Market Outlook for Q2 2021

US 10-yr yield

The US 10-yr yield could be the big story of the second quarter as the benchmark for global bonds creeps higher.

I said at the start of the year that it was pointing higher, and we are now seeing that move. The 10-yr has a path open to the 2.00 level and we will see how markets react to another move higher.

The latest move to 1.60 saw markets rattled and it looks like it may move further. Despite the ongoing devastation of lockdowns, we have seen markets living in a “risk-on” environment and valuations for stocks are really high in relative terms.

A quick example of this is Tesla, which suffered a recent sell-off, but still trades at a price/earnings ratio of 1115x earnings and a forward P/E of 125x.

These are fantasy valuations and investors are overpaying for the future potential of companies in a bullish environment. It works while the market is happy.

On a price/sales valuation, Tesla is trading at 20x, which is twice as much as it should be and if yields move higher then these types of stocks are at risk. The semiconductor shortage highlighted the risk for companies that are tied to global supply chains.

Apple stock is more cautiously valued at 32x P/E and a price/sales of 7x but this is still the higher end of historical valuations and near the levels before the last financial crisis.

Simply put, I am avoiding investing in these types of stocks and the same goes for stock indices. Money could be made on the short side this year if the timing is right.

A recent shortage in semiconductors is cause for concern with Tesla and Apple. Telsa’s factory was temporarily closed over the issue.

Stock Indices

Although I see risks in the valuation of stocks and indices, it is hard to say when they could turn.

The US government just passed a huge $1.9 trillion “stimulus” bill but the $1,400 checks that are handed out to the public make up only $100 million approximately, so it is more of a government bailout for states like California and Detroit.

The yields may start to rise this year with inflation and central banks will act to try and bring them down again.

This is also a reason why stock indices may continue their push higher.

I actually said years ago that stocks would continue to go higher and investors called it a bubble, but we are in a historical time where all developed countries have interest rates at zero.

The bond market had very low yields and pension funds were forced to invest in the stock market to chase higher returns.

This is also why central banks are doing everything in their power to keep stocks higher, but this brings the risk of sharper selling when the sentiment turns.

Dow Jones vs Nasdaq

The Dow Jones lagged the Nasdaq in the early stages of the recovery because of the “bricks and mortar” physical businesses in the Dow. Companies like Walt Disney had to close their retail parks and had to adapt.

In the last weeks we have seen the investment community rotating to “value stocks” as they seek value in a highly-valued world.

The irony of this strategy is that the “value” stocks may be overvalued, and the money could be made in the tech companies if lockdowns persist.

Shanghai Composite

For longer-term investors, the Shanghai Composite will be the place where fortunes are made. The index trades lower than its 2015 highs and that event showed the power of the Chinese public when a buying spree takes hold.

The bull market that comes in the Chinese market may be more pronounced than anything seen in the US indices over the years.

The Japanese index saw a big rally in the 1980s as investment capital rushed across to Japan and we could see this happening in the post-pandemic world.

We are seeing this with Chinese bonds which are now seen as a safe haven in the “reflation storm”.

J.P. Morgan Asset Management said: “China government bonds are as good an asset as U.S. Treasuries when looking at long-term correlations versus global stocks.”

The Shanghai Composite is trading around with the Yuan and Dollar moves but the country’s economy will outperform in the years ahead.

Britain is about to go through a revamp of its economy after Brexit but the country has damaged its key services economy. The country is now saddled with debt at 120% of GDP.

The same is true for Europe and the USA and Asia is likely to capitalize in the future. Hong Kong stocks and countries such as Australia would do well in an Asian boom, but other indices in emerging markets will also have opportunities.

In the short-term, if we do see a rise in global inflation, there would be big winners in global stock markets on this theme. The Shanghai index failed to get above the 3600 level and the index may move lower in Q2 towards 3,000.

The Chinese market is under-performing because of the chip shortage, while the US market powers higher with a weak US dollar and broken bond market.

Shortages of auto chips are forcing global carmakers to cut output, putting the brakes on their recovery.

Honda is slashing production in Japan, North America and China.

Nissan will be scaling down in Japan, while Toyota will do so in the U.S. Ford, Volkswagen and Daimler also join the list of automakers curtailing production. Big “tier one” suppliers to carmakers are also feeling the pinch.

JPN225

The chip situation could be bearish for Japan’s index which is setting new highs. I would expect a pullback to 24,000 to happen and this will depend on the reaction at the 30k level.

On the daily chart we can see that the market is looking to retest the 30-31k level and if it fails then further selling will occur.

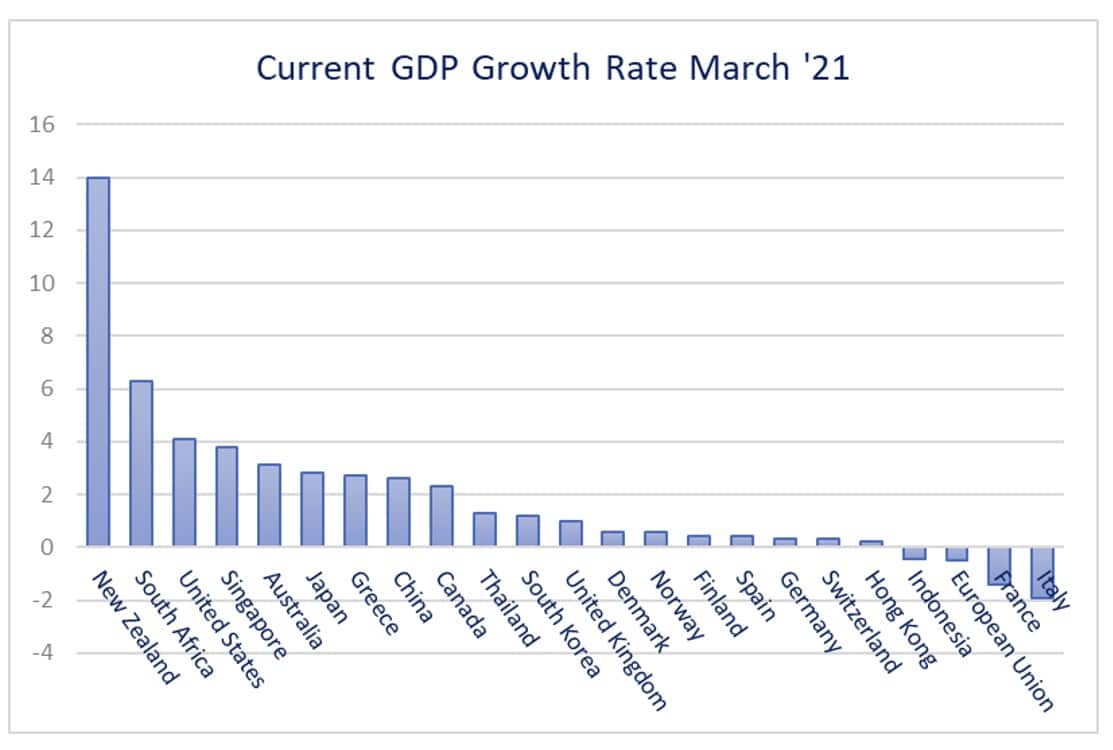

GDP growth levels are seen below for a sample of countries and highlights that Europe are behind the rest of the developed world.

Capital flows could move out of the Euro area and push the currencies of the stronger economies higher. It also shows that Asian economies are well positioned for the rest of the year.

Currency Outlook

DXY

One of the big drivers in markets last year was the US dollar and this could be set for a revival. The bounce at 90 is extending and could move higher in Q2. That could see a correction in commodities.

The dollar index could make its next move to 94.00 if the recent selling is temporary.

USDCNY

The US dollar broke down against the Yuan in the last year to reflect the growth trends. The dollar is trying to bounce but is likely to see further selling by year-end.

The potential for supply chain shocks like the one seen in the semiconductor industry could impact exporting countries. The Chinese Yuan could close the gap on the US in the currency market over the longer-term.

As the Chinese economy challenges the US to be the world’s largest, we should expect the currency market to reflect that with a move closer to parity.

EURUSD

The EURUSD has surrendered the 1.2200 level and now trades below 1.2000 with an opportunity to go to 1.1600. The OECD said this week that Europe would lag the UK and US in vaccines and this will hamper the growth prospects in Europe.

The important takeaway from the OECD report was the prediction that Germany would see 3% growth and this was downgraded from 3.7%.

The UK was upgraded from 4.2% to 5.1% growth in 2021, so the Euro may lag against the pound and the US dollar.

The pound and US dollar could also be seen as safe havens if the market turns sour and the European Central Bank are more likely to act aggressively in bond markets with many countries having large debt levels and low rates.

Would the ECB be able to replicate its bond buying efforts in Italy across other large nations such as France and Spain? The task to get to recovery is much harder with 27 countries.

EURGBP

I said at the start of the year that the pound could do well against the euro and this was the case. But the pound is still far from the pre-Brexit trading of 0.7000. The economy has not diverged much from Europe’s path and they both have low rates and issues with high debt.

The pound could benefit from a “risk-off” environment and the country could see safe haven flows in the same way that Switzerland does. If the UK opens up as planned in April-May then 0.8200 would be possible in Q2.

AUDUSD

For the same reasons that I have outlined, the Aussie dollar should continue to advance versus the pound, euro and US dollar. There may risk related corrections, but the Aussie will also be a play for commodities in inflation, while the country has seen less of a lockdown.

Australia’s debt is currently 50% of GDP approximately, while in the UK it is over 100%. European countries are in the same boat and the US has a lot of debt but is also a political risk.

The Australian political scene is less divided than the US and this is another reason to be bullish on Australia.

As I said earlier, Asia will do well in the years ahead for the relative stability in politics and economics.

The growth rate in the US is currently 4.1% and in the larger European countries it is below 1%. Q2 will depend on the reopening of the European countries and if countries start seeing higher inflation central banks will step in to lower yields.

This is just putting more strain on the large countries and creating imbalances.

EURAUD

Using the GDP chart, investors could look to trade pairs that reflect the growth picture. EURAUD for example, would be an opportunity once Australia gets reopened.

It is easier to manage one nation out of the recovery than 27. The Aussie also has the commodity play if there is further inflation.

GBPTHB

The Thai Baht looks bearish as there is no end in sight for the tourism sector yet. The pound v Baht could move to the 45-50 level this year.

Commodities

Inflation will continue to grow due to shortages that are created by the lockdown’s effects on the global supply chain. We have seen this emerging in the semiconductor market.

It could happen in other industries due to the closed borders and increased chance of bankruptcies.

Oil

I wrote a bullish case for oil back on December 1st which laid out the potential for a move to $65 by Q2 and this has been a success.

Oil is now starting to decouple from the supply and demand issue and could also benefit from inflationary investment. If there was trouble in the Middle East then it could even go to $100.

Oil needs a close above the $66 level to stay in bullish mode or it may correct back towards the $50 level, but there is potential for higher prices as economies reopen and inflation picks up.

Oil inventory levels are predicted to be tighter in mid-2021:

The prospective rise in processing and consequent draw down in crude inventories in the second and especially third quarters is what has been boosting futures prices and causing calendar spreads to tighten.

Increased refinery processing is another reason that oil stocks will be limited. This will depend on the economies reopening at the pace markets expect. Near-term risk is more lockdowns but this should fade later in the year with vaccine progress.

Gold

The gold/silver ratio was at extreme levels in April of 2020, and I predicted that silver would rally.

We saw this happening in the second quarter and there is still opportunity in silver as it trades below the record highs seen in 2008.

Gold’s recent sell-off has corrected some of the imbalance and gold will still have trading potential.

Gold’s price will revolve around the bond yield situation and if we see higher yields then gold could move lower, but the eventual path will be that central banks pump more money into economies and gold could benefit from the higher debt levels as it did in 2020.

The US dollar would be a risk to gold if it climbs higher in Q2 and it may be Q3 or 4 before we see central banks make any real changes.

They have shown a willingness lately to let inflation move to their 2% targets and that may also be a chance for them to let equity markets correct a little.

Bitcoin has been a drag on gold investment as money is chasing stocks and cryptocurrency, while the professional investors are in risk-on mode. Gold may see higher flows in the second half of the year if the wind is taken from the sail of stocks and BTC.

Silver

Silver still trades away from the 2008 highs and this is despite the trend lower in the US dollar.

The reason for this is that silver is driven by smaller investors and they are currently chasing stocks and cryptocurrencies.

When inflation does rise, silver will be a good investment. We may see it lower in Q2 if the US dollar bounces but Q3-4 may be a good time to get into longs.

Bitcoin

I was bullish about Bitcoin in summer 2020 at $8-9k but I am not bullish now. The market has exceeded my targets and I think there is potential for a pullback.

I also don’t think the price will make an easy path to 1 million as people predict. At some point governments will likely clamp down on the industry because it is sucking money away from equities and their ability to tax.

In Q2 I think BTC could be back at $40k but the recent rush of big investors into the coin could make the sell-off more pronounced.

There will be demand for the coin from corporations at lower levels, but a recent statement from Cathie Wood that Bitcoin “could replace the bond market” seems a bit outlandish and with China and the other large nations moving to digital currencies, I can see them making moves to limit the dominance of BTC and other coins.

This article was written by Investment Writer, Kevin George.

Source: Read Full Article