ESG DeFi, the next Trillion Dollar Asset Class

We’ve witnessed an avalanche of investment into crypto over the last two years thanks to the introduction of DeFi. Despite lingering high energy consumption and negative environmental impact narratives that aren’t necessarily untrue, $ millions have continued to pour into what seems like a never-ending cycle of DeFi products that offer lucrative returns on crypto assets. A chunk of that investment in 2021 has been directed towards ESG-focused and impact-driven projects in DeFi that reallocate funds for the public benefit or create new asset classes altogether to fight climate change for example. The x-factor here is the web3 dynamic where the overall success of these decentralized protocols is partially a function of large, enthusiastic Internet communities that support a project’s core values and are incentivized to contribute to its development via perpetual financial gamification. The result is a new paradigm that can be characterized as a symbiosis between DeFi and ESG where we all can be handsomely rewarded while giving back.

ESG meets DeFi

As crypto’s total market capitalization approaches $2.7 trillion, it’s impossible to not acknowledge how cryptocurrencies and tokens are not just transforming finance and money, but also how creators can form Internet-native organizations to create and share value. The crypto-curious are all about to ape in, and the on-ramps have made it simple to diversify portfolios with blue-chip and alternative cryptocurrencies – one small step before being sucked into DeFi and all of its glory.

In parallel, the world was hit with simultaneous, ongoing crises over the last few years: COVID-19, racial and social injustice, climate change, and dysfunctional geopolitics. As an investor, it’s difficult not to evaluate a firm’s conscientiousness for social and environmental factors. Which is the reason why TradFi has embraced ESG as a business opportunity, however genuine the model, in addition to the financial benefits of incorporating sustainability into corporate and investment strategies. ESG has become a commercial imperative and guiding framework in company policy. As a result, ~$300B has poured into ESG related ETF and mutual funds in 2020, a 96% YOY increase and a reflection of market sentiment (Source: ESG Playbook). It’s clear markets pay a premium for companies that both make money and benefit the greater good. A perfect example is Tesla.

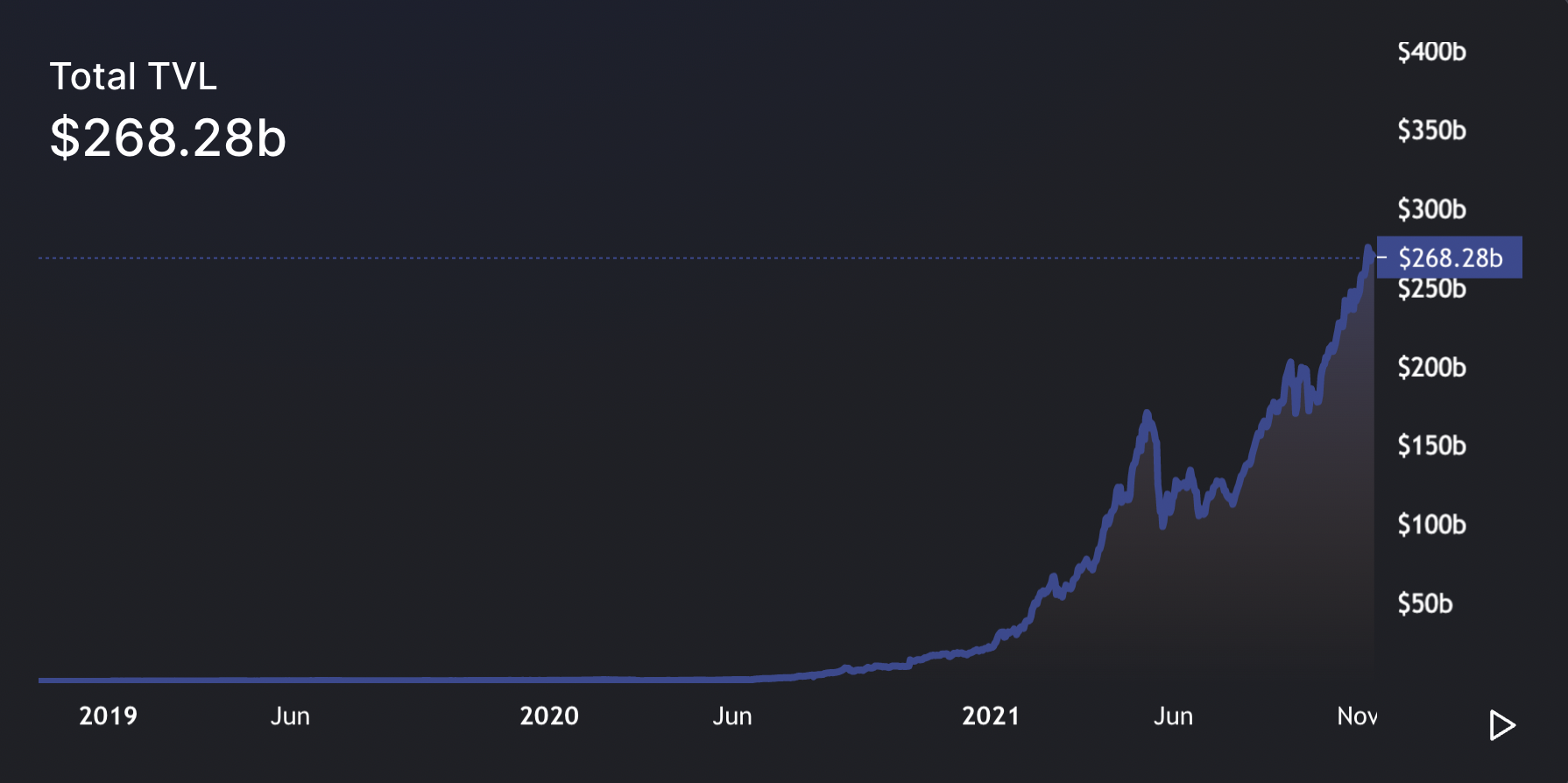

If TradFi is experiencing this tectonic shift in investment strategy, with ESG assets expected to exceed $50 Trillion by 2025 (Source: BI ESG 2021 Midyear Outlook), what does that mean for ESG in DeFi? At the moment there are only a handful of impact-driven projects that have just launched and only account for a sliver in total TVL.

Total Value Locked in DeFi

(source: DeFiLlama)

Web3’s decentralized and permissionless nature has onboarded a tidal wave of news users thanks to open software programs and decentralized applications. We can thank Vitalik Buterin and Gavin Wood for changing the game with Ethereum, as well as other creators of L1’s and L2 scaling solutions.

The Web3 // DeFi Powerhouse

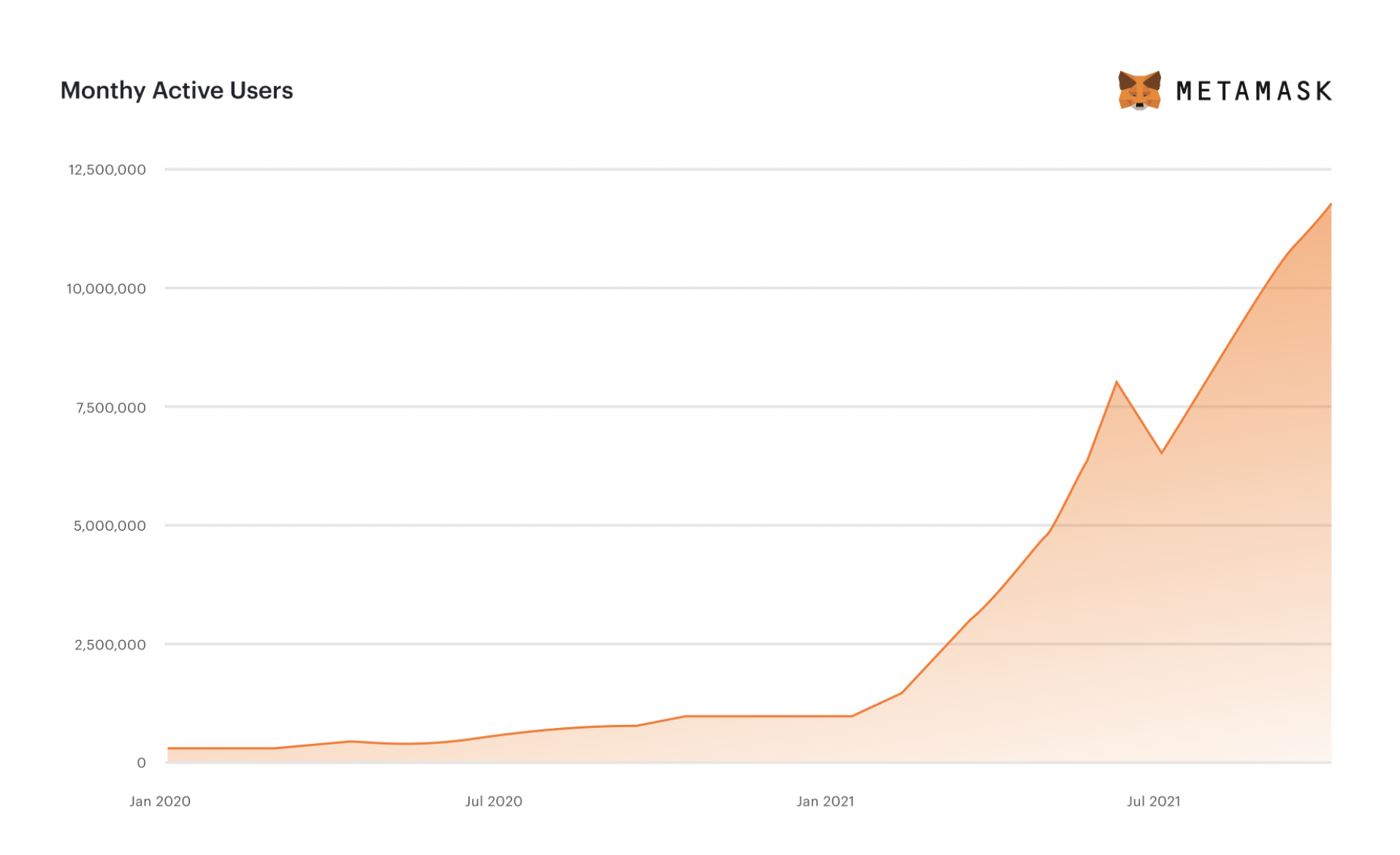

The increase in monthly active users on Ethereum alone illustrates the paradigm shift into Web3. It has become a proxy for ideation on restructuring the Internet and how people share in its value creation. This shared value creation in the context of developing DeFi products that simultaneously do good is certainly revolutionary, and the party has only just begun.

Monthly Active Ethereum Users

Source: Consensys Q3 2021 Report

The increase in monthly active users on Ethereum alone illustrates the paradigm shift into Web3. It has become a proxy for ideation on restructuring the Internet and how people share in its value creation. This shared value creation in the context of developing DeFi products that simultaneously do good is certainly revolutionary, and the party has only just begun.

A rich and net-green future

ESG and DeFi both fundamentally are reshaping the financial industry at an unprecedented rate. The pandemic and global race in reducing carbon emissions have catapulted ESG from niche to mandatory. ESG ETFs are to reach $1 trillion and ESG Debt $11 trillion by 2025 (Source: BI ESG 2021 Midyear Outlook), and DeFi is on the trajectory to reach $1 trillion in TVL by the end of 2022 certifying its mainstream success. With more institutional capital flooding into the DeFi market, innovation will continue to flourish, especially in the intersection between DeFi and ESG.

Institutional investors will continue to build portfolios that address environmental, social, and governance concerns in the traditional market; therefore, the expectation is there for this advent to be carried over in the cryptocurrency market. While considerations have been made about the impact of crypto mining, the market is much more expansive, with current projects just scratching the surface. What’s certain is that DeFi is putting the G back into ESG given its decentralized governance structure, giving back power to the people at an increasing rate, and reinforcing the ESG narrative in crypto altogether.

-Michael Kisselgof

Michael is Co-founder and Director of Operations at Popcorn, a DeFi platform that generates high yield on crypto assets while simultaneously funding community selected nonprofits and social impact impact organizations without any extra cost to the end user.

Image(s): Shutterstock.com

Source: Read Full Article