COVID-19 panic stock selling burned investors with shortest bear market ever

Don’t fear a 2% 10-year bond: UBS portfolio manager

UBS managing director and senior portfolio manager Jason Katz provides insight into economic recovery and Treasury yields.

A year ago this month, as COVID-19 raged, U.S. stocks plummeted to pandemic lows in what is considered one of the shortest and fiercest bear markets in history.

From February’s peak to March 23, 2020 stocks tanked 34% before bottoming out as a global panic set in over the coronavirus. Still, the bear market, just 16 days and topping the last record from 1929, is the shortest on record as tracked by Ryan Detrick, chief market strategist, at LPL Financial.

STOCKS CONQUERED COVID-19 BUT NEW HEADWINDS EMERGE

The rebound is equally impressive he notes, with the S&P 500 recovering its losses in just five months, the fastest ever for a drop over 30%. In 1987, a similar recovery took 20 months.

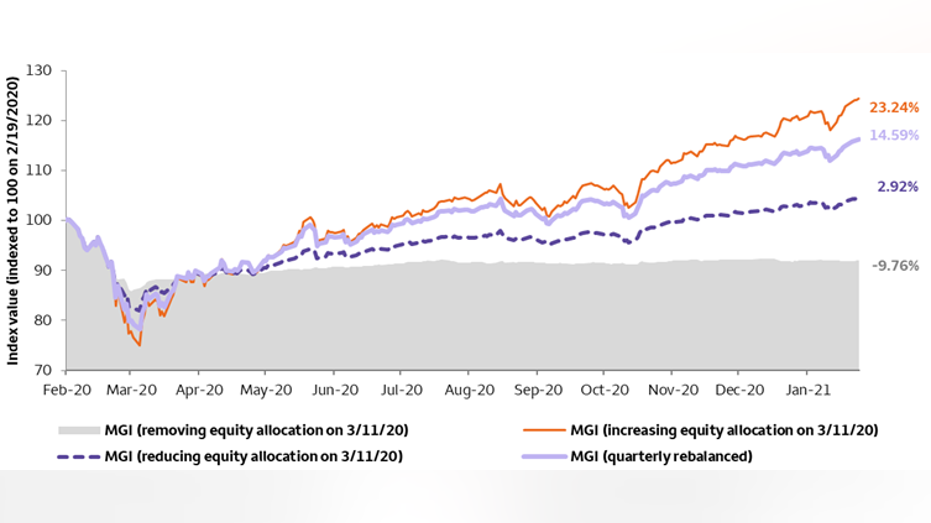

As of Monday, all three of the major averages have rebounded from the March lows with The Dow Jones Industrial Average and the S&P 500 bouncing back 76%, while the Nasdaq Composite has soared 95%. All three are hovering near record levels. Many investors who hit the panic button last March, either by yanking money out of stocks or reallocating were left holding the bag. TRUMP SAYS CHINA 'LAUGHS' AT DR. SEUSS CONTROVERSY: 'THEY THINK OUR COUNTRY IS STUPID' “The message of staying diversified had gotten lost” over the years Veronica Willis, investment strategy analyst for Wells Fargo Investment Institute, tells FOX Business citing the long time frame between prior bear markets. “This provided us with an example that was much more immediate” she explained. Source: Wells Fargo Investment Institute To prove their point, Wells used hypothetical portfolios to show the missed opportunities. Accounts that removed their stock exposure, resulted in negative returns, those who cut exposure saw a slim 3% rise. However, those who increased their allocation saw a 23% jump, while those who rebalanced saw gains of over 14%. The action is a clear and present reminder that stocks can and do bounce back from Black Swan events and Detrick notes stocks are now off to the “best start to a bull market ever” while he also noting things “might get rocky” he’s telling clients to stay the course. “While a pickup in volatility would be normal as this stage of a strong bull market, we think suitable investors may want to consider buying the dip. Vaccine distribution, fiscal and monetary stimulus, and a robust economic recovery all have our confidence high.” Source: Read Full Article