ECB Raises Rates By 75 Bps As Expected, Signals More Hikes

The European Central Bank raised its key interest rates by 75 basis points on Thursday, in line with expectations, and signaled that policymakers look forward to hike rates more in the months ahead as inflation is expected to stay high for an extended period.

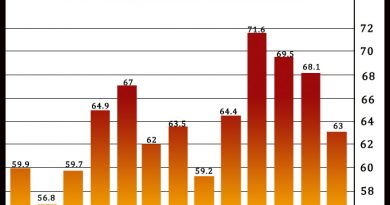

The Governing Council, led by ECB President Christine Lagarde, raised the main refinancing rate to 2.00 percent from 1.25 percent. The deposit facility rate was hiked to 1.50 percent from 0.75 percent. The marginal lending facility rate was lifted to 2.25 percent from 1.50 percent.

The previous change in Eurozone interest rates was a 75 basis points hike in early September.

“With this third major policy rate increase in a row, the Governing Council has made substantial progress in withdrawing monetary policy accommodation,” the central bank said in a statement.

“The Governing Council took today’s decision, and expects to raise interest rates further, to ensure the timely return of inflation to its 2 percent medium-term inflation target.”

The ECB said the monetary policy is aimed at reducing support for demand and guarding against the risk of a persistent upward shift in inflation expectations.

“Today’s rate hike provides further evidence of the extreme paradigm change at the ECB,” ING economist Carsten Brzeski said.

Brzeski observed that in just over three months the ECB has raised rates by a total of 200 basis points, in what is the sharpest and most aggressive hiking cycle ever in the history of the bank for the single currency bloc.

“At the current juncture of a looming recession and high uncertainty, normalizing monetary policy is one thing but moving into restrictive territory is another thing,” the economist said.

“With today’s rate hike, the ECB has come very close to the point at which normal could become restrictive.”

Policymakers also decided to change the terms and conditions of the third series of targeted longer-term refinancing operations, or TLTRO III.

The central bank acknowledged that TLTROs played a key role in countering downside risks to price stability during the acute phase of the pandemic.

However, the instrument now needs to be recalibrated, the bank said, citing the unexpected and extraordinary rise in inflation. The TLTRO must be made consistent with the broader monetary policy normalization process and to help in reinforcing the transmission of policy rate increases to bank lending conditions, the bank said.

The ECB decided to adjust the interest rates applicable to TLTRO III from November 23 and to offer banks additional voluntary early repayment dates.

The Governing Council also decided to set the remuneration of minimum reserves at the ECB’s deposit facility rate to align the remuneration of minimum reserves held by credit institutions with the Eurosystem more closely with money market conditions.

The bank reiterated that it will continue to reinvest proceeds from maturing securities bought under the asset purchase program for an extended period of time past the date when it started raising the key ECB interest rates.

Re-investments would continue for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance.

Regarding the pandemic emergency purchase program, or PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the program until at least the end of 2024, the ECB said.

The future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance, the bank added.

Source: Read Full Article