Novogratz: XRP Rise Doesn’t Make Sense; DOGE Doesn’t Really Have a Purpose

Mike Novogratz, the billionaire Founder of the crypto merchant bank Galaxy Digital, made some critical remarks on two of the moment’s most popular cryptocurrencies: XRP and Dogecoin (DOGE).

Novogratz told Bloomberg TV on Friday that in spite of recent upward price movements in DOGE markets, he will not be jumping onto the Dogecoin bandwagon. Why? “[Dogecoin] is a memecoin…it doesn’t really have a purpose,” he said.

Looking Forward to Meeting You at iFX EXPO Dubai May 2021 – Making It Happen!

“It’s reminiscent of GameStop,” Novogratz said, referring to the WallStreetBets (WSB) saga that upended capital markets earlier this year. At the time, WSB investors pumped millions into GameStop stock (NYSE:GME) and several other ‘meme stocks’ for the sole purpose of ‘squeezing’ hedge funds on Wall Street. “I would be very, very worried if one of my friends was investing in Dogecoin at these prices,” he said.

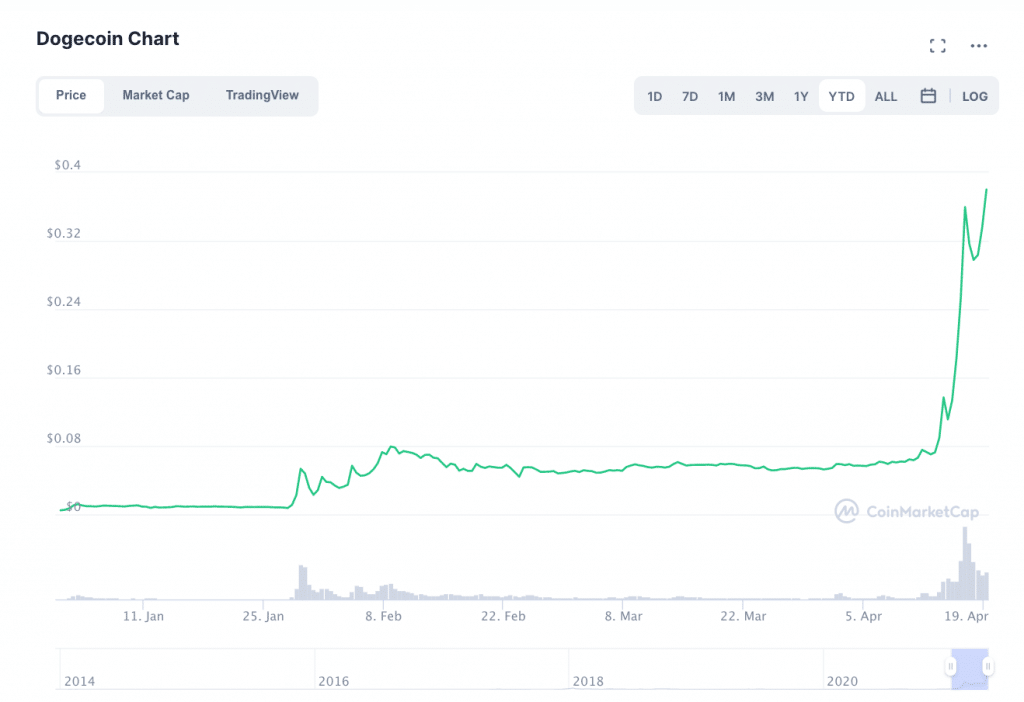

The price of Dogecoin has risen considerably throughout 2021. Part of its rise is directly associated with WSB traders: in February, a spinoff group of WSB investors targeted DOGE as their next asset to ‘pump’. The rise continued when Tesla Founder, Elon Musk began to promote the currency on Twitter.

As a result, DOGE’s price is up more than 7300% since the beginning of the year ($0.004834 on January 1st to ~$0.36 at press time).

“There Is a Retail Frenzy – It’s Not Really Being Seen in Bitcoin and Ethereum.”

Additionally, Novogratz commented on XRP, which has seen a significant increase in its price since the beginning of the year: $0.23 on January 1st to $1.46 at press time, a rise of roughly 540%.

“There are some pockets retail froth and speculation [in altcoin markets],” he said. “XRP, which has a parent company that is under investigation by the SEC…went from $0.40 to $1.60 in a month. It doesn’t make a lot of sense to me, either,” he said.

“There is a retail frenzy – it’s not really being seen in Bitcoin and Ethereum. Quite the opposite: money is coming out of Bitcoin and Ethereum and moving into these other coins for more juice, for more excitement.”

However, several Twitter users clapped back at Novogratz in the comments under Bloomberg’s post about the interview.

@Nietzbux, an anonymous cryptocurrency enthusiast, wrote, “so @novogratz, the man who bailed out Ethereum Foundation and bought ETH to fund them, treating it exactly like a security offering, says XRP is under investigation and therefore is as overvalued as Doge? You sir, are not an objective party (sic).”

Santiago Velez, Co-Founder & R&D Division Lead at Block Digital, had a different take on the conversation. “*sigh*. Zoom out folks, there is product to be sold, at the correct valuations & in due course. Sell the inventory that’s going to expire (technologically) first then upsell the next great thing. 10 year play, patience (sic),” he wrote.

*sigh*. Zoom out folks, there is product to be sold, at the correct valuations & in due course. Sell the inventory that's going to expire (technologically) first then upsell the next great thing. 10 year play, patience.

— Santiago Velez (@Santiag78758327) April 17, 2021

”Is Dogecoin the pets.com of the Cryptocurrency Era?”

In any case, each of these statements seems to point to a single basic truth, altcoin markets are growing at an unprecedented rate. The reasons for this, and the sustainability of the current cycle are yet unknown.

Speaking to Bloomberg Wealth, Scott Knapp, Chief Market Strategist at CUNA Mutual Group, compared the current altcoin frenzy to “the dot com days.”

“We knew something big was going on, a lot of investors were chasing it hard. That led to a bubble,” he said. “For every Amazon.com there were 10 pets.com that went bankrupt. Is Dogecoin the pets.com of the cryptocurrency era?”

Michale O’Rourke, Chief Market Strategist at JonesTrading, said that part of the altcoin mania could be due to the stimulus money that the US government pumped into the economy throughout 2020 and 2021. “The government has pumped so much monetary and fiscal stimulus into the economy now, even worthless assets are being bid up,” he said.

Source: Read Full Article