US watchdog to adopt new rule banning most foreclosures until 2022: report

Vacation-home buyers boost mortgage market

Dan Roccato on home loans, lenders

Millions of homeowners who are struggling to make their mortgage payments due to the coronavirus pandemic could get a fresh reprieve under new rules that a U.S. consumer watchdog plans to adopt this summer.

The Consumer Financial Protection Bureau (CFPB) will finalize a rule first proposed in April that would essentially prevent mortgage servicers from starting foreclosure proceedings until after Dec. 31, 2021, according to Reuters, citing sources familiar with the matter.

"The CFPB is working on finalizing the proposal," a spokesperson told FOX Business. "We remain committed to working with both servicers and homeowners to prevent avoidable foreclosures to the maximum extent possible. The economic recovery risks leaving some communities behind, and no one should lose their home without a chance to explore their options."

YELLEN SAYS INFLATION WILL BE HIGHER THAN BIDEN ADMINISTRATION ESTIMATED

The CFPB plans to finalize the rule and make it effective before the end of August, Reuters reported, and has agreed to carve out certain groups of borrowers after the industry said the proposal was too broad and beyond the bureau's legal limit. Individuals who may be excluded from the new protections include borrowers in the process of negotiating an arrangement with their servicer to avoid foreclosure but who have not yet applied to be put into forbearance.

Borrowers who may have abandoned their homes – without trying to notify their servicers – as well as those who do not respond to multiple inquiries from servicers about whether they wish to remain in their homes may also be excluded.

The exclusions are designed to limit the compliance burden for some servicers and give them more flexibility to help customers, according to Reuters.

CONSUMER PRICES SURGE 5% ANNUALLY, MOST SINCE AUGUST 2008

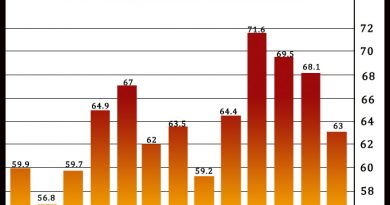

More than 2 million households are behind on their mortgage payments, according to the Mortgage Bankers Association, and nearly 1.7 million will exit their forbearance period in September. The restriction would apply only to mortgages on homes used as primary residences.

Bureau officials previously said the proposal is intended to give borrowers who had delayed or stopped paying their mortgage a chance to resume, or modify, their monthly payments before lenders move to take ownership or sell the home to recover the lost money.

"Millions of families are at risk of losing their homes to foreclosure in the coming months, even as the country opens back up," CFPB acting Director Dave Uejio said in an April statement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In February, President Biden directed federal housing regulators to extend mortgage forbearance programs for an additional six months and prolong other foreclosure relief programs.

Mortgage giants Fannie Mae and Freddie Mac also extended their forbearance and foreclosure programs in February. Individuals with federally backed properties can defer their mortgage payments for up to 15 months.

Source: Read Full Article