Vampire Attack or Innovation? Basketdao Storms the DeFi Index Scene

Key Takeaways

- BasketDAO’s main innovation is to replace DeFi tokens with their interest-bearing equivalents from Aave or Compound.

- BDPI is already the second DeFi index token in terms of market cap.

- With its governance token BASK, BasketDAO is incentivizing the migration of DPI holders.

BasketDAO has announced its new DeFi index: BDPI.

By taking the same underlying assets and converting them to their yield-bearing equivalent, BasketDAO is offering better a better return than DeFi Pulse’s DPI. Innovation or vampire attack?

One DeFi Index to Rule Them All

At this point, DeFi Pulse’s DPI is a household name. Any DeFi user has seen DeFi Pulse’s analytics and has considered investing through their index DPI, representing many DeFi “blue chip” tokens. Still, competition has been mounting.

BasketDAO is trying to chip away at DPI’s dominance in the DeFi index game.

To do so, they will take the same assets with the same portfolio structure but convert these assets to their yield-bearing equivalent on lending protocols. Instead of SNX, for example, BasketDAO’s BDPI will have Aave’s interest-bearing SNX token, aSNX.

To encourage migration from DPI to BDPI, BasketDAO will offer its governance token BASK. BasketDAO declared that BASK is a governance token that will accrue value from the interest-bearing tokens in BDPI.

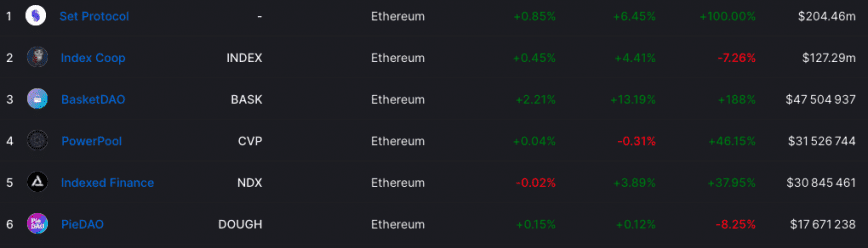

BasketDAO’s BDPI has already managed to reach a total value locked of $41 million, ranking it second behind Index Coop’s DPI in the list of DeFi indexes (Set Protocol is the website on which you can purchase DPI or other indexes).

Due to DeFi’s transparent nature, any project can build on top of any other project’s work. Sometimes, a new protocol is built on top of an older one because it has a different aim or target audience. This is the case with Cream Finance; built on top of Compound but targeted at a different audience. Often the cooperation goes smoothly.

There are cases, though, where the new protocol copies the older one and adds new incentives without truly innovating. This is what Sushiswap was accused of at its inception. To push users to migrate from Uniswap to its clone, Sushiswap offered its governance token as an incentive. This is referred to as a vampire attack.

In the case of BDPI, the line between innovation and vampire attack is hard to call.

On the one hand, BDPI is copying many elements of DPI’s product. On the other, the idea of replacing the DeFi tokens with interest-bearing ones is an important innovation that benefits users and guarantees higher returns. There is little reason for DPI holders to not migrate to BDPI – especially considering the liquidity mining rewards in the protocol’s governance token BASK.

Crypto Briefing asked Indexed.finance team member Lito Coen, another DeFi index project with $30 million total value locked, whether BasketDAO was likely to continue redirecting funds from DPI.

“We’ll see if BasketDAO can differentiate themselves over the long-term. DPI’s big strength is not the portfolio structure they use but their marketing skills and brand. This can’t be forked,” said Coen.

Disclaimer: The author held BTC, ETH, NDX, and several other cryptocurrencies at writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article