NFT craze = Dot Com Bubble 2.0

In 2021 in addition to yet another cryptocurrency bull market, NFTs have become the hot subject. The fad seemed to peak when artist Beeple sold a jpg file ‘as an NFT’ for $69 million. Yet the craze still continues months later, with art continuing to sell for millions in August 2021, netting absurd returns.

NFTs have simply become a buzzword where the meaning of the phrase is irrelevant, but labeling products with it will surely make its price appreciate.

Non-fungible tokens are supposed to be unique digital assets whose supply is verifiable, where the issuer and purchasers have attestation, rights, and controls over what can be done with said asset. This is what these art NFTs enable, right?

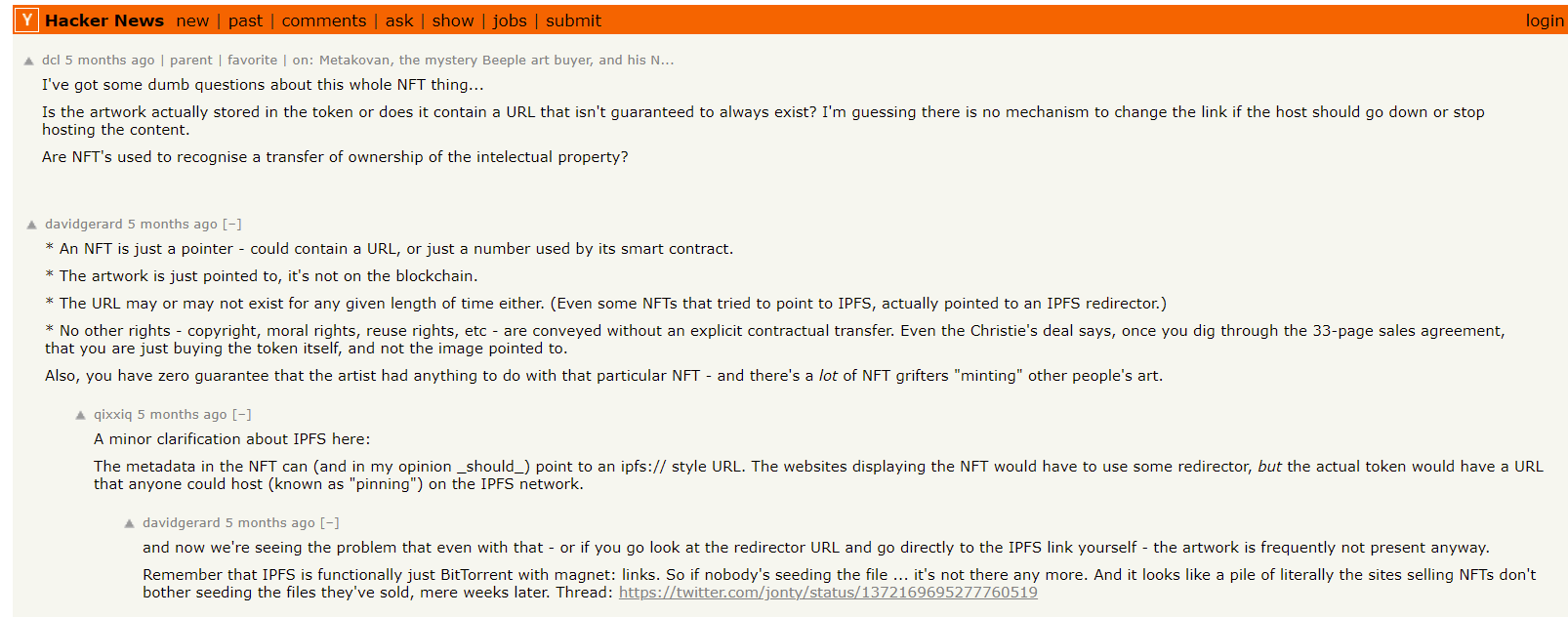

Wrong. If one cannot control access to an asset, or enforce rules related to ownership, then nothing is truly owned. An immediate criticism is that these files are being hosted not on the immutable ledgers the sales are recorded on, but instead on third party servers, IPFS or torrents. This criticism of where the file is located is tangential to the actual issue being that the purchaser does not actually have rights or ownership of anything.

The issuer does not gain anything in the process either, except profiting off the speculative bubble and greater fools of course. While the issuer can verify who is the owner of the NFT on a blockchain, they cannot dictate what is actually done with the asset. For example, any other person could copy the file from wherever it is posted (Twitter, news sites, IPFS, the public ledger, etc.) and print it, copy it, display in their house and use however they want!

The above tweet is true, but as a speculative bubble requires participation of many greater fools, logic and facts do not matter.

Those in BSV’s response to the NFT craze was to not fix these problems but repeat the same thing but somehow improving the concept by storing the files on the immutable public ledger where anyone can access them.

Here we have digital gif art where someone simply downloaded the gif from the blockchain, reminted, and sold it (‘scamming’ for over 1 BSV).

But wait—isn’t there like, an immutable contract ID and timestamp that cannot be forged that validates where the original was minted from?

@artonchain’s contract: 94281ebe0a866900ba88d41ddec5d4b027a1a604325610f4deac78f845773457_o1

The ‘fake’ contract: 0dc63f9cc560fba8469bc7f4d8c47fc676fc953155aef8cd712df034a31ab36f_o1

People don’t read or care about fundamentals if they can make ‘free tendies’.

To be clear I think artists being able to raise funds from their fans by selling digital art is a totally valid means of gaining support from their fans. However, to issue the art in such a naïve way with no controls over the rights of the art and expect no scamming to occur is naïve itself.

Now finally, how does the NFT boom relate to the dot com one?

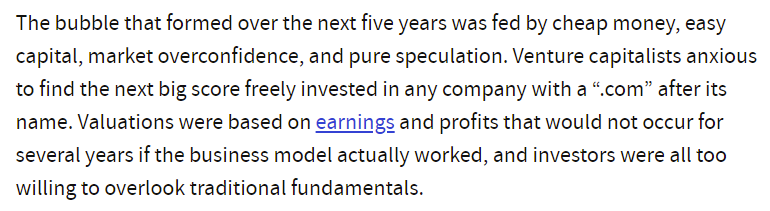

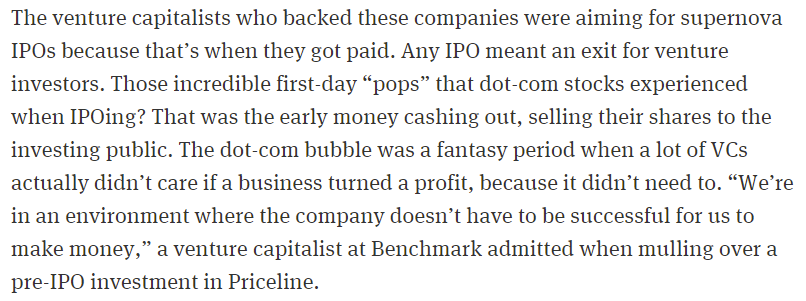

The above blurb sums up what is transpiring now; if product has ‘NFT’ in it – buy. Because it’s going to the moon. Why? Because it’s an NFT. The easy capital, market overconfidence and speculation derive from the digital currency boom itself as ‘investors’ grow bored with daily 20% gains and crave for 1,000,000% ones instead. Fundamentals are nowhere to be found because they do not matter.

I understand dot com bubble may be more in sync and scope with the greater cryptocurrency boom, but that is another topic.

How long can this continue? I do not know, but I do know this NFT nonsense has to stop at some point and develop fundamental value.

Just as an IPO of everythingandyourmama.com would have pumped in early 2000 but would now be absurd today, selling a .png ‘as an NFT’ will eventually look like a rhyme in history.

Source: Read Full Article