it? Clayton Weir, Chief Strategy Officer of FISPAN, explained that on a baseline level, “decentralized finance (De-Fi) has transformed banking for the future and will be here to stay long after the pandemic subsides.”

“While this technology is commonly viewed from only a cryptocurrency lense, it goes beyond this use case,” he continued. “I consider decentralized finance to be a form of finance that successfully cuts out intermediaries to streamline transactions. This is a part of the wider ‘Open Finance movement’ that is working towards a globally accessible alternative to every financial service we use today from savings to loans to insurance and more.”

In other words, DeFi provides many of the same financial services that banks do, but in a decentralized, autonomous fashion. For example, “banks traditionally accept deposits and provide loans to both individual and business customers as their lead offering, but De-Fi enables the borrowing and lending of money on an even larger scale between unknown participants and without the middleman,” Weir explained.

“Third-party applications help bring lenders and borrowers together, without an intermediary necessarily getting involved. The protocols are inclusive, and anybody can interact with them at any time, from any location, and with any currency amount.”

Is DeFi a Tool for the “Rich to Get Richer”?

Indeed, the term ‘inclusive’ and the concept of inclusivity has been an important part of the ethos of the DeFi world. However, as more institutional and corporate investors have continued to enter into the DeFi space, critics have pointed out that DeFi may be a tool to make the “rich get richer.”

For example, Chainflow’s Chris Remus wrote a piece on TheDefiant.io about how Proof-of-Stake (PoS) algorithms, on which many DeFi protocols run, contribute to centralization and make “the rich get richer.” In the tagline for a CoinDesk article, Crypto Writer and Analyst, Leigh Cuen called DeFi “a whale’s game.”

Still, as Cuen wrote, that does not mean that “normies” are making “life-changing amount[s] of money” from participating in the DeFi universe.

Indeed, Nishank Khanna told Finance Magnates that: “while DeFi is arguably helping the rich get richer, there’s a lower barrier to entry when it comes to investing in coins.”

“Lower-wealth individuals and communities have the opportunity to purchase cryptocurrencies and build wealth too,” he said.

And indeed, while DeFi “whales” and large institutional investors may have more capital to play with, there is virtually no barrier to enter into the DeFi ecosystem.

Nick Pappageorge, Senior Analyst at Delphi Digital, told Finance Magnates that: “everyone using these protocol-based services is on even footing, so it’s not a rich-getting-richer story.”

“DeFi is more inclusive than the traditional system because a low-income individual gets treated the same as a large corporation,” he said.

Still, there is a learning curve when it comes to participating in and earning from DeFi: “the initial cohort of DeFi users probably tend to be crypto-native and well-resourced,” Pappageorge said.

“Little is in the way for lower-wealth individuals and communities to take advantage of these services especially when gas fees (a barrier to adoption that can mean every ‘click’ within the DeFi app costs $10+) get lowered significantly with the upcoming upgrade to Ethereum.”

Accessibility & Inclusivity in DeFi

Therefore, DeFi is indeed much more inclusive, or at least, has the potential to be much more inclusive, than the traditional financial system as we know it.

“DeFi is trustless and permissionless by default, meaning that anyone can use the services,” Pappageorge explained. “In theory, this is much more inclusive than the traditional financial system where the realities of credit scoring, regulations, and profit motive mean certain user groups get better terms than others.”

“There is also a greater guarantee of liquidity and safety because the platforms managing your money can’t suddenly decide to change the terms,” he continued. “For example, I’ve seen centralized exchanges suddenly stop the trading of a certain token pair arbitrarily, leaving traders unable to take advantage of the price action.”

There are also practical and logistical things that make DeFi potentially more accessible to wider groups of users. “DeFi is also digitally-native and 24/7, so you don’t need to wait for business hours to get access to a loan,” Pappageorge said.

Will DeFi Intersect with Traditional Banking?

And indeed, this kind of accessibility toward lending and other kinds of financial services is what Pappageorge believes has contributed so heavily to DeFi’s success.

“The most important things being done right now are arguably in trading and lending…Decentralized trading and lending have become the backbone of the DeFi economy,” he said. “Projects like Uniswap and Aave, for example, mimic the services of real-world companies such as Coinbase and BlockFi respectively, except with all these added benefits. The ability to borrow and trade is now opening up many new opportunities in the space.”

And while the distinction between DeFi and the traditional financial system has been quite deep, it is possible that banks could eventually take a leaf out of the DeFi book.

FISPAN’s Clayton Weir told Finance Magnates that: “banks, in particular, are at an advantage when it comes to taking advantage of DeFi because they already hold a large amount of data about their clients.”

“This is a large opportunity for banks, as their role is evolving from storing money to distributing it, and they are increasingly acting as a validator between various decentralized ledgers using the data they already have access to,” he said.

“For example, a bank has insights into a client’s entire payment network, which means that they are then able to rationalize and contextualize those insights to later provide them back to the client in the form of an incredibly powerful user experience to the client for future profits.”

Therefore, DeFi-powered financial services could one day become the norm. “A large number of global banks will become connected by this very highly permissioned and secure network where they can communicate to each other about a wide range of data points. But in the short term, account validation is where the bank is key. In the future, that is what will change the ease, the openness, the time and the execution costs of how we move money internationally.”

“There is a big effort around the client/user experience, and it’s not just related to providing traditional banking services. It is about providing guidance, advice and decision-making tools — and the best decision-making tools are those that are driven by data.”

Source: Read Full Article