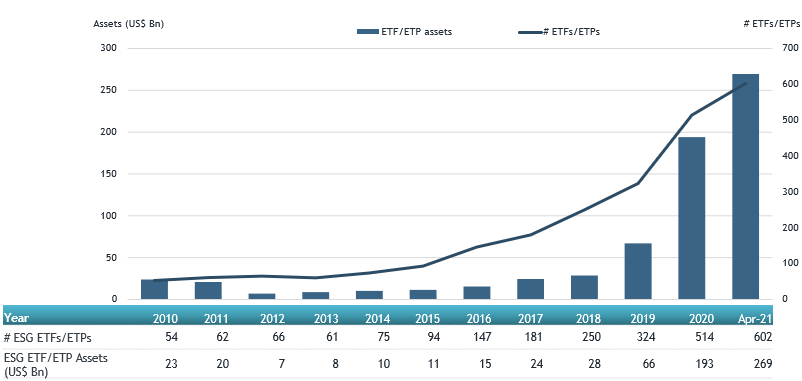

ESG ETFs and ETPs listed globally reached a record of US$269 billion at the end of April 2021

By ETFGI

ETFGI, an independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported on May 31 that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$12.27 billion during April, bringing year-to-date net inflows to US$67.72 billion which is much higher than the US$21.56 billion gathered at this point last year. Total assets invested in ESG ETFs and ETPs increased by 9.3% from US$246 billion at the end of March 2021 to US$269 billion, according to ETFGI’s April 2021 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ESG ETFs and ETPs listed globally reached a record of $269 Bn at the end of April.

- Record YTD net inflows of $67.72 Bn beating the prior record of $21.56 Bn gathered YTD in 2020.

“The S&P 500 gained 5.34% in April and 11.84% YTD as positive corporate earnings and US stimulus measures helped push U.S. equities higher. Developed markets ex-U.S. gained 3.35% in April. Denmark 7.07% and Finland 7.05% were the leaders of the month while Japan lost 1.60% and was the only country to be down for the month. Emerging markets were up 2.93% at the end of April. Poland (up 9.9%) and Greece were the leaders (up 9.20%), whilst Chile (down 8.1%), Peru (down 7.1%), and Colombia (down 6.5%) were down the most,” according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

The Global ESG ETF/ETP had 602 ETFs/ETPs, with 1,757 listings, assets of US$269 Bn, from 133 providers on 36 exchanges in 29 countries. Following net inflows of $12.27 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 9.3% from $246 Bn at the end of March 2021 to $269 Bn at the end of April 2021.

Global ESG ETF and ETP asset growth as at end of April 2021

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, with 602 ESG ETFs/ETPs and 1,757 listings globally at the end of April 2021. During April, 18 new ESG ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $6.93 Bn in April. Blackrock US Carbon Transition Readiness ETF (LCTU US) gathered $1.31 Bn alone.

Top 20 ESG ETFs/ETPs by net new assets April 2021

| Name | Ticker | Assets (US$ Mn) YTD-21 | NNA (US$ Mn) YTD-21 | NNA (US$ Mn) 21-Apr |

|---|---|---|---|---|

| Blackrock US Carbon Transition Readiness ETF | LCTU US | 1,342.40 | 1,314.12 | 1,314.12 |

| Blackrock World EX US Carbon Transition Readiness ETF | LCTD US | 591.19 | 586.49 | 586.49 |

| iShares Trust iShares ESG Aware MSCI USA ETF | ESGU US | 1,6838.41 | 1,866.28 | 550.57 |

| iShares Global Clean Energy UCITS ETF | INRG LN | 5,444.97 | 1,360.81 | 494.28 |

| iShares MSCI USA SRI UCITS ETF – Acc | SUAS LN | 6,703.43 | 1,235.78 | 464.05 |

| iShares Global Clean Energy ETF | ICLN US | 5,855.48 | 2,505.95 | 433.98 |

| Quadratic Interest Rate Volatility and Inflation ETF | IVOL US | 2,940.65 | 1,947.13 | 321.04 |

| Amundi MSCI USA ESG Leaders Select UCITS ETF DR – Acc | SADU GY | 1,715.15 | 1,251.39 | 295.71 |

| Xtrackers MSCI World ESG UCITS ETF – 1C – Acc | XZW0 LN | 2,170.84 | 730.02 | 262.39 |

| Amundi MSCI EMU ESG Leaders Select UCITS ETF DR – Acc | CMU FP | 1,945.95 | 316.99 | 249.22 |

| iShares MSCI World SRI UCITS ETF – EUR – Acc | SUSW LN | 3,196.73 | 451.02 | 238.45 |

| iShares ESG MSCI EAFE ETF | ESGD US | 5,386.60 | 1,098.65 | 232.44 |

| iShares MSCI Europe SRI UCITS ETF – Acc | IESG LN | 3,687.24 | 438.08 | 230.38 |

| iShares EUR Corp Bond 0-3yr ESG UCITS ETF | SUSS LN | 2,165.74 | 962.56 | 205.04 |

| Xtrackers MSCI USA ESG UCITS ETF – 1C – Acc | XZMU GY | 2,481.51 | 638.31 | 186.12 |

| Vanguard ESG US Stock ETF | ESGV US | 4,227.66 | 881.84 | 184.72 |

| iShares ESG MSCI Mexico ETF | ESGMEX MM | 1,105.55 | 232.03 | 180.92 |

| Invesco MSCI USA ESG Universal Screened UCITS ETF – Acc | ESGU LN | 731.34 | 567.40 | 173.65 |

| AMUNDI INDEX EURO AGG CORPORATE SRI – UCITS ETF DR (C) – Acc | ECRP FP | 1,853.74 | 311.81 | 161.37 |

| AMUNDI S&P 500 ESG UCITS ETF | S500 FP | 584.24 | 189.64 | 160.81 |

Source: ETFGI data sourced from ETF/ETP sponsors, exchanges, regulatory filings, Thomson Reuters/Lipper, Bloomberg, publicly available sources and data generated in-house. Note: This report is based on the most recent data available at the time of publication. Asset and flow data may change slightly as additional data becomes available.

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative that seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organized into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Please contact [email protected] if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Source: Read Full Article