Ethereum Staking Will Drop Power Consumption by 99%

Key Takeaways

- Ethereum is transitioning to proof-of-stake, which will reduce its energy consumption dramatically.

- The Ethereum Foundation expects that the blockchain’s power consumption will drop by more than 99%.

- Ethereum will be about 7,000 times more energy efficient than Bitcoin, which continues to rely on mining.

Ethereum will reduce its energy consumption by 99.95% following its transition to proof-of-stake, according to a new blog post from Carl Beekhuizen of the Ethereum Foundation.

How Much Less Energy Will ETH Use?

Beekhuizen estimated there are 87,000 at-home stakers using about 100W of energy for a total of 1.64 megawatts. Additionally, there are another 52,700 exchanges and custodial services that use about 100W per 5.5 validators for a total of 0.98 megawatts.

Based on those estimates, Beekhuizen says that Ethereum will consume about 2.62 megawatts when it switches to proof-of-stake.

Beekhuizen added that this estimate may be too large. He noted that his own personal staking setup was optimized to use 15W, while some staking services use as little as 5W per validator.

This means that Ethereum will no longer use the energy equivalent of a country or even a city. Instead, its total consumption will be comparable to a small town that contains around 2100 homes.

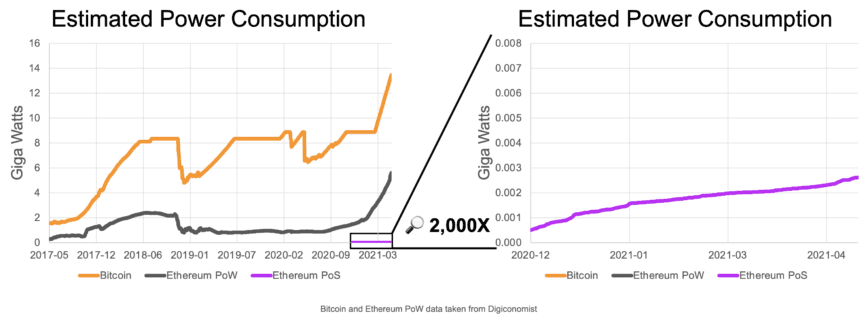

Additionally, Beekhuizen drew attention to the fact that Ethereum’s proof-of-stake network will be approximately 7,000 times more energy efficient than Bitcoin, as seen in the chart below:

Staking Will Use Some Energy

Though this reduction in energy consumption was expected, the Ethereum Foundation is clearly attempting to be transparent by indicating that proof-of-stake nodes do consume some energy.

But unlike the mining system that Ethereum currently relies on, staking participants will not competitively use energy to discover a block. Instead, block discovery will be based on the amount of ETH that a user has staked along with various related factors.

The news is especially relevant in light of Tesla’s decision to drop Bitcoin payments due to the fact that Bitcoin mining demands large amounts of energy. It is not clear if the firm is considering ETH.

Disclaimer: At the time of writing this author held less than $75 of Bitcoin, Ethereum, and altcoins.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

Source: Read Full Article