How Long Does a Bitcoin Bull Run Last? Proponents Use a Myriad of Charts and Models to Predict Future Prices – Featured Bitcoin News

As bitcoin prices hover above the $55k zone, a number of participants wonder when the bull run will end. Bitcoin proponents are convinced bull markets have three waves and another wave may start soon. However, despite a variety of tools being used like tarot cards, no one is truly sure what will happen with bitcoin and crypto markets next.

Counting Down the Days- Guesstimating Bitcoin Bull Runs

Bitcoin enthusiasts are still very optimistic about the price of the leading crypto asset and many believe the bull run is not over. Traders and those who are extremely curious about short-term price swings have been leveraging a number of tools in order to predict the future price of BTC. Tools and charts utilized include the stock-to-flow (S2F) model, logarithmic growth curves, golden ratio multiplier, HODL waves, profitable days and so much more.

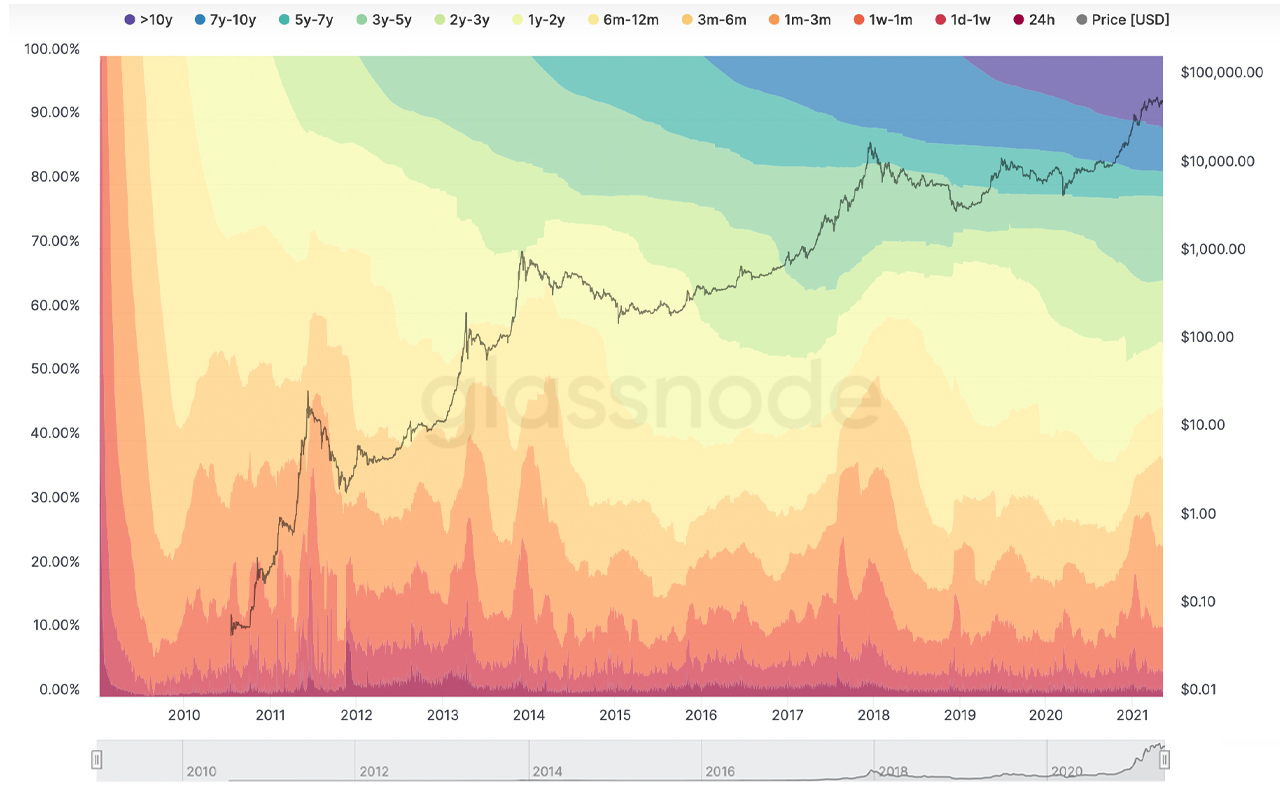

For instance, the popular Twitter account Bitcoin Archive tweeted about realized cap HODL waves and shared an image from Glassnode’s platform to his 184,000 followers.

“‘Hot money’ has cooled down and we can see a nicely formed 1st HODL wave (realised cap). Bitcoin bull markets typically have 3 waves— so expect another one to start soon,” Bitcoin Archive said. Following the tweet, the account Cryptovizart responded to the tweet and said the three-wave pattern was not happening like two previous cycles. Cryptovizart believes that institutional FOMO caused the first wave to last longer.

Trends further show a popular question on Google is “How long does a Bitcoin bull run last?” and there are many editorials that cover this subject. On April 12, 2021, Rekt Capital published a comprehensive editorial on when the top will come. Rekt Capital says a typical bitcoin bull run lasts around 518 days.

“It took roughly the same amount of time for bitcoin to bottom prior to halving #2 (546 days) as it took for bitcoin to rally before topping out after its second post-halving #1 market cycle (518 days),” the editorial notes.

No Tool or Model Is Perfectly Accurate, But Market Participants Will Always Use Them

The popular Youtuber and digital currency proponent Colin Talks Crypto has been covering the bull run’s length for quite some time now. In a Youtube video published on April 17, Colin discusses when to sell and talked about his recently launched “Crypto Bitcoin Bull Run Index (CBBI ).”

“The CBBI is an average of 11 different metrics to help us get a better idea of where we are in the Bitcoin bull run (and bear market) cycle,” the website description notes. Currently, Colin’s CBBI shows a score of 71 on May 10, 2021.

“The Colin Talks Crypto Bitcoin Bull Run Index (CBBI) is an indicator based on a portfolio of 8 bitcoin metrics designed to give us a better idea of where we are in a Bitcoin bull run cycle,” the website explains. “The CBBI score is a ‘peak confidence score.’ As it approaches 100, it indicates we may be getting closer to a price top.

A recent thread written by Coincharts on Twitter discussed the length of the current bull run in a tweetstorm this week.

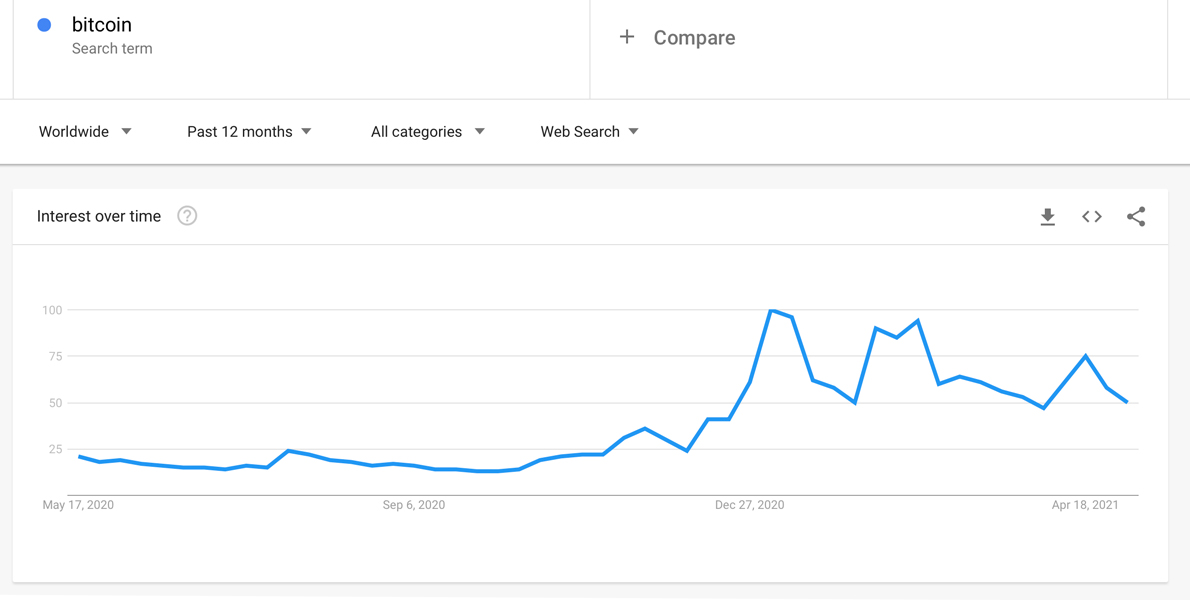

“Where are we in this bull run? It has now been 143 days since bitcoin broke the all-time high of 2017. But how far are we in this bull run, and how long will it take? This is of course very difficult to determine, but there are some things you can look at,” Coincharts said. Coincharts uses a number of tools like the “MA 200 Heatmap This indicator is a Moving Average over the last 200 week candles,” “Google Trends,” and “HODL waves.”

Everyone has their special tool and technical analysis at their disposal, and some are utilizing bitcoin derivatives markets like futures and options to guess the price going forward. There are those that believe BTC’s Taproot upgrade could boost the price while others are counting on news like institutional adoption to keep the market bursting.

There is no exact science or rhyme and reason when it comes to the future price of bitcoin. There will never be a tool that predicts markets perfectly, but we can guarantee market participants will always try to predict the future using anything they can to get ahead.

Source: Read Full Article