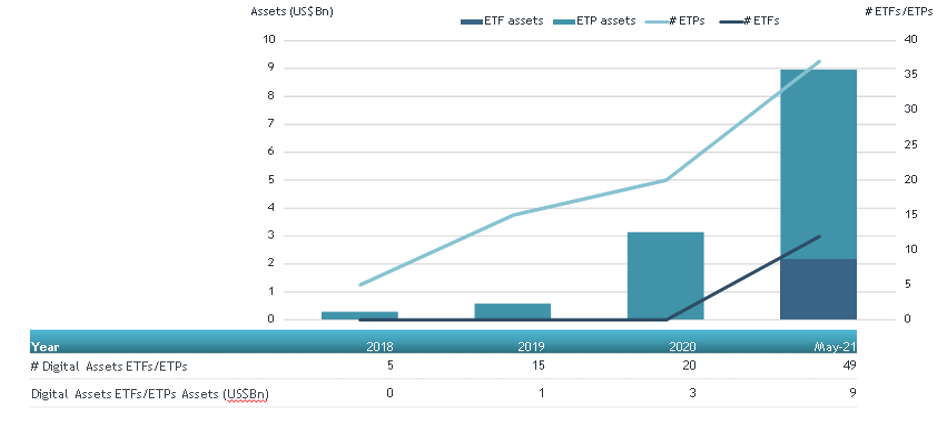

Assets Invested in Digital Asset ETFs and ETPs Listed Globally Reached a Record US$9 billion at the End of May 2021

By ETFGI

ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported Wednesday that assets invested in Digital Asset ETFs and ETPs listed globally reached a record US$9 billion at the end of May. Digital Asset ETFs and ETPs listed globally gathered net inflows of US$1.04 billion during May, bringing year-to-date net inflows to US$3.72 billion which is much higher than the US$32 million gathered at this point last year. Total assets invested in Digital Asset ETFs and ETPs decreased by 18.0% from US$11 billion at the end of April 2021 to US$9 billion, according to ETFGI’s May 2021 ETF and ETP Digital Assets industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Record $9 Bn invested in Digital Assets ETFs and ETPs listed globally at the end of May.

- During May, Digital Assets ETFs and ETPs gathered net inflows of $1.04 Bn.

- YTD net inflows of $3.72 Bn are the highest on record compared to YTD net inflows of previous years.

The S&P 500 gained 0.7% in May and 12.62% YTD, with positive figures for four consecutive months. Developed markets ex-U.S. gained 3.11% in May. Austria 8.29% and Luxembourg 8.12% were the leaders of the month while New Zealand lost 3.92%. Emerging markets were up 2.58% at the end of May. Hungary (up 15.54%) and Poland (up 13.98%) were the leaders, whilst Egypt (down 3.86%), Chile (down 3.64%), and Malaysia (down 2.79%) were down the most, according to Deborah Fuhr, managing partner, founder and owner of ETFGI.

The Global Digital Assets ETF/ETP had 49 ETFs/ETPs, with 107 listings, assets of US$9 Bn, from 17 providers on 11 exchanges in 10 countries. Following net inflows of $1.04 Bn and market moves during the month, assets invested in Digital Assets ETFs/ETPs listed globally decreased by 18.0% from $11 Bn at the end of April 2021 to $9 Bn at the end of May 2021.

Global Digital Assets ETF and ETP Asset Growth as at End of May 2021

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Since the launch of the first Digital Assets ETF/ETP in 2015, the Bitcoin Tracker One-SEK, the number and diversity of products have increased steadily, with 49 Digital Assets ETFs/ETPs and 107 listings globally at the end of May 2021. During May, 2 new Digital Asset ETFs/ETPs were listed.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $1.43 Bn at the end of May. 3iQ CoinShares Bitcoin ETF (BTCQ/U CN) gathered the largest net inflows $402 Mn.

Top 20 Digital Assets ETFs/ETPs by Net New Assets May 2021

| Name | Ticker | Assets (US$ Mn) May-21 | NNA (US$ Mn) YTD-21 | NNA (US$ Mn) May-21 |

|---|---|---|---|---|

| 3iQ CoinShares Bitcoin ETF | BTCQ/U CN | 671.74 | 803.87 | 401.53 |

| 3iQ CoinShares Ether ETF | ETHQ/U CN | 210.81 | 307.86 | 31-Oct |

| CI Galaxy Ethereum ETF | ETHX/B CN | 180.93 | 217.28 | 137.39 |

| CI Galaxy Bitcoin ETF – Acc (USD) | BTCX/U CN | 106.93 | 171.57 | 136.94 |

| ETHetc – ETC Group Physical Ethereum – Acc | ZETH GY | 99.58 | 103.94 | 57.9 |

| 21Shares Ethereum ETP – Acc | AETH SW | 263.04 | 152.78 | 49.54 |

| VanEck Vectors Ethereum ETN – Acc | VETH GY | 51.56 | 58.94 | 38.75 |

| Purpose Bitcoin ETF – CAD Hdg Acc | BTCC CN | 110.52 | 148.7 | 36.9 |

| Purpose Ether ETF – CAD Hdg | ETHH CN | 55.38 | 60.79 | 35.54 |

| Purpose Ether ETF | ETHH/B CN | 41.63 | 34.15 | 34.15 |

| CI Galaxy Bitcoin ETF – Acc | BTCX/B CN | 67.99 | 98.15 | 34 |

| WisdomTree Ethereum | ETHW SW | 22.69 | 29.6 | 28.48 |

| 21Shares Cardano ETP | AADA SW | 27.39 | 29.79 | 27.34 |

| Ether ETF | ETHR CN | 28.8 | 35.19 | 26.06 |

| 21Shares Polkadot ETP – Acc | ADOT SW | 41.13 | 58.38 | 16.76 |

| 21Shares Sygnum Platform Winners Index ETP – Acc | MOON SW | 42.04 | 23.57 | 15.95 |

| Iconic Funds Physical Bitcoin ETP | XBTI GY | 9.21 | 13.87 | 13.87 |

| CoinShares Physical Ethereum – Acc | ETHE SW | 125.98 | 81.57 | 11.81 |

| SA1 Ethereum ETP | SETH SW | 8.28 | 13.09 | 10.45 |

| VanEck Vectors Bitcoin ETN – Acc | VBTC GY | 137.23 | 122.23 | 10.28 |

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Please contact [email protected] if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Source: Read Full Article