U.S. SEC Takes Legal Action Against Stoner Cats for Selling NFTs

On September 13, the U.S. Securities and Exchange Commission (SEC) announced that it had charged Stoner Cats 2 LLC (“SC2”) for conducting an unregistered offering of crypto asset securities in the form of NFTs.

In a press release issued earlier today, the SEC says these securities were in the form of non-fungible tokens (NFTs), which were intended to fund an animated web series called Stoner Cats.

https://youtube.com/watch?v=aq9O6On7Ju4%3Ffeature%3Doembed

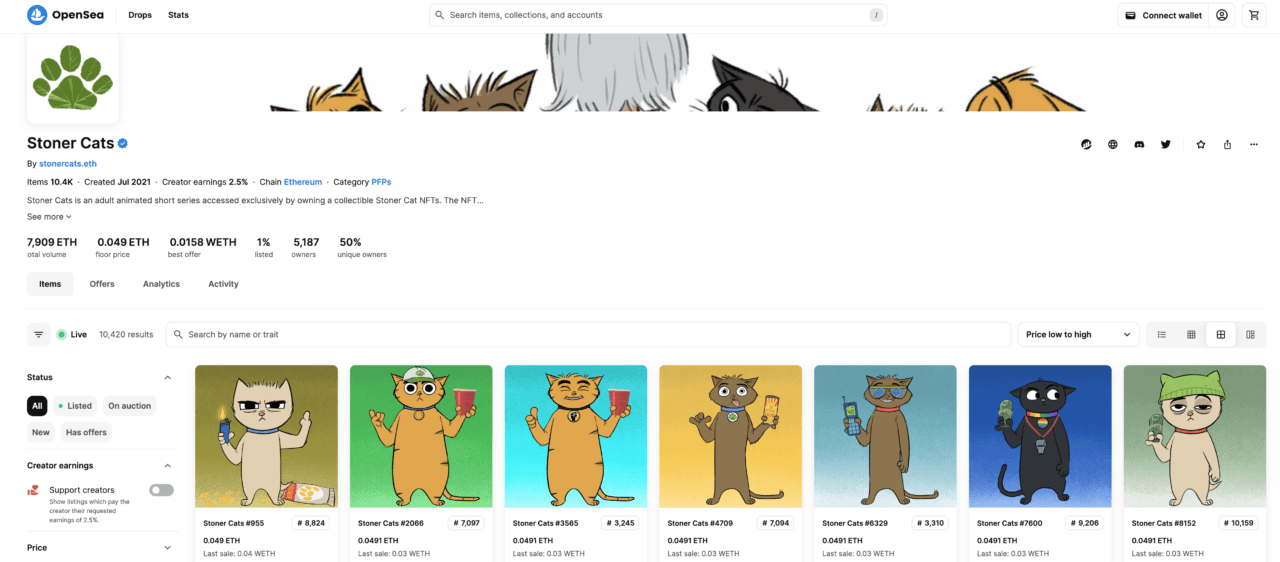

According to the SEC’s order, SC2 offered and sold over 10,000 NFTs at a price of approximately $800 each on July 27, 2021. The NFTs sold out in just 35 minutes, raising around $8 million. The SEC mentions that the speed at which these NFTs were sold indicates a high level of interest from investors, likely fueled by SC2’s marketing strategies.

The SEC order points out that SC2’s marketing campaign emphasized various benefits of owning the Stoner Cats NFTs. These benefits apparently included the ability to resell the NFTs on secondary markets. Additionally, it claims SC2 highlighted its team’s expertise in Hollywood production and crypto projects and the involvement of well-known actors in the web series, which the SEC believes led investors to anticipate profits, particularly if the web series turned out to be successful, thereby increasing the resale value of the NFTs.

https://youtube.com/watch?v=nuOA1afHvSM%3Ffeature%3Doembed

The SEC also found that SC2 had allegedly configured the Stoner Cats NFTs to provide the company with a 2.5% royalty for each secondary market transaction, which it says encouraged individuals to buy and sell the NFTs, resulting in more than $20 million spent in at least 10,000 transactions.

The SEC concluded that SC2 had violated the Securities Act of 1933 by offering and selling these crypto asset securities without registering them or qualifying for an exemption. This is a significant point, as it underscores the SEC’s stance that the economic substance of an offering determines whether it is a security, regardless of the form it takes.

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, emphasized that the economic reality of the offering, rather than the labels or underlying objects, determines what constitutes an investment contract and, therefore, a security. Carolyn Welshhans, Associate Director of the SEC’s Home Office, added that SC2 sought the benefits of a public offering without adhering to the legal responsibilities that come with it.

SC2 has agreed to a cease-and-desist order without admitting or denying the SEC’s findings. The company will also pay a civil penalty of $1 million. A Fair Fund will be established to return money to injured investors, and SC2 has agreed to destroy all NFTs in its possession or control.

Featured Image via Pixabay

Source: Read Full Article