What Are DAOs? The Future of Global Organizations Explained

Key Takeaways

- DAO is an abbreviation for “Decentralized Autonomous Organization,” a community which interacts around hard-coded rules encoded in the blockchain.

- DAOs have seen exponential growth in 2021, most notably from DeFi protocols delegating governance to their communities.

- While DAOs have so far mostly been connected to crypto, traditional organizations could benefit from the technological innovation of blockchain-based governance.

DAO is an abbreviation for “Decentralized Autonomous Organization.” These crypto-native organizations are transparent communities whose core principles are hard-coded in the blockchain.

DAOs vs. Traditional Organizations

DAOs have gathered a lot of pace in crypto recently. For many blockchain enthusiasts, the explosion is only the start of a wider trend that will see global organizations exist in decentralized form in the future.

Where traditional organizations require a great deal of trust between members on different hierarchical levels, the core rules and governance for DAOs are handled by smart contracts. Similar to how DeFi protocols automate the necessary trust between financial actors in the traditional world, you don’t have to worry about a self-interested CEO or a dishonest CFO in the world of DAOs.

DAOs are Internet-native financial organizations collectively owned and managed by their own members. Instead of traditional top-down businesses, DAOs reward participation from all members in a proportion decided by the DAO’s founding code. That code can be consulted at all times by anyone on the blockchain.

In the traditional world, organizations have always required trust to function, especially when bigger sums of money are involved. DAOs don’t need trust to function as all the rules are in the open, and any changes require a majority vote. Such votes also happen on the blockchain, so no third parties or intermediaries are necessary.

To learn more about how DAOs function, Crypto Briefing spoke to DAOhaus product manager Spencer Graham. DAOhaus is a DAO explorer at the frontier of innovation in this sector. It allows any user to join an existing DAO or create a new one. Explaining the value of DAOs over traditional organizations, Graham says:

“Structurally, DAOs are superior to traditional organizations because they distribute ownership and power much more evenly, are much easier to create, and have significantly lower barriers to contribution.”

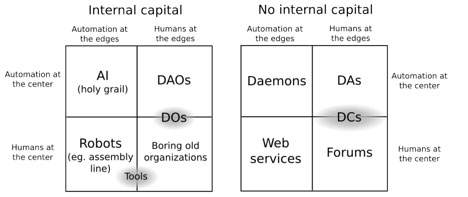

On May 6, 2014, Ethereum founder Vitalik Buterin posted an article titled “DAOs, DACs, DAs, and More: An Incomplete Terminology Guide” detailing the potential for blockchain-based organization governance. Buterin wrote:

“The idea of a decentralized autonomous organization is easy to describe: it is an entity that lives on the Internet and exists autonomously, but also heavily relies on hiring individuals to perform certain tasks that the automaton itself cannot do.”

As Buterin notes, DAOs still need humans. It is not the human action that is automated, but rather the interaction between these human actors. A contributor to a DAO could propose a certain project to the community, such as building a website detailing their activities and attach a certain price for his contributions. The price could be denominated in either a dollar figure or in the DAO’s governance token. If enough members of the DAO vote for the proposal, the DAO will automatically send the agreed-upon price to the contributor.

The greatest strength of DAOs lies in their global, permissionless nature. Modern corporations are some of the most closed organizations in history. To join a company, individuals have to prove that they’ve extensively studied a certain subject, show experience in a related field, and complete several interviews with existing members.

However, there are no physical limitations to joining a DAO. There may be a conscious choice to limit participation on a geographical basis, but true to crypto’s Internet-native nature, DAOs are typically international organizations. This allows them to grow much faster than companies as they’re both more horizontal and open to access. To join a DAO can be as simple as joining a Discord server or buying a governance token.

DAOs in Practice

Some would argue that Bitcoin was the first DAO. No one governs Bitcoin. Very precise, immutable rules decide who in the Bitcoin community is rewarded for action and how those rewards evolve over time. In the case of Bitcoin, miners are incentivized to secure the network’s Proof-of-Work consensus mechanism by BTC block rewards that half every four years. These simple rules have created a diehard community around one of the greatest financial innovations of this century. Discussing Bitcoin as a self-governing protocol, Graham adds:

“The Bitcoin network is self-governing and self-sustaining with no means of centralized control, and emerges from individuals behaving in response to incentives embedded within the Bitcoin protocol. Bitcoin was designed to function without the need for its users to coordinate outside of the protocol itself. In contrast, in the last few years we’ve seen DAOs embracing a more community-driven, human-centric coordination design.”

While Bitcoin could be described as the first DAO, the integration of smart contracts in blockchain has been the key technical development that allowed DAOs to fulfill their potential. DeFi protocols built on Ethereum have been the perfect beta-testers for DAOs. First, DeFi protocols also use the same smart contract infrastructure to remove trust and intermediaries from the interactions between users. Second, cryptocurrencies are the most appropriate type of currency to allow permissionless, worldwide interaction between members. Discussing the integral role cryptocurrencies play in DAOs, Graham says:

“Perhaps cryptocurrency is not necessary for DAOs to exist, but it’s definitely important for DAOs to reach their full potential. Any DAO’s sole purpose is to facilitate coordination around its objective, a large part of which involves deploying resources such as capital. If a central party can shut down a DAO’s medium of exchange (i.e., its currency), then they can shut down its primary avenue for achieving its objective.”

Most DAOs have their own governance token for rewarding good behavior that favors the DAO’s growth. These tokens, often labeled as “worthless” by their creators, give their holders voting power on the future of the protocol or organization. These DAOs can be focused on many different domains, NFT art being one of the fastest-growing categories.

As very active secondary markets exist for tokens, they’re often traded like shares in a traditional company. In many cases, users can receive a token simply by interacting with a protocol. This system creates a positive feedback loop for both user and protocol.

For example, DeFi exchange Balancer recently offered users a reimbursement of their gas fees in Balancer’s governance token BAL. First, this drew users to use the protocol when gas fees soared. Second, these users received BAL tokens, which incentivized them to see the overall value of the protocol grow, as it would help their portfolio’s value grow. This led them to use Balancer more often, participate in governance with their BAL tokens, and talk about Balancer to their friends.

Governance tokens align incentives for both present and future contributors to the DAO around the growth of the organization and its future prosperity. These tokens can also act as a sort of reputation system, letting those with the most skin in the game have the most important voice in its governance. Buterin says of the structure of DAOs:

“Instead of a hierarchical structure managed by a set of humans interacting in person and controlling property via the legal system, a decentralized organization involves a set of humans interacting with each other according to a protocol specified in code, and enforced on the blockchain.”

DAOs are often natural extensions of DeFi protocols as the builders’ protocols seek to decentralize governance and go from team-led to community-led, while still having built-in incentivization mechanisms in play to reward both core contributors and users of the protocol. Those systems reward participation and gradually increase the financial incentive to participate actively in the growth of DeFi protocols.

Teams distribute governance tokens to incentivize early participation. Tokens then create a financial incentive to further the growth of the protocol from helping development, to simply evangelizing the project to other DeFi users. This is also an important way to guarantee innovation and fair competition between incumbent protocols and new ones.

For example, a new exchange will always have less liquidity in its pools than, say, Uniswap. DeFi projects need deep liquidity to function effectively; for decentralized exchanges, lower liquidity leads to higher slippage and less favorable prices for users. To compete with Uniswap, a new exchange could offer governance tokens in exchange for using the protocol (SushiSwap took this approach to launch at the height of the “DeFi summer” of 2020). In essence, the protocol proposes voting power in the future of its governance against comparatively worse prices in the present. Very often, protocols focus on incentivizing liquidity providers, as they’re the key element to providing the best prices.

The Potential Problems of DAOs

Despite the huge potential of DAOs, there are also many associated problems. DAOs are particularly vulnerable to collusion and oligarchy. If a few members hold too much power, they can turn the virtuous cycle of DAO governance on its head. Instead of all users being incentivized to make the DAO more prosperous to make their own stake in it more valuable, powerful bad actors may abuse a DAO for their own financial gain. However, Graham argues that collusion is trickier to achieve in DAOs than in traditional organizations. He says:

“DAOs are more resistant to collusion than traditional organizations. In any organization, especially larger ones, it’s possible for a subset of its members to have incentives or goals that compete with the objective of the organization. When power is highly concentrated like in a traditional organization, it only takes a few colluders to succeed in hurting the broader organization. But in a DAO, where power is much more distributed, many more members would need to collude to have an impact. In other words, the Nakamoto coefficient of DAOs is typically much higher than traditional organizations.”

DAOs also incentivize the economic development of a protocol, which dampens all non-financial motivations a certain DAO could have. For example, if a DAO focused on seed investing in green projects distributes its governance tokens and a majority of participants decide to simply invest in the most financially viable projects, there is nothing the DAO can do about it.

Another example of a problem could be a DAO focused on promoting new NFT artists where the community votes to buy certain artworks from those new artists. There is a risk that financial interests could take over human ones, with the community focusing on the most lucrative deals rather than promoting new artists.

While a clear framework and governing structure can be coded into a smart contract, some things like culture and social values are not the ideal candidates for code. In that case, it’s down to the prerogative of the community to evolve in a direction that matches its defining ideology. The fluidity of DAOs is a strength in a fast-evolving world, but it’s also one of its most important vulnerabilities as financial interests have a built-in advantage due to the governance model.

The Future of DAOs

DAOs empower online communities to do much more than was ever possible before. Trust in online, sometimes anonymous, people has been a bottleneck to greater cooperation. Hard-coded rules over control of the treasury of an online community allow much better financial cooperation in a world where money is digital.

Smart contracts provide an immutable structure that allows for better transparency and control than many modern organizations. For example, charities are one of the best candidates for DAOs. One of the key issues charities face is the misappropriation of funds and inefficiencies in distributing funds. DAOs can help immensely in these areas.

The transparency guaranteed by an open blockchain allows for a level of control that’s never previously been possible with organizations. Perhaps more importantly, the control doesn’t come from an overarching supervisor. Anyone in any organization can check their boss’ salary and whether the agreed allocation of funds is respected.

Other key candidates for DAOs could be grant programs where anyone can propose to offer part of the DAO’s treasury to a team developing a specific project the DAO wants to encourage. Today, DAOs have emerged for play-to-earn guilds, which have a much more robust infrastructure to handle their fast-growing treasuries. Reflecting on how DAOs could grow in the future, Graham says:

“The total addressable market of DAOs is the total addressable market of companies and non-profit organizations. In fact, it’s probably bigger—how many companies and traditional organizations are not created today because of how difficult they are to start? We believe the transition is inevitable, but it’s a big shift—culturally, structurally, and procedurally—so it will be slow.”

Today, token-based DAOs are an essential feature of DeFi. The most famous example is MakerDAO, the organization controlling the issuance and management of DAI, the crypto asset-backed stablecoin. Participation in the DAO is open to anyone who owns the platform’s governance token, MKR. Thanks to new innovations, voting in governance decisions is now free. Projects like Snapshot help in providing governance tools that allow better communication in DAOs without requiring expensive on-chain transactions.

The complementary nature of DeFi protocols and DAOs was the turning point for adoption. Now that DAOs have shown they can handle the massive treasuries of DeFi protocols, it is only a matter of time before traditional organizations and institutions realize the potential for blockchain-based infrastructure. DAOs are already raising huge sums from some of the most important figures in tech, and it looks like their story is only just beginning.

Disclaimer: The author of this feature owned ETH, and several other cryptocurrencies at the time of writing.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article