MEV Protection Project Alchemist Rallies on Deal Rumors

Key Takeaways

- Alchemist’s MIST token has rallied on rumors of a new partnership with Uniswap.

- The rumors circulated after a video showing a Uniswap v3 interface with the mistX front-running protection feature was posted to Reddit.

- mistX, the protocol’s flagship product, helps protects against MEV attacks on DEXs.

MIST, the native token of the MEV protection project Alchemist, has rallied after rumors of a partnership with the decentralized exchange Uniswap circulated online.

Alchemist Rumored To Partner With Uniswap

Alchemist’s native token has rallied on rumors of a new partnership with Uniswap.

According to social media reports, Uniswap may soon be deploying Alchemist’s mistX product, a popular solution for protection against Miner Extractable Value (MEV). MEV is a phenomenon where by reordering transactions in the next on-chain block, miners can front-run trades on Ethereum’s decentralized exchanges (DEXs).

The price rally followed a video posted to Reddit that showed a privately hosted Uniswap v3 interface with a front-running protection feature that read “powered by Flashbots and mistX.”

UNISWAP+MISTX FRONT RUNNING PROTECT DEMO (GITHUB DEMO NOT OFFICIAL) from alchemist_coin

By serving as an effective solution against MEV, the Alchemist’s mistX product has hit over $311 million in volume traded over the course of five months since it went live in May 2021.

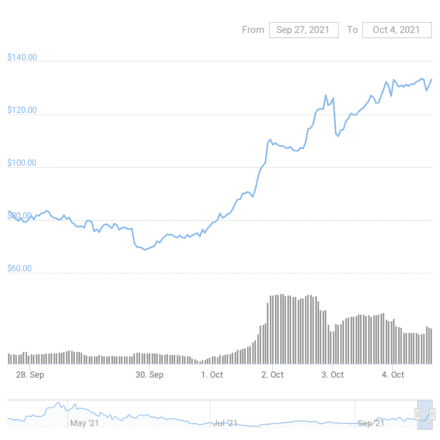

The Uniswap partnership reports coupled with the protocol’s growing use of has driven a strong rally for Alchemist’s MIST token, which is up 68% since Oct. 1 and is currently trading at about $130.

While nothing has been made official as of now, the team at Alchemist and Don Vincenzo, a core team member, have further stoked the rumors surrounding the partnership by hinting that a major announcement is soon to follow.

mistX, one of Alchemist’s flagship products, uses Flashbots technology to protect DEX traders from Miner Extractable Value (MEV). MEV has become a major concern for the Ethereum blockchain, allowing miners to practically “steal” millions of dollars each day. With rising instances of front-running, the need for MEV protection has grown proportionally.

Simply put, mistX works as a layer on top of DEXs and routes transactions through Flashbots, a type of private communication protocol between DEXs and miners that aims to protect against MEV attacks.

If the rumors are true, a partnership with Alchemist could improve trades for Uniswap users, the largest DEX by daily trading volume. As per reports, Uniswap traders are vulnerable to MEV attacks as no solution is currently in place.

Other projects such as Gnosis’ CowSwap and Eden Network have also deployed MEV protection solutions, but with different approaches. For example, another leading DEX, Sushi, has already integrated Eden Network to protect its users from MEV. A partnership with a large DEX like Uniswap could give a further boost to the fees Alchemist generates.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article