Huobi Founder is Reportedly Looking to Sell His 50% Stake in the Crypto Exchange.

Summary:

- Huobi’s founder, Li Lin, is reportedly looking to sell his stake in the crypto exchange.

- Mr. Lin currently holds more than 50% of the shares at Huobi.

- The crypto exchange has been affected by the ongoing crypto winter and plans to lay off 30% of its staff.

- Huobi’s HT token continues to trade in bear territory.

The founder of the Huobi crypto exchange, Li Lin, is reportedly looking to sell his stake in the company. According to crypto-journalist Colin Wu of WuBlockchain, Mr. Lin currently holds more than 50% of the shares at Huobi. Through the following tweet, Mr. Wu shared his insights into the probability of Huobi’s founder selling his stake in the company.

EXCLUSIVE: Huobi founder Li Lin is looking to sell his stake in Huobi. Li Lin currently holds more than 50% of the shares. The second largest shareholder of Huobi is Sequoia China. Huobi’s revenue plummeted after it wiped out all Chinese users and is laying off staff. https://t.co/67KOlW9aT9

— Wu Blockchain (@WuBlockchain) July 1, 2022

Huobi Is Probably the Second Most Profitable Exchange After Binance.

Mr. Wu also pointed out that Huobi was probably the second most profitable crypto exchange after Binance, with its 2021 profit being more than $1 billion. He explained:

With a profit of more than $1 billion in 2021, Huobi may be the most profitable exchange in the world after Binance in 2021, and it holds many compliance licenses. But when the market is down, it may be difficult to sell higher value.

At the time of writing, and according to Coinmarketcap, Huobi is ranked seventh in terms of daily trade volume. The exchange is currently handling $1.459 Billion worth of trades in the last 24 hours, with estimated weekly visits to the site of 868,946. In comparison, Binance is ranked first in daily trade volume handling $12.720 billion worth of trades per day. The Binance website has an estimated 22.612 million weekly visits.

Huobi Was Also Allegedly Planning to Reduce its Workforce by 30%.

News of Li Lin potentially selling his stake at Huobi comes less than a week after it was reported that the crypto exchange was planning to reduce its workforce by over 30% due to the ongoing crypto bear market.

In addition, Huobi’s revenue was hard hit by its exit from mainland China after the blanket government ban on crypto mining and trading activities within the country’s territory.

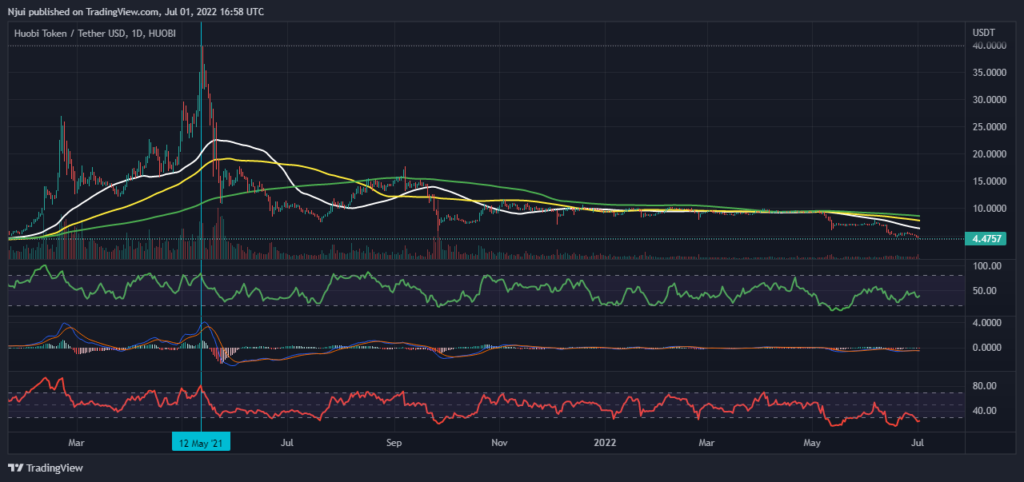

Huobi’s HT Token Continues to Trade in Bear Territory.

Concerning the value of Huobi’s HT token, the digital asset continues to trade in bear territory. Its ongoing pullback originates from its May 2021 all-time high of $39.81. The daily HT/USDT chart below further demonstrates this fact.

Source: Read Full Article