Ethereum Struggles to Break the $1,150 Resistance, Uptrend Resumption Is Likely

Presently, Ethereum bulls are attempting to break the $1,150 resistance. A breakout at the resistance will propel the crypto to resume the upside momentum.

Perhaps, the current resistance at $1,300 would be broken. Nevertheless, the previous attempt at the $1,150 resistance was met with a bearish consequence. Ether retraced to $1,000 support and resumed a fresh uptrend.

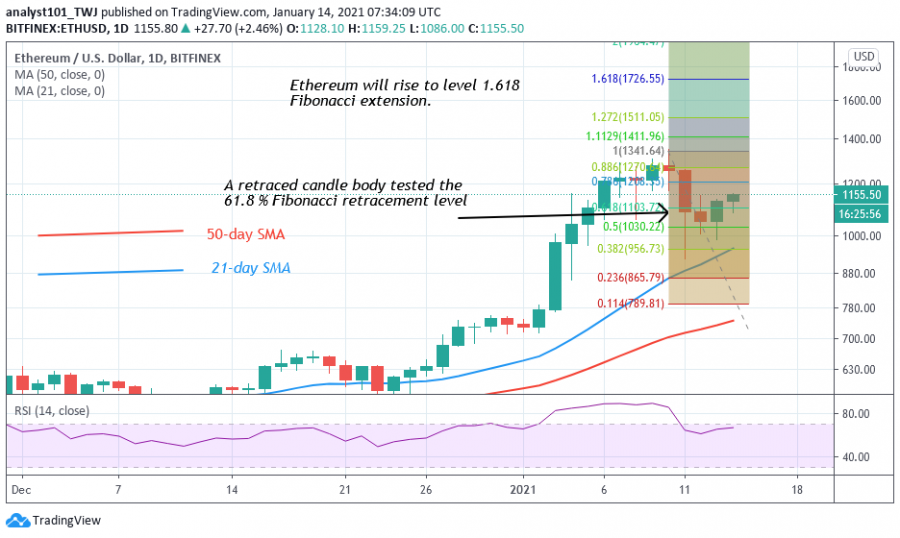

In the second attempt, buyers are at the point of breaking the current resistance to pave way for a fresh uptrend. In the current bull market, Ethereum and Bitcoin have something in common. At the time of writing, Bitcoin is attempting to reclaim the psychological price level of $40,000. In the same vein, if the bulls break the resistance at $1,150, Ether will retest the $1,300 high. Also, a breakout at $1,300 will catapult the coin to rally above the $1,700 price level. Meanwhile, the coin is trading at $1.164 at the time of writing.

Ethereum indicator analysis

The altcoin is below the 80% range of the daily stochastic. This indicates that the coin earlier had bearish momentum. Presently, the stochastic bands are making a U-turn signalling the resumption of bullish momentum. The price retraced to the support above 21-day SMA which indicates the possibility of an upward move.

Key Resistance Zones: $1200, $1,300, $1,400

Key Support Zones: $800, $700, $600

What is the next direction for Ethereum?

As Ether breaks the minor resistance at $1, 150, there is a possibility of a further upward move. On January 10 uptrend; a retraced candle body tested the 61.8 % Fibonacci retracement level. This retracement indicates that ETH will rise to level 1.618 Fibonacci extension. That is, Ether will reach a high of $1,726.55

Disclaimer. This analysis and forecast are the personal opinions of the author that are not a recommendation to buy or sell cryptocurrency and should not be viewed as an endorsement by CoinIdol. Readers should do their research before investing funds.

Source: Read Full Article