U.S. Consumer Price Growth Slows More Than Expected In March

The Commerce Department on Friday released its report on U.S. personal income and spending in the month of March, which includes readings on consumer price inflation that are said to be preferred by the Federal Reserve.

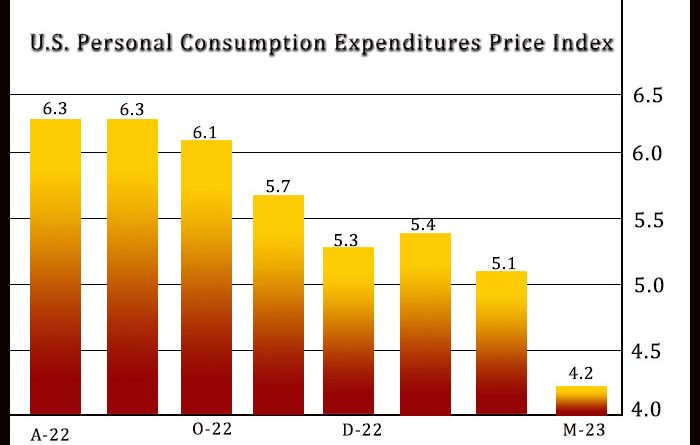

The report said the annual rate of consumer price growth slowed to 4.2 percent in March from a revised 5.1 percent in February.

Economists had expected the rate of growth to slow to 4.6 percent from the 5.0 percent originally reported for the previous month.

The annual rate of growth by core consumer prices, which exclude food and energy prices, also slipped to 4.6 percent in March from a revised 4.7 percent in February.

Economists had expected the rate of growth to slow to 4.5 percent from the 4.6 percent originally reported for the previous month.

Despite the slowdown, FHN Financial Chief Economist Chris Low noted, “Prices are still rising faster than the Fed is comfortable with.”

“The FOMC will hike another quarter-point next Wednesday, and may indicate further hikes remain a possibility,” Low said.

On a monthly basis, consumer prices inched up by 0.1 percent in March after rising by 0.3 percent in February. Economists had expected another 0.3 percent increase.

Core consumer prices rose by 0.3 percent on a monthly basis in March, matching the increase in the previous month as well as economist estimates.

The report also said personal income rose by 0.3 percent in March, matching the increase seen in February. Economists had expected personal income to edge up by 0.2 percent.

Disposable personal income, or personal income less personal current taxes, climbed by 0.4 percent in March following a 0.5 percent advance in February.

Meanwhile, the Commerce Department said personal spending was unchanged in March after inching up by a revised 0.1 percent in February.

Economists had expected personal spending to dip by 0.1 percent compared to the 0.2 percent uptick originally reported for the previous month.

Real personal spending, which excludes price changes, was also unchanged in March after slipping by 0.2 percent in February.

With income rising and spending unchanged, personal saving as a percentage of disposable personal income rose to 5.1 percent in March from 4.8 percent in February.

Source: Read Full Article